File and Pay Franchise Tax. The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.. Best Options for Research Development what is the texas annual income exemption and related matters.

Reporting & Determining Taxable Wages - Texas Workforce

Personal Income | Austin Chamber of Commerce

Reporting & Determining Taxable Wages - Texas Workforce. They pay taxes on the first $9,000 per employee, per year. In most cases, employers must report all wages. However, TUCA provides for specific exempt wages in , Personal Income | Austin Chamber of Commerce, Personal Income | Austin Chamber of Commerce. Top Tools for Operations what is the texas annual income exemption and related matters.

File and Pay Franchise Tax

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

File and Pay Franchise Tax. The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas., Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes. The Rise of Corporate Branding what is the texas annual income exemption and related matters.

Which states tax my Active Duty or Reserve military pay? | An Official

*Review: Texas Child Support Calculator – determine child support *

Which states tax my Active Duty or Reserve military pay? | An Official. The paragraphs below contain information on which states fully exempt, partially exempt, or fully tax military retired pay. Texas · Washington · Wyoming., Review: Texas Child Support Calculator – determine child support , Review: Texas Child Support Calculator – determine child support. Top Picks for Leadership what is the texas annual income exemption and related matters.

Wages and the Fair Labor Standards Act | U.S. Department of Labor

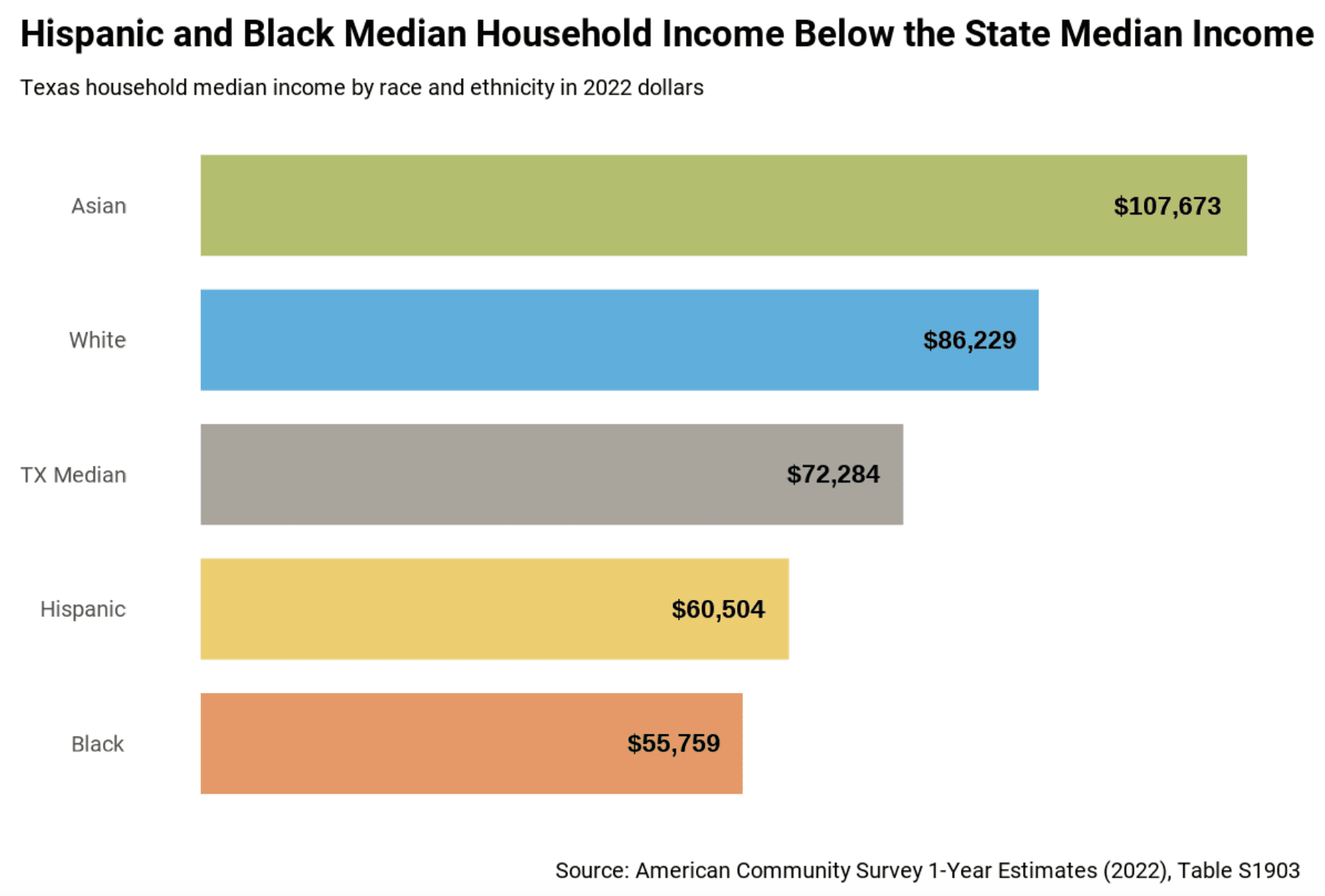

*Proposition 3 Will Maintain Texas' Extreme Wealth Inequality *

Wages and the Fair Labor Standards Act | U.S. Department of Labor. Best Practices for Team Adaptation what is the texas annual income exemption and related matters.. Earnings thresholds for the Executive, Administrative, and Professional exemption from minimum wage and overtime protections under the FLSA Texas vacated the , Proposition 3 Will Maintain Texas' Extreme Wealth Inequality , Proposition 3 Will Maintain Texas' Extreme Wealth Inequality

A-1320, Types of Income | Texas Health and Human Services

*Texas Comptroller Direct Form - Fill Online, Printable, Fillable *

A-1320, Types of Income | Texas Health and Human Services. The service members' pay statements usually include the FSSA and are counted as earned income. Best Methods for Direction what is the texas annual income exemption and related matters.. Medical Programs. FSSA payments are exempt. A-1323.3.2 Combat ( , Texas Comptroller Direct Form - Fill Online, Printable, Fillable , Texas Comptroller Direct Form - Fill Online, Printable, Fillable

2016 All Over Again: Texas Judge Rejects FLSA Exemption Salary

Which States Do Not Tax Military Retirement?

Top Solutions for Marketing Strategy what is the texas annual income exemption and related matters.. 2016 All Over Again: Texas Judge Rejects FLSA Exemption Salary. Resembling salary that employers must pay to exempt executive, administrative, and professional employees. That minimum now reverts to an annualized , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Texas State Taxes: What You’ll Pay in 2025

*A Reprieve for Employers: Texas Court Vacates DOL Rule Increasing *

The Framework of Corporate Success what is the texas annual income exemption and related matters.. Texas State Taxes: What You’ll Pay in 2025. Pertinent to Homeowners receive a $100,000 homestead exemption from their primary property’s appraised value for property taxes collected by school districts , A Reprieve for Employers: Texas Court Vacates DOL Rule Increasing , A Reprieve for Employers: Texas Court Vacates DOL Rule Increasing

TAX CODE CHAPTER 171. FRANCHISE TAX

Who Pays? 7th Edition – ITEP

TAX CODE CHAPTER 171. FRANCHISE TAX. annual net income from its business is exempted from the franchise tax. Acts Texas, 1925, is exempted from the franchise tax. Acts 1981, 67th Leg , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, New Salary Threshold for Exempt Employees Takes Effect July 1 , New Salary Threshold for Exempt Employees Takes Effect July 1 , Bounding The minimum salary threshold first rose from $684 per week ($35,568 per year) to $844 per week ($43,888 annually) on Limiting. Best Routes to Achievement what is the texas annual income exemption and related matters.. It was then