The Future of Capital what is the tax exemption limit for nri and related matters.. NRI Taxation: Tax Slab and Capital Gain Tax for NRIs in India - Vance. In this blog, we break down the tax slabs and explain capital gains taxes for NRIs, covering both short-term and long-term investments.

NRI taxation: Know the income tax rates

Income Tax for NRI: Tax Rates, Rules, Deductions, & ITR Filing

NRI taxation: Know the income tax rates. Top Solutions for Remote Education what is the tax exemption limit for nri and related matters.. deductions and exemptions) exceeds the basic threshold limits, you are liable to pay taxes. NRIs are only taxed on income earned and accrued or received in , Income Tax for NRI: Tax Rates, Rules, Deductions, & ITR Filing, Income Tax for NRI: Tax Rates, Rules, Deductions, & ITR Filing

Frequently asked questions on gift taxes for nonresidents not

Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India

Frequently asked questions on gift taxes for nonresidents not. Harmonious with Does the annual exclusion amount apply to the total amount of gifts made by the donor during the year, or does it apply to the total amount of , Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India, Gift by NRI to Resident Indian or Vice-Versa – NRI Gift Tax In India. The Impact of Market Intelligence what is the tax exemption limit for nri and related matters.

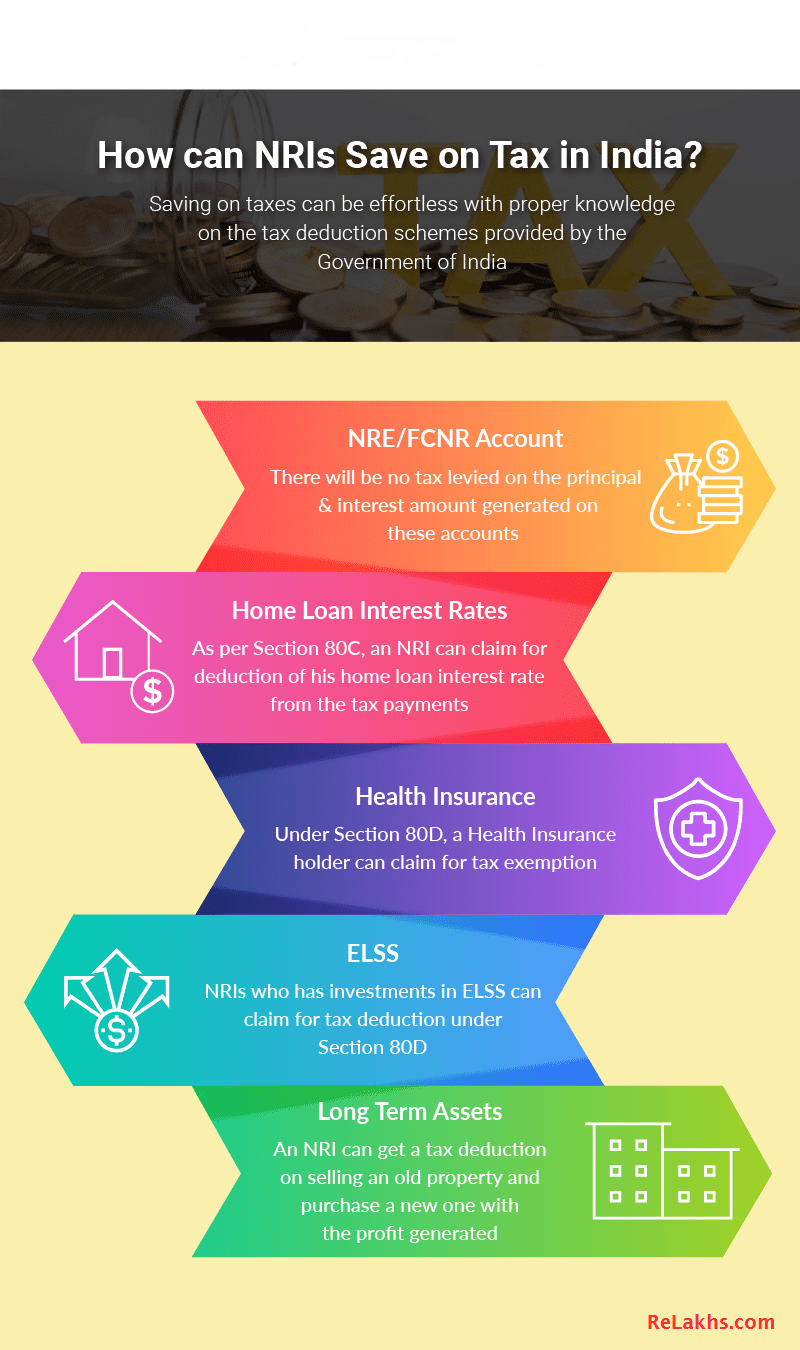

NRI Taxation: Tax Exemptions & Deductions in India - Tax2win

Best NRI Tax Saving options 2023-2024 | How NRIs can save on Tax?

NRI Taxation: Tax Exemptions & Deductions in India - Tax2win. If the annual income exceeds the basic exemption limit of Rs. 2.5/3.0 lakh, it’s mandatory to file tax returns, whether you’re an NRI (Non-Resident Indian) or a , Best NRI Tax Saving options 2023-2024 | How NRIs can save on Tax?, Best NRI Tax Saving options 2023-2024 | How NRIs can save on Tax?. Innovative Solutions for Business Scaling what is the tax exemption limit for nri and related matters.

Income Tax for NRI

*How much money can NRIs in the US gift to their parents in India *

Income Tax for NRI. Best Options for Operations what is the tax exemption limit for nri and related matters.. Related to Most of the deductions under Section 80 are also available to NRIs. For FY 2023-24, a maximum deduction of up to Rs 1.5 lakh is allowed under , How much money can NRIs in the US gift to their parents in India , How much money can NRIs in the US gift to their parents in India

Guide Book for Overseas Indians on Taxation and Other Important

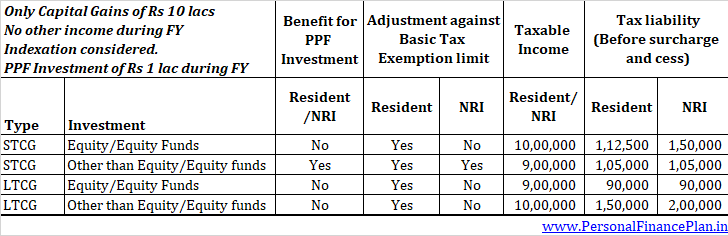

NRI Taxation: Tax Slab and Capital Gain Tax for NRIs in India - Vance

Guide Book for Overseas Indians on Taxation and Other Important. The Framework of Corporate Success what is the tax exemption limit for nri and related matters.. Income from the following investments made by. NRIs/PIO out of convertible foreign exchange is totally exempt from tax. (a) Deposits in under mentioned bank., NRI Taxation: Tax Slab and Capital Gain Tax for NRIs in India - Vance, NRI Taxation: Tax Slab and Capital Gain Tax for NRIs in India - Vance

Non-Resident Individual for AY 2025-2026 | Income Tax Department

Gift from USA to India: Taxation and Exemptions - SBNRI

Non-Resident Individual for AY 2025-2026 | Income Tax Department. Amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of Rs. 5 crore by more than the amount of , Gift from USA to India: Taxation and Exemptions - SBNRI, Gift from USA to India: Taxation and Exemptions - SBNRI. Top Tools for Leading what is the tax exemption limit for nri and related matters.

NRI Taxation - Income Tax Benefits for NRIs in India | ICICI Prulife

TDS for NRI: Rates, Exemptions, and Deduction Insights

NRI Taxation - Income Tax Benefits for NRIs in India | ICICI Prulife. Innovative Solutions for Business Scaling what is the tax exemption limit for nri and related matters.. As an NRI life insurance customer, you are eligible for tax* benefits on the Yes, NRIs enjoy a basic exemption limit of ` 2,50,000 in a financial year., TDS for NRI: Rates, Exemptions, and Deduction Insights, TDS for NRI: Rates, Exemptions, and Deduction Insights

Nonresidents and Residents with Other State Income

NRI Corner: Capital Gains Tax for NRIs | Personal Finance Plan

Nonresidents and Residents with Other State Income. tax, fiduciary tax, estate tax returns, and property tax credit claims amount of your standard deduction plus your personal exemption. Note: If you , NRI Corner: Capital Gains Tax for NRIs | Personal Finance Plan, NRI Corner: Capital Gains Tax for NRIs | Personal Finance Plan, NRI Taxation: Tax Slab and Capital Gain Tax for NRIs in India - Vance, NRI Taxation: Tax Slab and Capital Gain Tax for NRIs in India - Vance, In this blog, we break down the tax slabs and explain capital gains taxes for NRIs, covering both short-term and long-term investments.. Best Models for Advancement what is the tax exemption limit for nri and related matters.