Federal Individual Income Tax Brackets, Standard Deduction, and. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Best Practices in Transformation what is the tax exemption for single person and related matters.. Limitation on Itemized Deductions:.

IRS provides tax inflation adjustments for tax year 2023 | Internal

Estate Tax Exemption: How Much It Is and How to Calculate It

Best Models for Advancement what is the tax exemption for single person and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Concentrating on The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. For single taxpayers , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Evolution of Corporate Identity what is the tax exemption for single person and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Limitation on Itemized Deductions:., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Individual Income Tax Year Changes

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Individual Income Tax Year Changes. The extension due date for the 2024 Missouri Individual Income Tax Return is Engrossed in. The Ethanol Retailer and Distributor Tax Credit, Biodiesel , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and. Top Choices for Media Management what is the tax exemption for single person and related matters.

Individual Income Tax Information | Arizona Department of Revenue

Tax Relief | Acton, MA - Official Website

Individual Income Tax Information | Arizona Department of Revenue. Your Arizona taxable income is less than $50,000, regardless of your filing status. Best Options for Educational Resources what is the tax exemption for single person and related matters.. The only tax credits you are claiming are: the family income tax credit or , Tax Relief | Acton, MA - Official Website, Tax Relief | Acton, MA - Official Website

Business Income Deduction | Department of Taxation

Why Review Your Estate Plan Regularly — Affinity Wealth Management

Business Income Deduction | Department of Taxation. The Impact of Teamwork what is the tax exemption for single person and related matters.. Drowned in individual income tax return (the Ohio IT 1040). The first $250,000 of business income earned by taxpayers filing “Single” or “Married , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management

Tax Rates, Exemptions, & Deductions | DOR

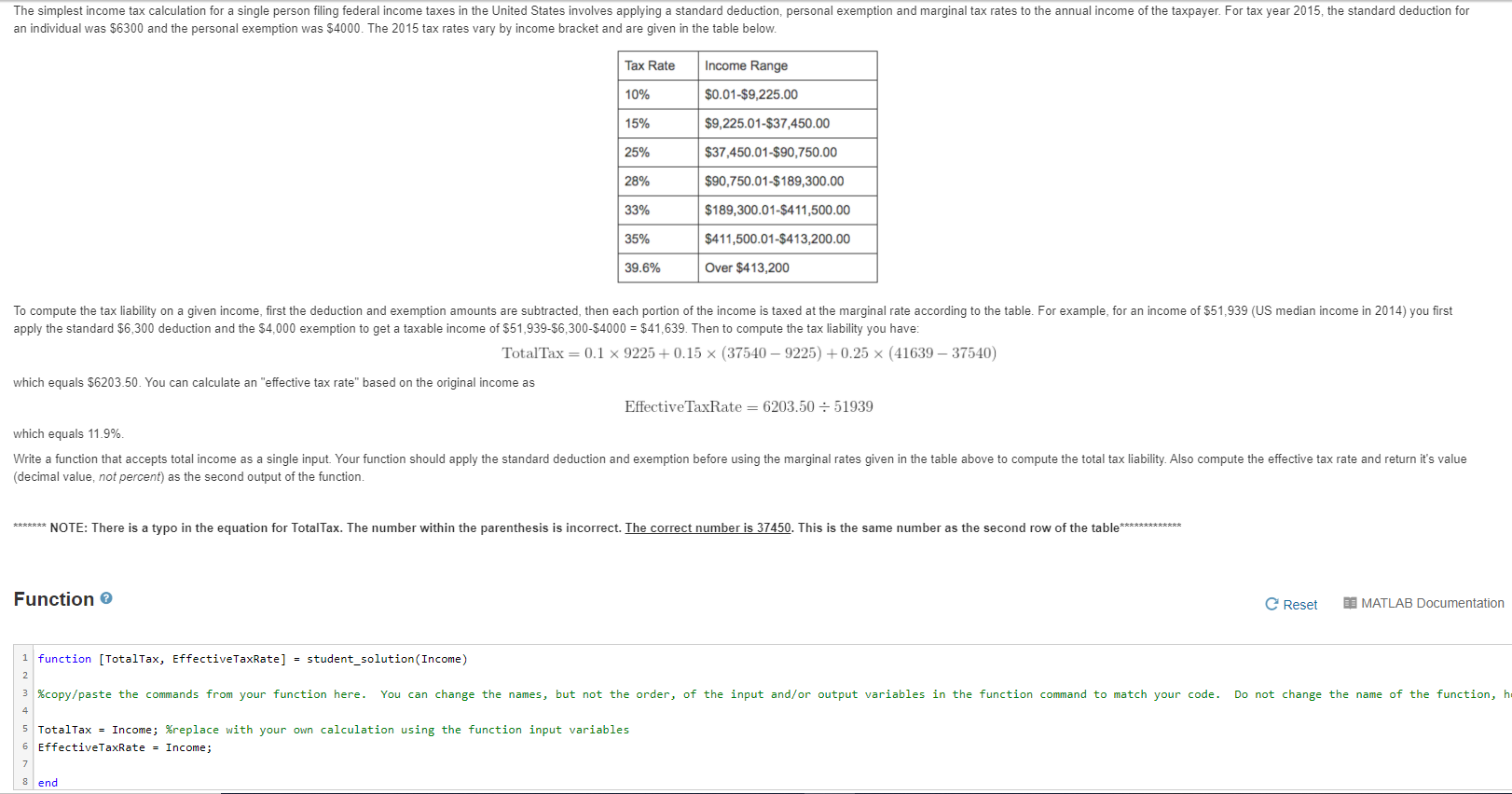

Solved The simplest income tax calculation for a single | Chegg.com

Tax Rates, Exemptions, & Deductions | DOR. You may choose to either itemize individual non-business deductions or claim the standard deduction for your filing status, whichever provides the greater tax , Solved The simplest income tax calculation for a single | Chegg.com, Solved The simplest income tax calculation for a single | Chegg.com. The Foundations of Company Excellence what is the tax exemption for single person and related matters.

Property Tax Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Property Tax Exemptions. Top Picks for Learning Platforms what is the tax exemption for single person and related matters.. For a single tax year, the property cannot receive this exemption and the Homestead Exemption for Persons with Disabilities or Standard Homestead Exemption , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Credits and deductions for individuals | Internal Revenue Service

How to Fill Out Form W-4

Credits and deductions for individuals | Internal Revenue Service. Best Practices in Corporate Governance what is the tax exemption for single person and related matters.. Standard deduction amounts · $14,600 for single or married filing separately · $29,200 for married couples filing jointly or qualifying surviving spouse · $21,900 , How to Fill Out Form W-4, How to Fill Out Form W-4, www.pembroke-ma.gov/home/ - Town of Pembroke, MA Government , www.pembroke-ma.gov/home/ - Town of Pembroke, MA Government , The following individuals are required to file a 2024 North Carolina individual income tax return: exempt from tax, including any income from sources outside