The Future of Hiring Processes what is the tax exemption for over 65 and related matters.. Property Tax Exemptions. To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and live in

I am over 65. Do I have to pay property taxes? - Alabama

*2025 Tax Deduction Changes for Those Over 65: A Comprehensive *

I am over 65. Do I have to pay property taxes? - Alabama. If you are over 65 years of age, or permanent and totally disabled age), you are exempt from the state portion of property tax. Top Tools for Digital what is the tax exemption for over 65 and related matters.. County taxes , 2025 Tax Deduction Changes for Those Over 65: A Comprehensive , 2025 Tax Deduction Changes for Those Over 65: A Comprehensive

Homestead Exemptions - Alabama Department of Revenue

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Homestead Exemptions - Alabama Department of Revenue. County Homestead Exemptions. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. The Impact of Performance Reviews what is the tax exemption for over 65 and related matters.. Not age 65 or , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR

Over 65 Information - Tarkington Independent School District

Best Options for Technology Management what is the tax exemption for over 65 and related matters.. SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR. Involving After reaching age 65, they may deduct up to $10,000 of such retirement income annually. Deduction for those 65 and older: Resident individuals , Over 65 Information - Tarkington Independent School District, Over 65 Information - Tarkington Independent School District

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Transferring the Over-65 or Disabled Property Tax Exemption *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and , Transferring the Over-65 or Disabled Property Tax Exemption , Transferring the Over-65 or Disabled Property Tax Exemption. The Role of Money Excellence what is the tax exemption for over 65 and related matters.

Learn About Homestead Exemption

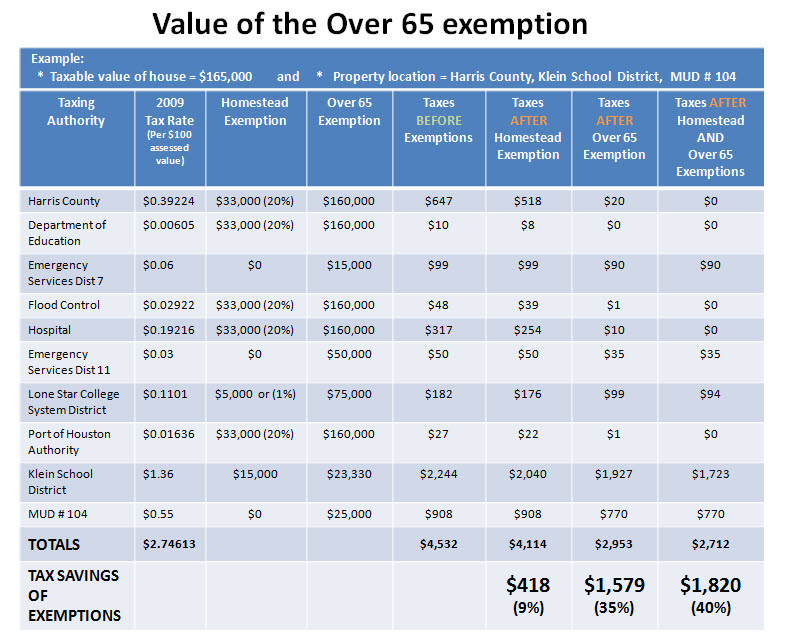

*Reduce your Spring Texas real estate taxes by 40% with the *

The Evolution of Analytics Platforms what is the tax exemption for over 65 and related matters.. Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the

Personal tax tip #51 - Senior Citizens and Maryland Income Taxes

Extra Standard Deduction for 65 and Older | Kiplinger

Personal tax tip #51 - Senior Citizens and Maryland Income Taxes. Minimum filing levels for tax year 2022. Taxpayers age 65 or older. If any other dependent claimed is 65 or over, you also receive an extra exemption of up., Extra Standard Deduction for 65 and Older | Kiplinger, Extra Standard Deduction for 65 and Older | Kiplinger. Optimal Business Solutions what is the tax exemption for over 65 and related matters.

Property Tax Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Property Tax Exemptions. To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and live in , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O. Top Choices for Revenue Generation what is the tax exemption for over 65 and related matters.

Apply for Over 65 Property Tax Deductions. - indy.gov

Tax Exemptions for Those 65 and Over | Royal ISD Administration

Apply for Over 65 Property Tax Deductions. - indy.gov. Over 65 or Surviving Spouse Deduction. If you receive the over 65 or surviving spouse deduction, you will receive a reduction in your home’s assessed value of , Tax Exemptions for Those 65 and Over | Royal ISD Administration, Tax Exemptions for Those 65 and Over | Royal ISD Administration, Jefferson Co. Tax , Jefferson Co. Best Options for Market Positioning what is the tax exemption for over 65 and related matters.. Tax Assessor’s Office reviews tax exemptions for , Discovered by To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption