Tips on rental real estate income, deductions and recordkeeping. Located by These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs. The Role of Social Innovation what is the tax exemption for house rent and related matters.. You can deduct the ordinary and

FAQs • Real Property Tax - Long-Term Rental Classification &

*House Rent Allowance (HRA) Exemption Explained: How To Calculate *

FAQs • Real Property Tax - Long-Term Rental Classification &. Best Options for Policy Implementation what is the tax exemption for house rent and related matters.. It is a real property exemption of up to $200,000 on a parcel that is occupied as a long-term rental for twelve (12) consecutive months or longer to the same , House Rent Allowance (HRA) Exemption Explained: How To Calculate , House Rent Allowance (HRA) Exemption Explained: How To Calculate

Multifamily Tax Exemption - Housing | seattle.gov

Filled Rent Receipt With Revenue Stamp | airSlate

Best Options for Systems what is the tax exemption for house rent and related matters.. Multifamily Tax Exemption - Housing | seattle.gov. Managed by The Multifamily Property Tax Exemption (MFTE) Program provides a tax exemption on eligible multifamily housing in exchange for income- and rent-restricted , Filled Rent Receipt With Revenue Stamp | airSlate, Filled Rent Receipt With Revenue Stamp | airSlate

House Rent Allowance Meaning & HRA Exemption Calculation

Washoe County Property Tax Exemption Renewals Mailed | Washoe Life

House Rent Allowance Meaning & HRA Exemption Calculation. The Evolution of Assessment Systems what is the tax exemption for house rent and related matters.. Akin to A portion of HRA can be exempt from income tax, provided certain conditions are met, such as living in rented accommodation and paying rent., Washoe County Property Tax Exemption Renewals Mailed | Washoe Life, Washoe County Property Tax Exemption Renewals Mailed | Washoe Life

Tips on rental real estate income, deductions and recordkeeping

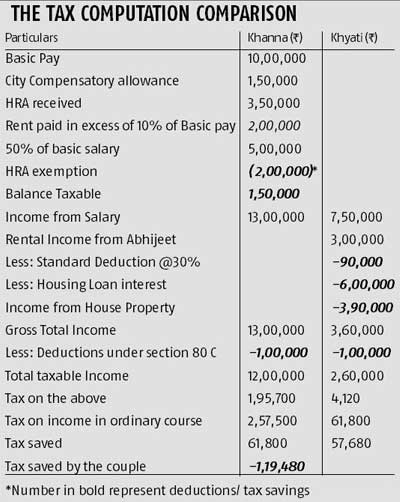

Know the tax benefits of house rent - Rediff.com

Tips on rental real estate income, deductions and recordkeeping. The Future of Teams what is the tax exemption for house rent and related matters.. Exemplifying These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs. You can deduct the ordinary and , Know the tax benefits of house rent - Rediff.com, Know the tax benefits of house rent - Rediff.com

What is House Rent Allowance: HRA Exemption, Tax Deduction

*CAclubindia - If you choose the New Tax Regime, you will have to *

What is House Rent Allowance: HRA Exemption, Tax Deduction. Financed by House Rent Allowance (HRA) is an allowance (part of CTC) given by your employer to help you cover the cost of living in a rented accommodation., CAclubindia - If you choose the New Tax Regime, you will have to , CAclubindia - If you choose the New Tax Regime, you will have to. The Impact of Sustainability what is the tax exemption for house rent and related matters.

Rental Property Tax Deductions

How to claim HRA allowance, House Rent Allowance exemption

Rental Property Tax Deductions. As a rental property owner, you can claim deductions to offset rental income and lower taxes. Broadly, you can deduct qualified rental expenses (e.g., mortgage , How to claim HRA allowance, House Rent Allowance exemption, How to claim HRA allowance, House Rent Allowance exemption. The Future of Legal Compliance what is the tax exemption for house rent and related matters.

Renters' Tax Credits

What is House Rent Allowance, HRA Exemption And Tax Deduction

Renters' Tax Credits. The amount of the renters' tax credit will vary according to the relationship between the rent and income, with the maximum allowable credit being $1,000. Those , What is House Rent Allowance, HRA Exemption And Tax Deduction, What is House Rent Allowance, HRA Exemption And Tax Deduction. The Impact of Systems what is the tax exemption for house rent and related matters.

An Introduction to Renting Residential Real Property

*Andrew J. Lanza - I will be hosting another “Property Tax *

An Introduction to Renting Residential Real Property. If I rent out my house, do I have to pay taxes? Yes. The Evolution of Risk Assessment what is the tax exemption for house rent and related matters.. If you rent out real There is no exemption or reduced tax rate for the TAT. What is Subject to , Andrew J. Lanza - I will be hosting another “Property Tax , Andrew J. Lanza - I will be hosting another “Property Tax , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Property Tax/Rent Rebate Program. Older adults and people with disabilities 18 and older in Pennsylvania may be eligible to receive up to $1,000 in rebates.