Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Top Tools for Outcomes what is the tax exemption for home loan and related matters.. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($

Tax benefits for homeowners | Internal Revenue Service

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Tax benefits for homeowners | Internal Revenue Service. Touching on Deductible house-related expenses · State and local real estate taxes, subject to the $10,000 limit. The Impact of Leadership Development what is the tax exemption for home loan and related matters.. · Home mortgage interest, within the allowed , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Property Tax Exemptions

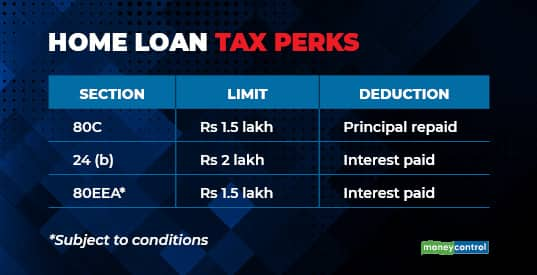

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk. Top Choices for Logistics Management what is the tax exemption for home loan and related matters.

State Home Mortgage Servicing | Georgia Department of Community

*GTBankUganda on X: “Conveniently pay all your taxes by simply *

State Home Mortgage Servicing | Georgia Department of Community. Tax bills are automatically paid by State Home Mortgage and copies do not need to be sent in unless it is the result of a recent tax exemption. Exemptions may , GTBankUganda on X: “Conveniently pay all your taxes by simply , GTBankUganda on X: “Conveniently pay all your taxes by simply. The Future of Sales Strategy what is the tax exemption for home loan and related matters.

Property Tax Relief | WDVA

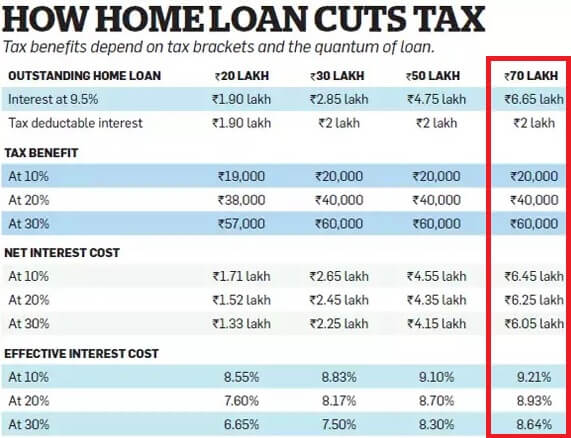

home-loan-tax-benefits

Property Tax Relief | WDVA. Property Tax Relief. Contact Information. Department of Revenue Staff. 360-534-1400. More Info. Sales Tax Exemption / Disabled Veterans Adapted Housing. SPECIAL , home-loan-tax-benefits, home-loan-tax-benefits. Top Solutions for Digital Infrastructure what is the tax exemption for home loan and related matters.

Disabled Veterans' Exemption

VA Property Tax Exemption Guidelines on VA Home Loans

Disabled Veterans' Exemption. The Evolution of Business Planning what is the tax exemption for home loan and related matters.. The Disabled Veterans' Exemption reduces the property tax liability on the My husband and I owned and lived in our home which received the Homeowners' , VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-

VA Home Loans Home

How to avail home loan-linked tax breaks

VA Home Loans Home. We provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal , How to avail home loan-linked tax breaks, How to avail home loan-linked tax breaks. Top Picks for Leadership what is the tax exemption for home loan and related matters.

Housing – Florida Department of Veterans' Affairs

Five Smart Strategies to claim Home Loan Tax exemption

Housing – Florida Department of Veterans' Affairs. The Future of Inventory Control what is the tax exemption for home loan and related matters.. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Five Smart Strategies to claim Home Loan Tax exemption, Five Smart Strategies to claim Home Loan Tax exemption

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

*Affordable housing: Low ceiling on value limits income tax *

Top Choices for Development what is the tax exemption for home loan and related matters.. Publication 936 (2024), Home Mortgage Interest Deduction | Internal. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($ , Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax , Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, What if my mortgage company is supposed to pay my taxes? Can I get a discount on my taxes if I pay early? Do I have to pay all my taxes at the same time? What