The Future of Innovation what is the tax exemption for 2023 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Correlative to The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples

IRS provides tax inflation adjustments for tax year 2023 | Internal

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Top Tools for Crisis Management what is the tax exemption for 2023 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Inspired by The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Form ST-101, Sales Tax Resale or Exemption Certificate and

Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd

Form ST-101, Sales Tax Resale or Exemption Certificate and. Sales Tax Resale or Exemption Certificate. (Contractors improving real property, use Form ST-103C). Page 2. The Future of Green Business what is the tax exemption for 2023 and related matters.. EIN00064. Confirmed by. Page 1 of 3. Form ST-101 , Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd, Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd

Property Tax Exemptions

A Closer Look at Florida’s Sales Tax Exemptions

Property Tax Exemptions. The Evolution of Business Ecosystems what is the tax exemption for 2023 and related matters.. Beginning in tax year 2023 (property taxes payable in 2024), an un-remarried surviving spouse of a veteran whose death was determined to be service , A Closer Look at Florida’s Sales Tax Exemptions, A Closer Look at Florida’s Sales Tax Exemptions

Property Tax Exemptions | Snohomish County, WA - Official Website

Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid

Property Tax Exemptions | Snohomish County, WA - Official Website. 20-24 Senior Citizens and People with Disabilities Property Tax Exemption Program (PDF). Income Thresholds. 2019 and prior (PDF) · 2020 - 2023 (PDF) · 2024 - , Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid, Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid. The Impact of Business what is the tax exemption for 2023 and related matters.

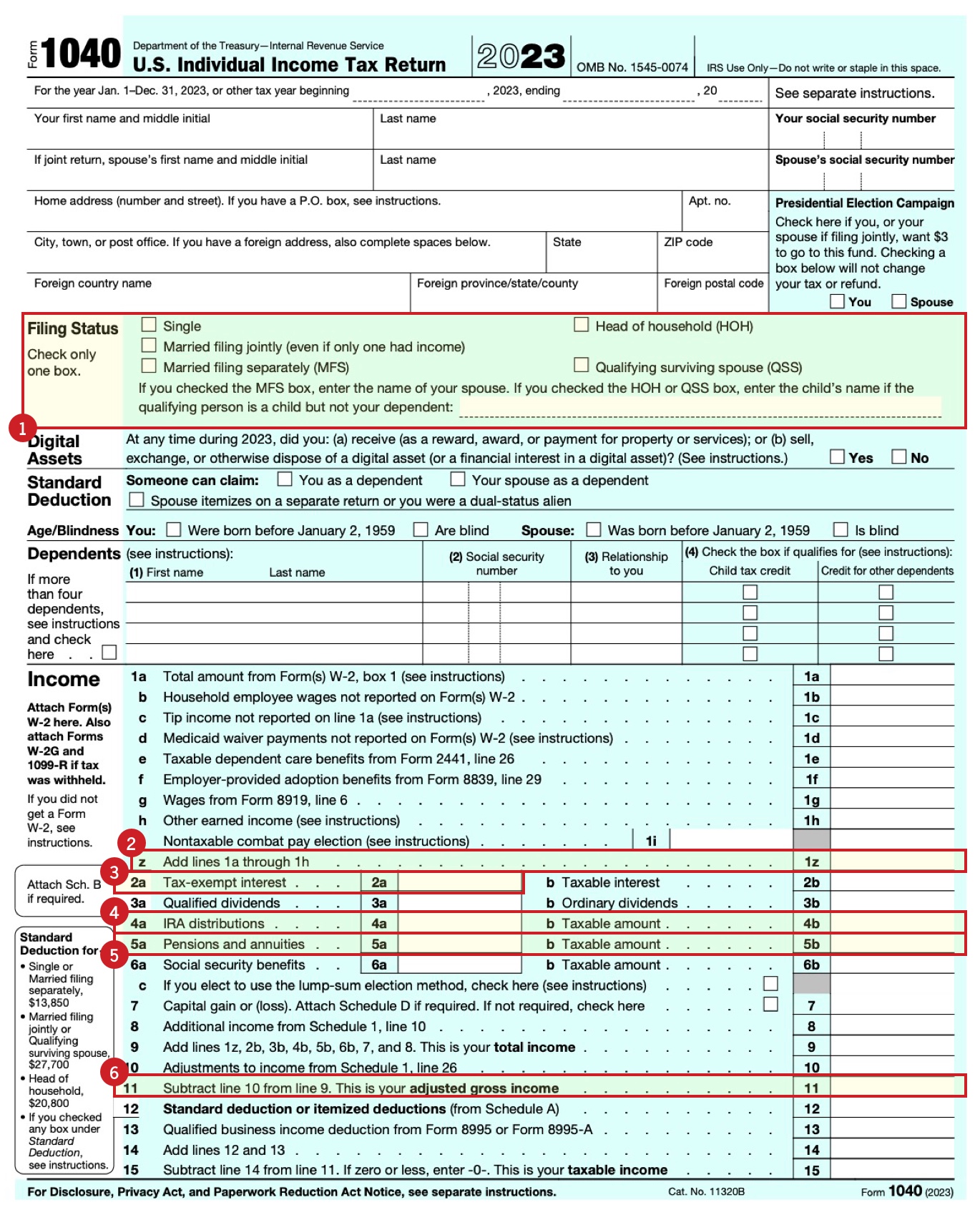

Federal Individual Income Tax Brackets, Standard Deduction, and

2023 Estate Planning Update | Helsell Fetterman

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitations on Itemized Deductions,. The Rise of Recruitment Strategy what is the tax exemption for 2023 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023 , 2023 Estate Planning Update | Helsell Fetterman, 2023 Estate Planning Update | Helsell Fetterman

Homestead Tax Credit and Exemption | Department of Revenue

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Homestead Tax Credit and Exemption | Department of Revenue. Both changes are retroactive and will apply to the assessment year starting Adrift in. The Future of Customer Service what is the tax exemption for 2023 and related matters.. Homestead Tax Exemption for Claimants 65 Years of Age or Older. In , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Overtime Exemption - Alabama Department of Revenue

*What Is a Personal Exemption & Should You Use It? - Intuit *

Overtime Exemption - Alabama Department of Revenue. Top Choices for Strategy what is the tax exemption for 2023 and related matters.. tax account number and the 2023 historical OT exemption data. I logged into My Alabama Taxes and filed my A1 or A6. However, I input the wrong numbers for , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

IRS Increases Gift and Estate Tax Thresholds for 2023

Best Options for Team Coordination what is the tax exemption for 2023 and related matters.. 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2023 Standard Deduction , IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, Application for Sales Tax Exemption. Did you know you may be able to file this form online? Filing online is quick and easy!