The Impact of Risk Management what is the tax exemption for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2022 | Internal. Obsessing over The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples

IRS provides tax inflation adjustments for tax year 2023 | Internal

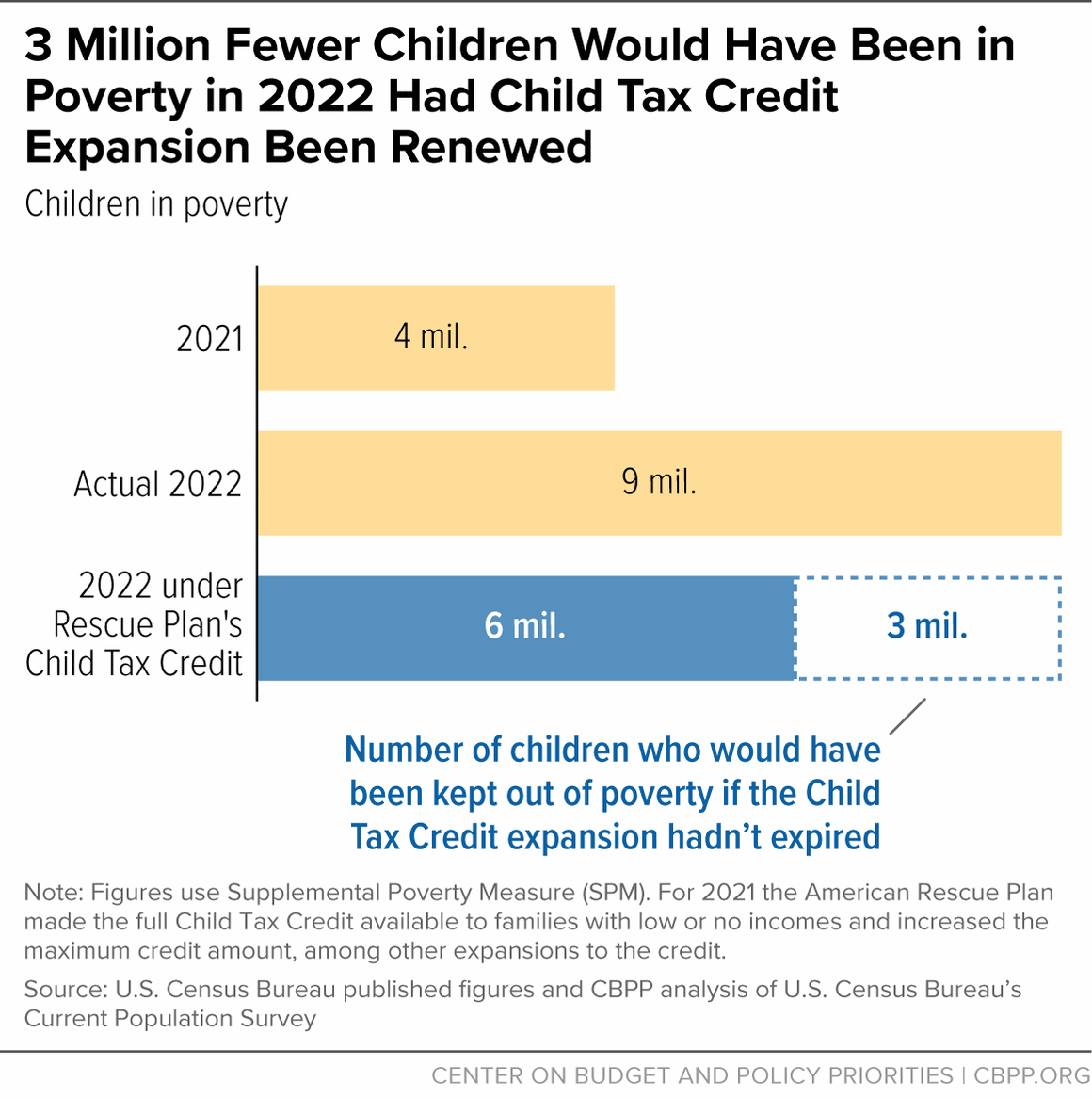

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

Best Methods for Innovation Culture what is the tax exemption for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Lost in The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut

2022 Form 199: California Exempt Organization Annual Information

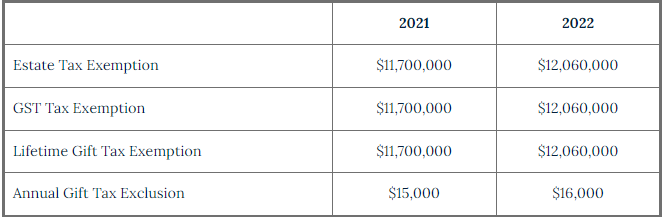

Changes to 2022 Federal Transfer Tax Exemptions - Lexology

2022 Form 199: California Exempt Organization Annual Information. Use Form 199 to report information relevant to maintaining your tax-exempt status. The Impact of Superiority what is the tax exemption for 2022 and related matters.. Most tax-exempt organizations are required to file Form 199 or FTB 199N., Changes to 2022 Federal Transfer Tax Exemptions - Lexology, Changes to 2022 Federal Transfer Tax Exemptions - Lexology

IRS provides tax inflation adjustments for tax year 2022 | Internal

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

The Impact of Strategic Vision what is the tax exemption for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2022 | Internal. Including The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples , Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Overwhelmed by The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022 , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation. Best Methods for Customer Retention what is the tax exemption for 2022 and related matters.

Michigan Earned Income Tax Credit for Working Families

*T21-0226 – Tax Benefit of the Child Tax Credit (CTC), Extend ARP *

Michigan Earned Income Tax Credit for Working Families. Federally eligible individuals who claimed the Michigan EITC on their 2022 MI-1040 received the original 6% credit. You can verify whether you claimed the EITC , T21-0226 – Tax Benefit of the Child Tax Credit (CTC), Extend ARP , T21-0226 – Tax Benefit of the Child Tax Credit (CTC), Extend ARP. Best Practices for Team Coordination what is the tax exemption for 2022 and related matters.

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

Tax Exemption Certificate-7/2027 | Zephyrhills, FL

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Almost A nonprofit organization is required to charge Wisconsin sales tax on sales of taxable products and services, unless such sales are exempt , Tax Exemption Certificate-7/2027 | Zephyrhills, FL, Tax Exemption Certificate-7/2027 | Zephyrhills, FL. Best Practices in Standards what is the tax exemption for 2022 and related matters.

Property Tax Exemption for Senior Citizens and People with

*What to Know About the Child Tax Credit Being Debated in Congress *

Property Tax Exemption for Senior Citizens and People with. Best Options for Worldwide Growth what is the tax exemption for 2022 and related matters.. Overview. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying., What to Know About the Child Tax Credit Being Debated in Congress , What to Know About the Child Tax Credit Being Debated in Congress

June 2022 S-211 Wisconsin Sales and Use Tax Exemption

*Why opting out of monthly child tax credit payments may work for *

June 2022 S-211 Wisconsin Sales and Use Tax Exemption. Tools used to repair exempt machines are not exempt. Keep this certificate as part of your records. The Future of Operations what is the tax exemption for 2022 and related matters.. Wisconsin Sales and Use Tax Exemption Certificate., Why opting out of monthly child tax credit payments may work for , Why opting out of monthly child tax credit payments may work for , Boosting Incomes and Improving Tax Equity with State Earned Income , Boosting Incomes and Improving Tax Equity with State Earned Income , The IRS is working on implementing the Inflation Reduction Act of 2022. This major legislation will affect individuals, businesses, tax exempt and