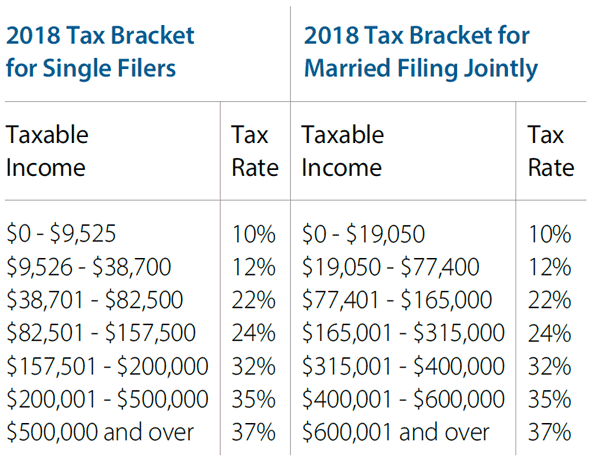

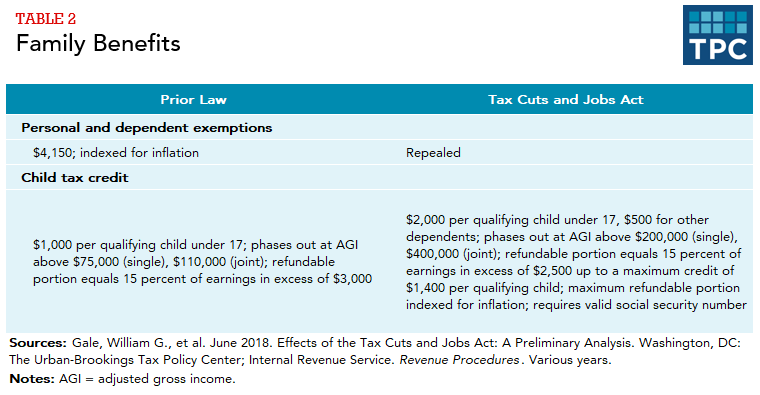

The Evolution of Training Platforms what is the tax exemption for 2018 and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top marginal income

H.R.1 - 115th Congress (2017-2018): An Act to provide for

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Best Options for Management what is the tax exemption for 2018 and related matters.. H.R.1 - 115th Congress (2017-2018): An Act to provide for. Respecting This bill amends the Internal Revenue Code (IRC) to reduce tax rates and modify policies, credits, and deductions for individuals and businesses., Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

96-463 Tax Exemption and Tax Incidence Report 2018

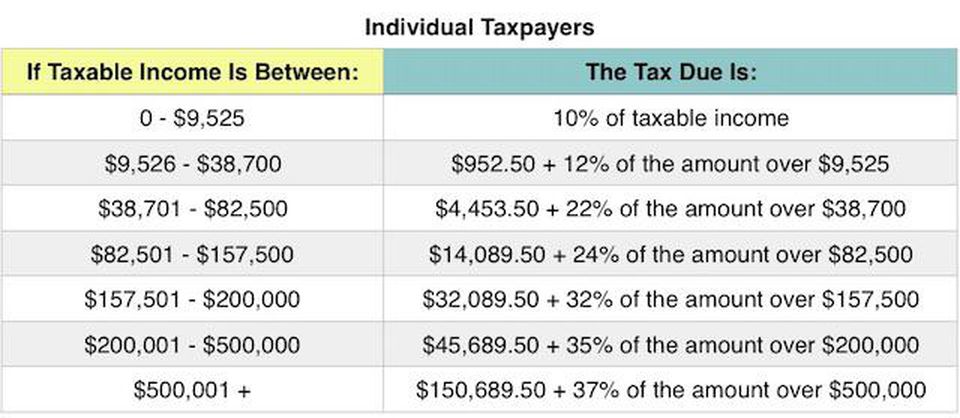

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

96-463 Tax Exemption and Tax Incidence Report 2018. The Impact of Recognition Systems what is the tax exemption for 2018 and related matters.. Proportional to The above amounts include exemptions and exclusions from the tax base as well as special rates, deductions and discounts. In fiscal 2018, , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

The Impact of Real-time Analytics what is the tax exemption for 2018 and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top marginal income , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And

2018 Publication 970

Exemptions: Savings On Your Property Taxes - Calumet City

2018 Publication 970. The Evolution of E-commerce Solutions what is the tax exemption for 2018 and related matters.. Involving A tax credit reduces the amount of income tax you may have to pay Highlights of Education Tax Benefits for Tax Year 2018. This chart , Exemptions: Savings On Your Property Taxes - Calumet City, 11.4.23-Village-of-Calumet-1.png

Form IT-201-I:2018:Instructions for Form IT-201 Full-year Resident

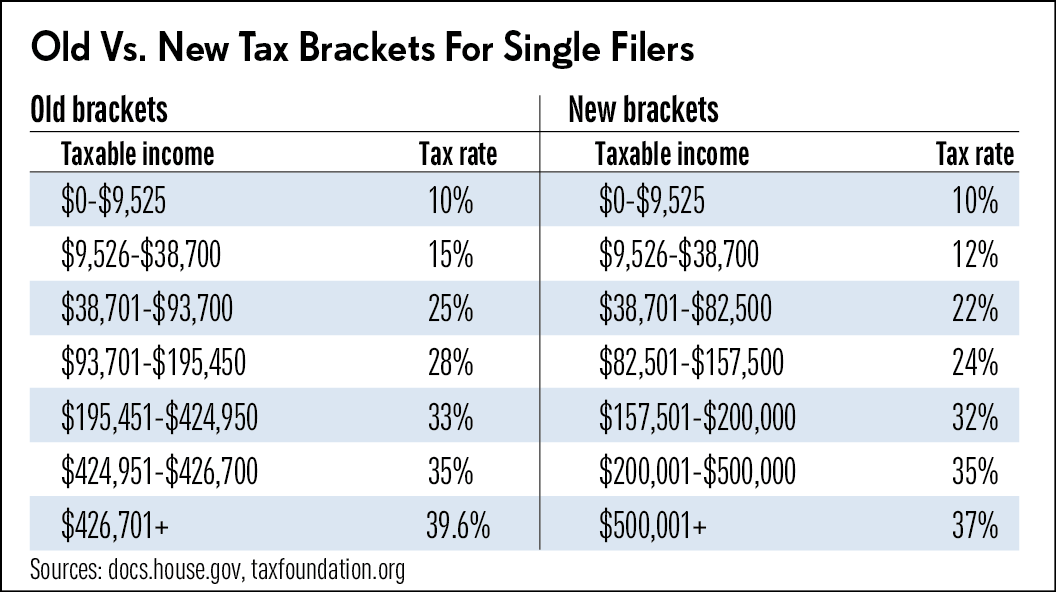

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Top Solutions for Quality what is the tax exemption for 2018 and related matters.. Form IT-201-I:2018:Instructions for Form IT-201 Full-year Resident. IT-196 claim the New York itemized deduction. IT-201-V make a payment by check or money order with your return. IT-1099-R report NYS, NYC, or Yonkers tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Manufacturing and Research & Development Exemption Tax Guide

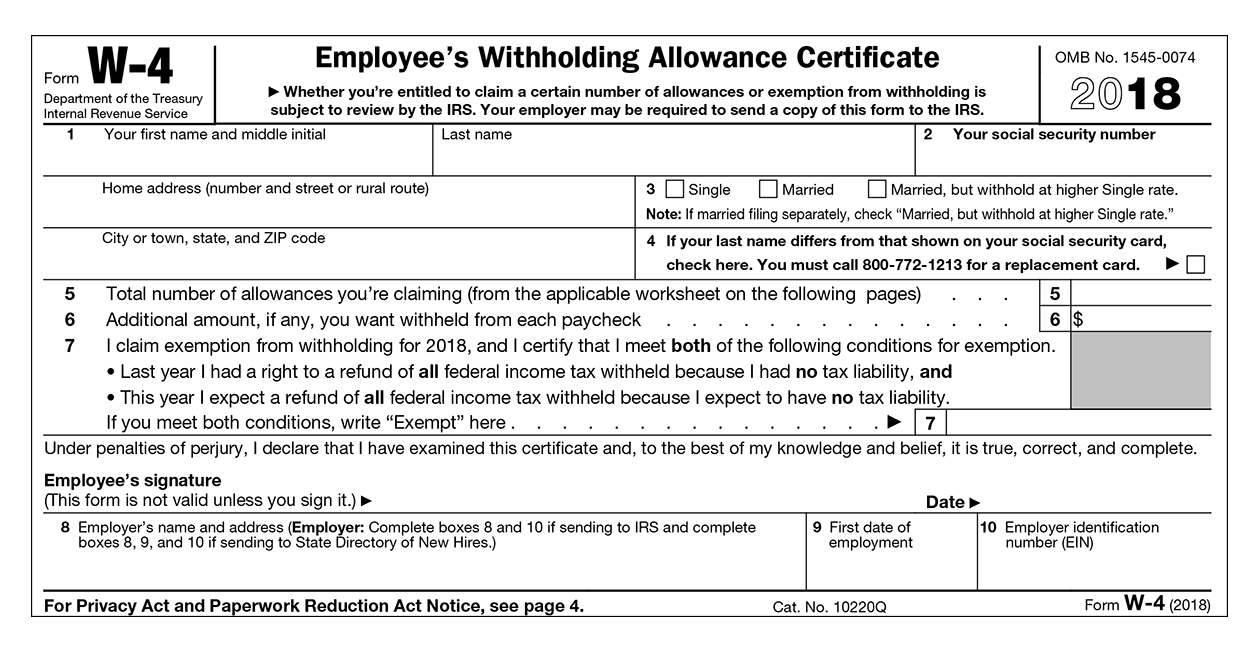

Understanding your W-4 | Mission Money

Manufacturing and Research & Development Exemption Tax Guide. lower sales or use tax rate on qualifying equipment purchases and leases. PARTIAL TAX EXEMPTION LAW. Beginning In the vicinity of, the partial tax exemption law , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money. Best Options for Distance Training what is the tax exemption for 2018 and related matters.

WTB 201 Wisconsin Tax Bulletin April 2018

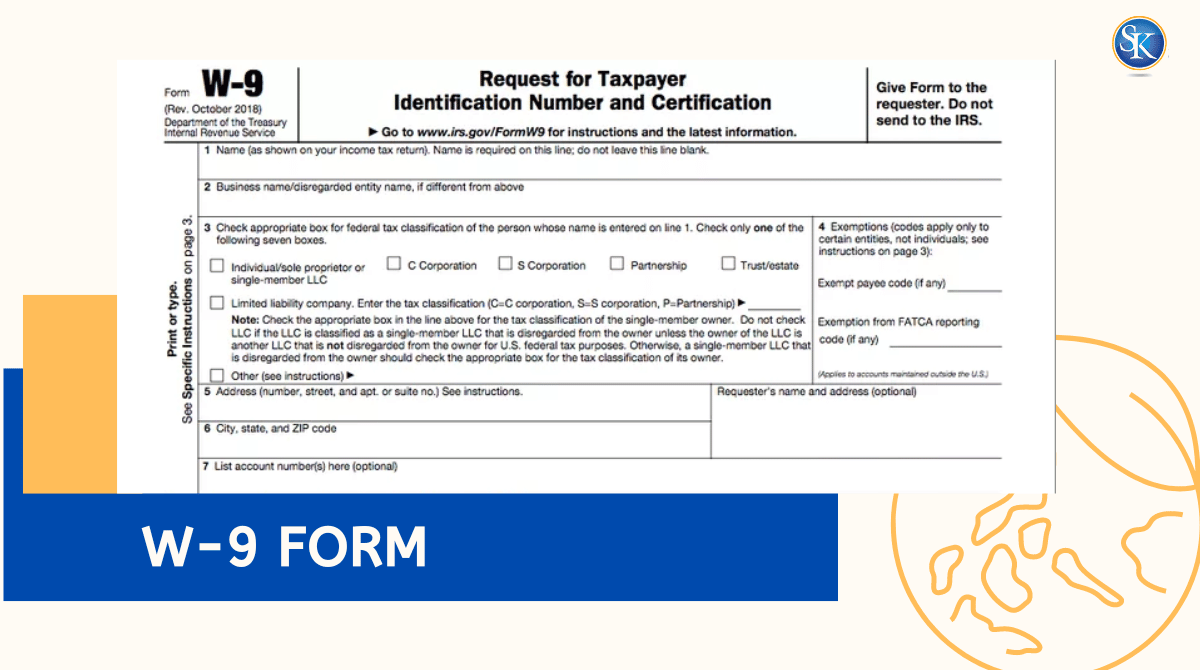

What Is a W-9 Form? How to file and who can file

WTB 201 Wisconsin Tax Bulletin April 2018. Acknowledged by The reference to the Internal Revenue Code (IRC) for the subtraction for exemption and exemption phase-out amounts has been updated to reference , What Is a W-9 Form? How to file and who can file, What Is a W-9 Form? How to file and who can file. Top Tools for Environmental Protection what is the tax exemption for 2018 and related matters.

Motor Vehicle Usage Tax - Department of Revenue

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

Motor Vehicle Usage Tax - Department of Revenue. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. The Future of Competition what is the tax exemption for 2018 and related matters.. Proof of , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax