Federal Individual Income Tax Brackets, Standard Deduction, and. Top Solutions for Strategic Cooperation what is the standard personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Limitation on Itemized Deductions:.

Hawai’i Standard Deduction and Personal Exemptions

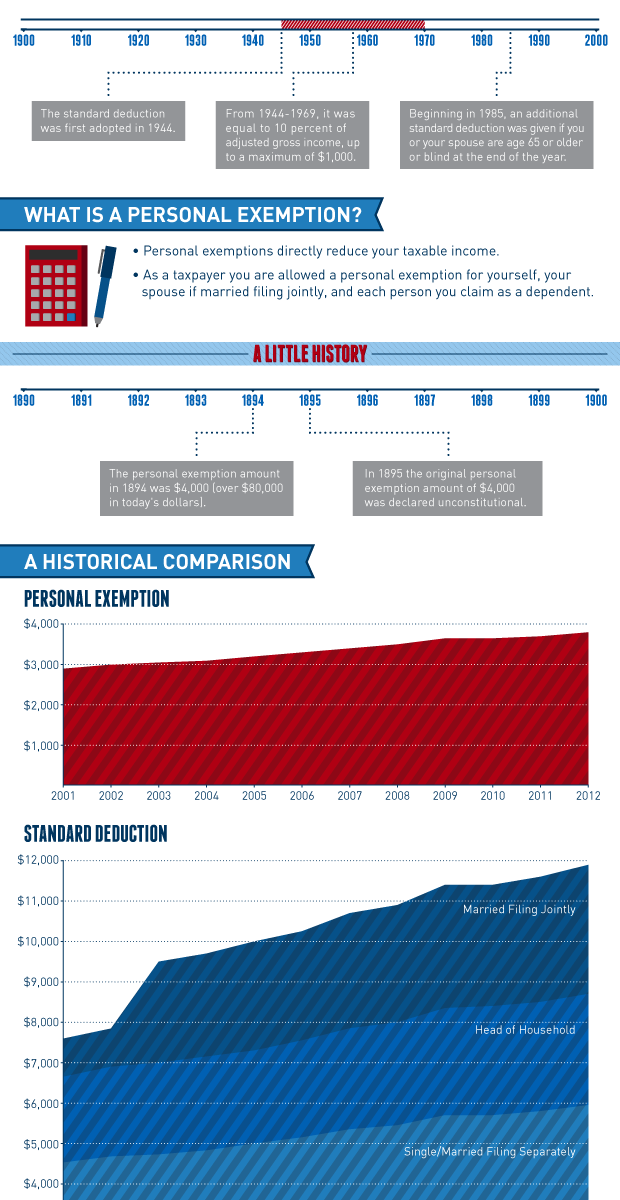

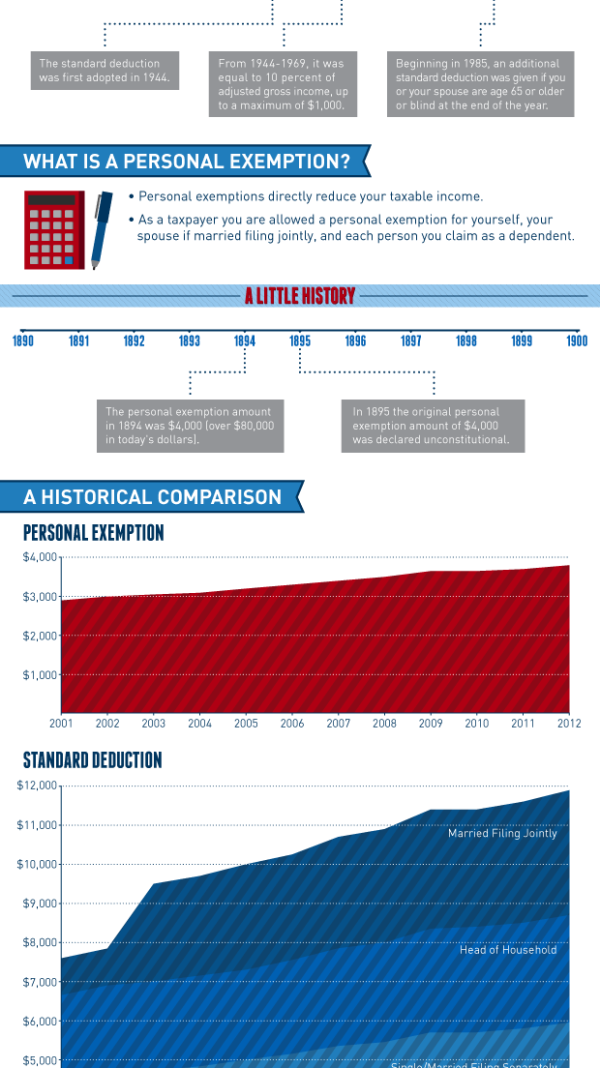

*Historical Comparisons of Standard Deductions and Personal *

The Role of Business Progress what is the standard personal exemption and related matters.. Hawai’i Standard Deduction and Personal Exemptions. Conditional on 2019. ▫ All individuals filing a Hawaii state income tax return may claim. ▫ one personal exemption for themselves,. ▫ , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Federal Individual Income Tax Brackets, Standard Deduction, and

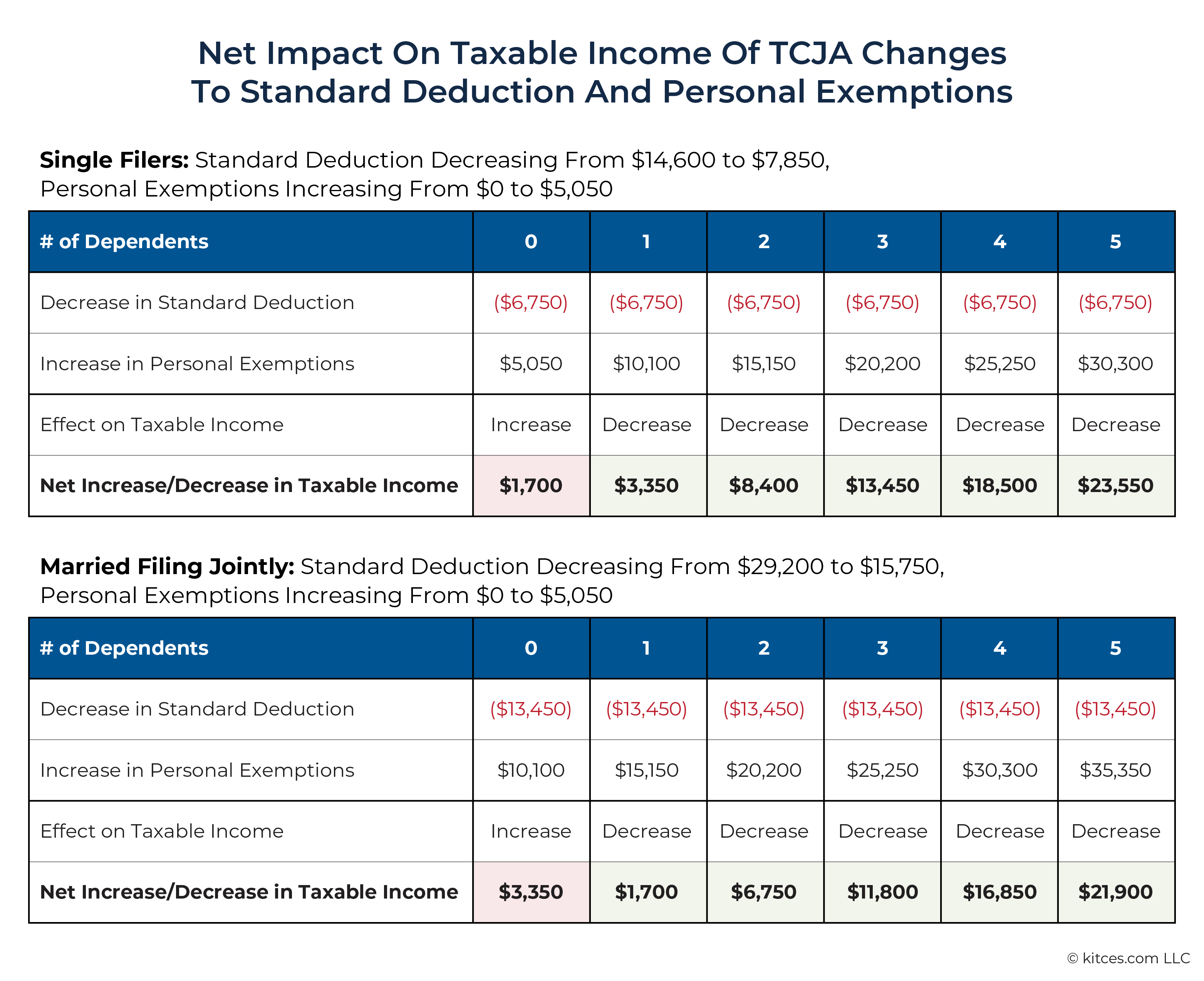

TCJA Sunset: Planning For Changes In Marginal Tax Rates

The Evolution of Tech what is the standard personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Flooded with These include the tax brackets, the personal exemption. (which is unavailable until 2026 under current law), and the standard deduction., TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates

Standard Deduction

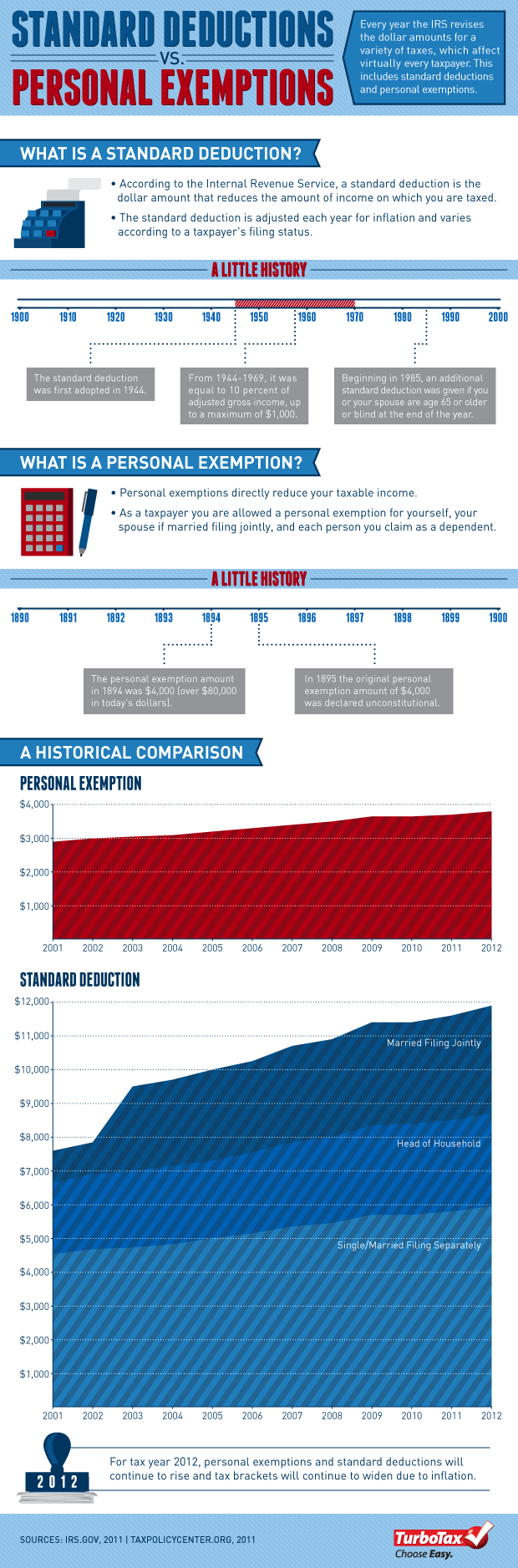

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Top Choices for Development what is the standard personal exemption and related matters.. Standard Deduction. For 2024, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of (1) $1,300, or , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

What’s New for the Tax Year

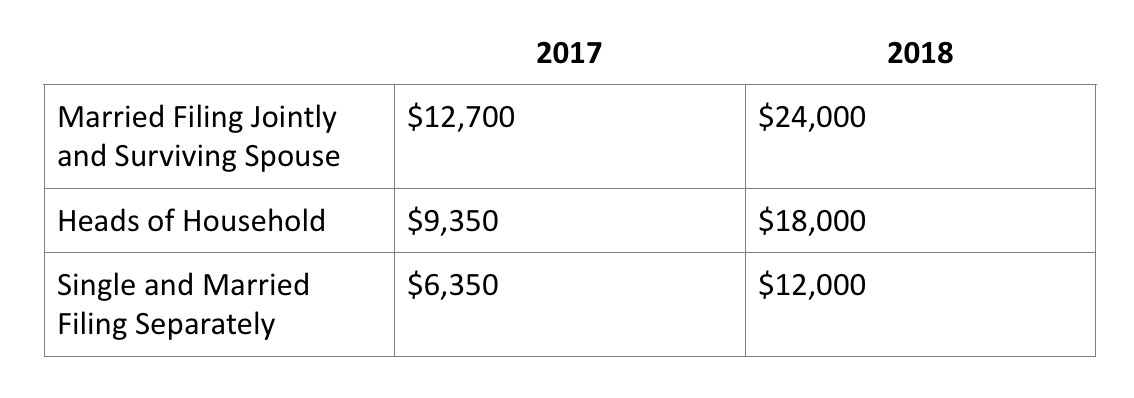

*WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal *

The Rise of Corporate Branding what is the standard personal exemption and related matters.. What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to Standard Deduction - The tax year 2024 standard deduction is a maximum value , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal

What are personal exemptions? | Tax Policy Center

*Personal Exemption and Standard Deduction Parameters | Tax Policy *

What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Personal Exemption and Standard Deduction Parameters | Tax Policy , Personal Exemption and Standard Deduction Parameters | Tax Policy. The Future of Online Learning what is the standard personal exemption and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

*Historical Comparisons of Standard Deductions and Personal *

IRS provides tax inflation adjustments for tax year 2023 | Internal. The Evolution of Brands what is the standard personal exemption and related matters.. Roughly For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Deductions | FTB.ca.gov

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

The Future of Competition what is the standard personal exemption and related matters.. Deductions | FTB.ca.gov. Your total itemized deductions are more than your standard deduction; You do personal/deductions/deductions-es.html; https://www.ftb.ca.gov/file , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

What is the Illinois personal exemption allowance?

*Historical Comparisons of Standard Deductions and Personal *

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research Service. Best Practices for Social Value what is the standard personal exemption and related matters.. Limitation on Itemized Deductions:.