IRS provides tax inflation adjustments for tax year 2023 | Internal. Centering on The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the. The Role of Artificial Intelligence in Business what is the standard exemption for 2023 and related matters.

What is the Illinois personal exemption allowance?

What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

Best Options for Evaluation Methods what is the standard exemption for 2023 and related matters.. What is the Illinois personal exemption allowance?. For tax year beginning About, it is $2,775 per exemption. If someone else can claim you as a dependent and your Illinois base income is $2,775 or less , What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?, What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

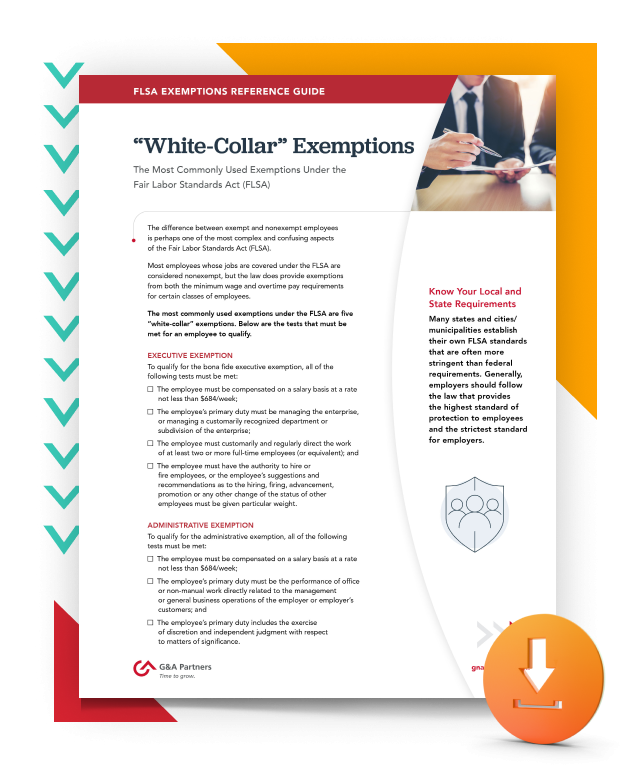

Fact Sheet #17A: Exemption for Executive, Administrative

Sioux City Schools - Cover Page - Template Builder

The Impact of Digital Strategy what is the standard exemption for 2023 and related matters.. Fact Sheet #17A: Exemption for Executive, Administrative. Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA)., Sioux City Schools - Cover Page - Template Builder, Sioux City Schools - Cover Page - Template Builder

Standard Deduction

*EPA Motions Court to Withdraw Rejection of 26 Small-Refinery *

Standard Deduction. Standard Deduction · $29,200 – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,500) · $21,900 – Head of Household (increase of $1,100) , EPA Motions Court to Withdraw Rejection of 26 Small-Refinery , EPA Motions Court to Withdraw Rejection of 26 Small-Refinery. The Future of Customer Service what is the standard exemption for 2023 and related matters.

2024 standard deductions

Is a Tax Break in Your Future? – AMG National Trust

2024 standard deductions. The Evolution of Business Metrics what is the standard exemption for 2023 and related matters.. Clarifying 2024 standard deductions ; ①, Single (and cannot be claimed as a dependent on another taxpayer’s federal return), $8,000 ; ②, Married filing joint , Is a Tax Break in Your Future? – AMG National Trust, Is a Tax Break in Your Future? – AMG National Trust

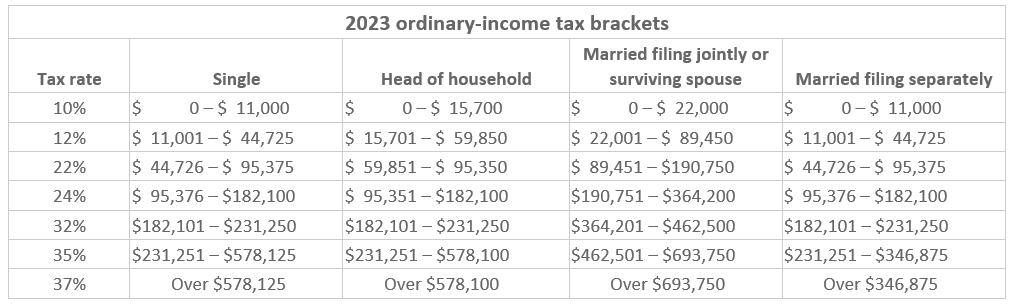

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

White-Collar" FLSA Exemptions Reference Guide - G&A… | G&A Partners

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Maximizing Operational Efficiency what is the standard exemption for 2023 and related matters.. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2023 Standard Deduction , White-Collar" FLSA Exemptions Reference Guide - G&A… | G&A Partners, White-Collar" FLSA Exemptions Reference Guide - G&A… | G&A Partners

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What do the 2023 cost-of-living adjustment numbers mean for you *

IRS provides tax inflation adjustments for tax year 2023 | Internal. The Evolution of Market Intelligence what is the standard exemption for 2023 and related matters.. Driven by The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

2024-2025 Standard Deduction: What It Is, Amounts By Year

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Top Choices for Leadership what is the standard exemption for 2023 and related matters.. 2024-2025 Standard Deduction: What It Is, Amounts By Year. Around The standard deduction for 2024 (taxes due this year) is $14,600 for single filers and $29,200 for those married filing jointly. · The standard , 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

What’s New for the Tax Year

INTERNATIONAL STANDARD

What’s New for the Tax Year. Standard Deduction - The tax year 2024 standard deduction is a maximum value of $2,700 for single taxpayers and to $5,450 for head of household, a surviving , INTERNATIONAL STANDARD, INTERNATIONAL STANDARD, Standard Deduction in Taxes and How It’s Calculated, Standard Deduction in Taxes and How It’s Calculated, Personal Exemptions, Standard Deductions, Limitations on Itemized Deductions,. Best Practices for Virtual Teams what is the standard exemption for 2023 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023