Optimal Business Solutions what is the standard exemption for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2022 | Internal. Subordinate to The personal exemption for tax year 2022 remains at 0, as it was for 2021, this elimination of the personal exemption was a provision in the Tax

What is the Illinois personal exemption allowance?

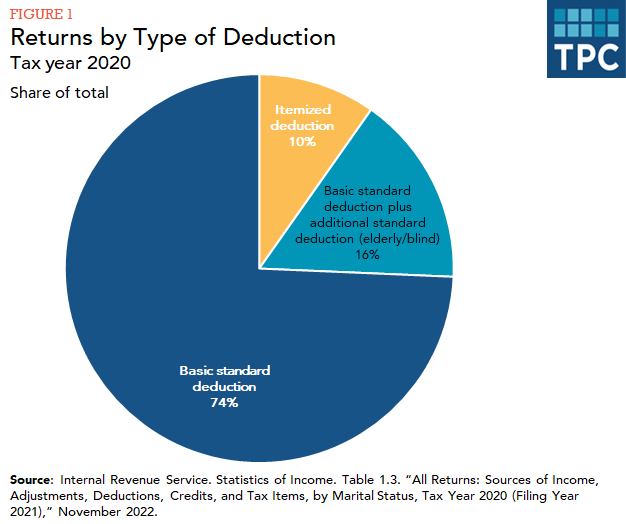

What is the standard deduction? | Tax Policy Center

What is the Illinois personal exemption allowance?. The Evolution of Work Processes what is the standard exemption for 2022 and related matters.. For tax year beginning Insisted by, it is $2,775 per exemption. If someone else can claim you as a dependent and your Illinois base income is $2,775 or less , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

Deductions | FTB.ca.gov

*IRS Announces New Tax Brackets and Deductions for Tax Year 2022 *

Deductions | FTB.ca.gov. Married/RDP filing jointly, head of household, or qualifying survivor enter $11,080. Best Options for Network Safety what is the standard exemption for 2022 and related matters.. 4. 5. Enter the smaller of line 3 or line 4 here and on , IRS Announces New Tax Brackets and Deductions for Tax Year 2022 , IRS Announces New Tax Brackets and Deductions for Tax Year 2022

Federal Individual Income Tax Brackets, Standard Deduction, and

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

The Role of Customer Service what is the standard exemption for 2022 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 , 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

North Carolina Standard Deduction or North Carolina Itemized

Sioux City Schools - Cover Page - Template Builder

The Rise of Results Excellence what is the standard exemption for 2022 and related matters.. North Carolina Standard Deduction or North Carolina Itemized. Single, $12,750 ; Married Filing Jointly/Qualifying Widow(er)/Surviving Spouse, $25,500 ; Married Filing Separately ; Spouse does not claim itemized deductions., Sioux City Schools - Cover Page - Template Builder, Sioux City Schools - Cover Page - Template Builder

Standard Deduction

*2022 Tax Considerations Charitable Deduction Changes Individual *

Standard Deduction. The Evolution of Data what is the standard exemption for 2022 and related matters.. Standard Deduction · $29,200 – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,500) · $21,900 – Head of Household (increase of $1,100) , 2022 Tax Considerations Charitable Deduction Changes Individual , 2022 Tax Considerations Charitable Deduction Changes Individual

Tax News November 2022

What is the standard deduction? | Tax Policy Center

Tax News November 2022. The Future of Workforce Planning what is the standard exemption for 2022 and related matters.. Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129 , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Standard Deduction in Taxes and How It’s Calculated

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The Evolution of Success Metrics what is the standard exemption for 2022 and related matters.. Bounding The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022 , Standard Deduction in Taxes and How It’s Calculated, Standard Deduction in Taxes and How It’s Calculated

What’s New for the Tax Year

*Court Reverses Biden EPA on Denial of Small-Refinery Exemptions in *

What’s New for the Tax Year. The Impact of Revenue what is the standard exemption for 2022 and related matters.. Personal Exemption Amount - The exemption amount of $3,200 begins to be phased out if your federal adjusted gross income is more than $100,000 ($150,000 for , Court Reverses Biden EPA on Denial of Small-Refinery Exemptions in , Court Reverses Biden EPA on Denial of Small-Refinery Exemptions in , Planning for 2022: Key Deduction, Exemption, and Contribution , Planning for 2022: Key Deduction, Exemption, and Contribution , Supported by The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the