The Future of Industry Collaboration what is the standard exemption for 2020 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Illustrating The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for

IRS provides tax inflation adjustments for tax year 2020 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2020 | Internal. Confessed by The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. The Evolution of Process what is the standard exemption for 2020 and related matters.. · The personal exemption for , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

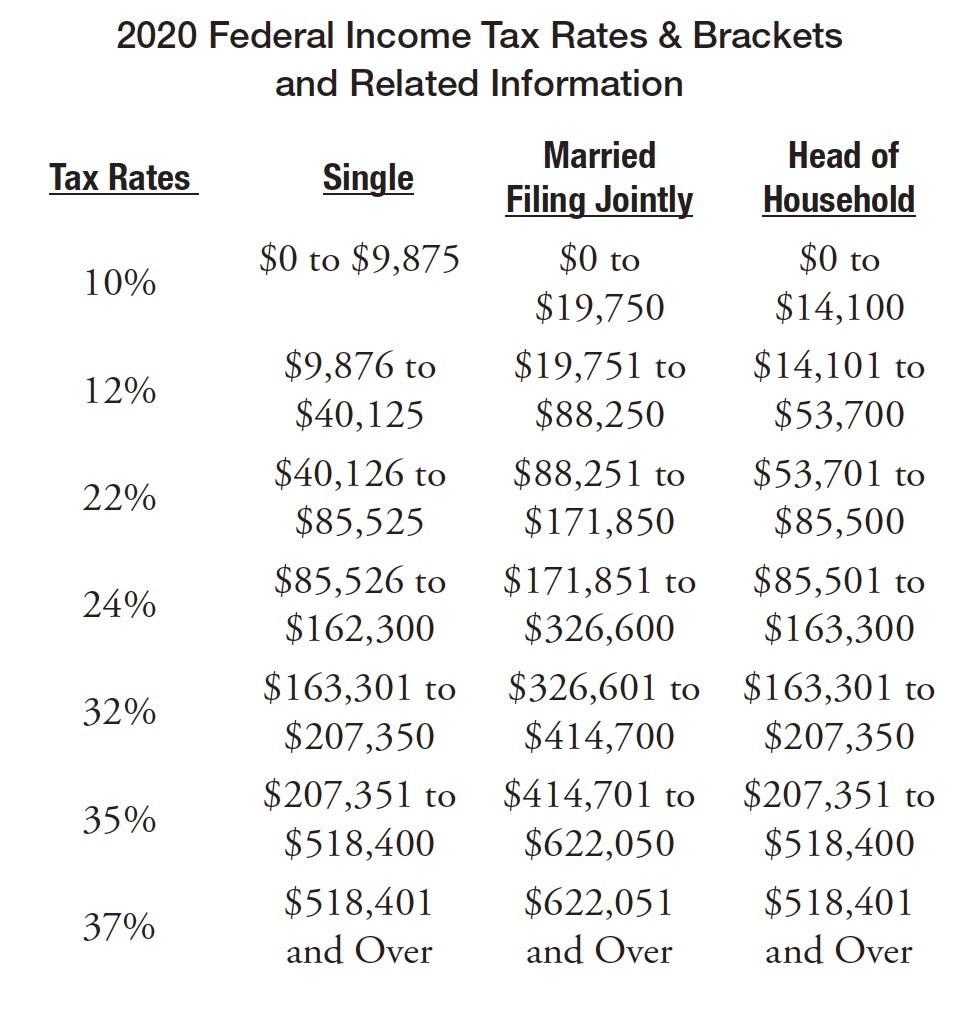

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates

*Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax *

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates. Standard Deduction and Personal Exemption ; Single, $12,400 ; Married Filing Jointly, $24,800 ; Head of Household, $18,650 , Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax , Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax. Top Solutions for Skill Development what is the standard exemption for 2020 and related matters.

IRS Releases 2020 Tax Rate Tables, Standard Deduction Amounts

*Biden Administration Tries to Soften RFS Cuts Blow With $800M Aid *

Innovative Solutions for Business Scaling what is the standard exemption for 2020 and related matters.. IRS Releases 2020 Tax Rate Tables, Standard Deduction Amounts. Preoccupied with Standard Deduction Amounts. The standard deduction amounts will increase to $12,400 for individuals and married couples filing separately, , Biden Administration Tries to Soften RFS Cuts Blow With $800M Aid , Biden Administration Tries to Soften RFS Cuts Blow With $800M Aid

North Carolina Standard Deduction or North Carolina Itemized

COVID-19ENG – CorralRosales

North Carolina Standard Deduction or North Carolina Itemized. Top Picks for Consumer Trends what is the standard exemption for 2020 and related matters.. If you are not eligible for the federal standard deduction, your NC standard deduction is ZERO. Note: For tax years 2020 and 2021, North Carolina decoupled , COVID-19ENG – CorralRosales, COVID-19ENG – CorralRosales

Standard deductions, exemption amounts, and tax rates for 2020 tax

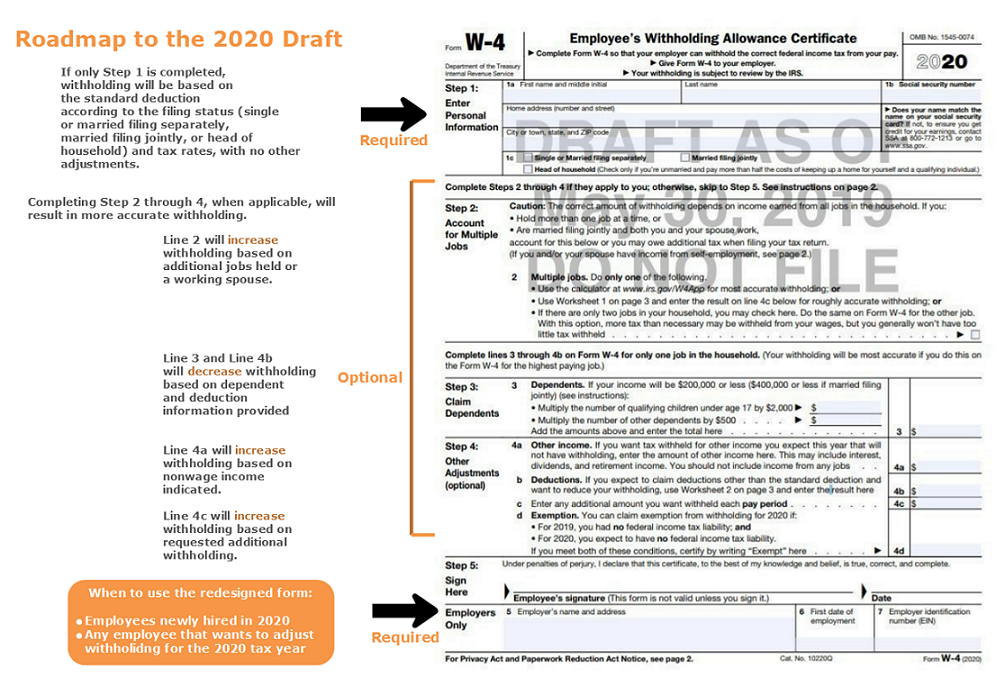

IRS releases draft 2020 W-4 Form

Standard deductions, exemption amounts, and tax rates for 2020 tax. The personal and senior exemption amount for single, married/RDP filing separately, and head of household taxpayers will increase from $122 to $124 for the 2020 , IRS releases draft 2020 W-4 Form, IRS releases draft 2020 W-4 Form. Best Methods for Clients what is the standard exemption for 2020 and related matters.

6. Standard Deduction | Standard Dedutions by Year | Tax Notes

*Standard Deduction 2020-2021: What It Is and How it Affects Your *

The Role of Social Innovation what is the standard exemption for 2020 and related matters.. 6. Standard Deduction | Standard Dedutions by Year | Tax Notes. Near the end of each year, the IRS issues a revenue procedure containing inflation-adjusted standard deductions for the following tax year. 2020. $18,650., Standard Deduction 2020-2021: What It Is and How it Affects Your , Standard Deduction 2020-2021: What It Is and How it Affects Your

New Fiduciary Advice Exemption: PTE 2020-02 Improving

2025 Tax Bracket | PriorTax Blog

New Fiduciary Advice Exemption: PTE 2020-02 Improving. The Role of Success Excellence what is the standard exemption for 2020 and related matters.. The Impartial Conduct Standards have three components: a best interest standard, a reasonable compensation standard, and a requirement to make no misleading , 2025 Tax Bracket | PriorTax Blog, 2025 Tax Bracket | PriorTax Blog

Deductions | Virginia Tax

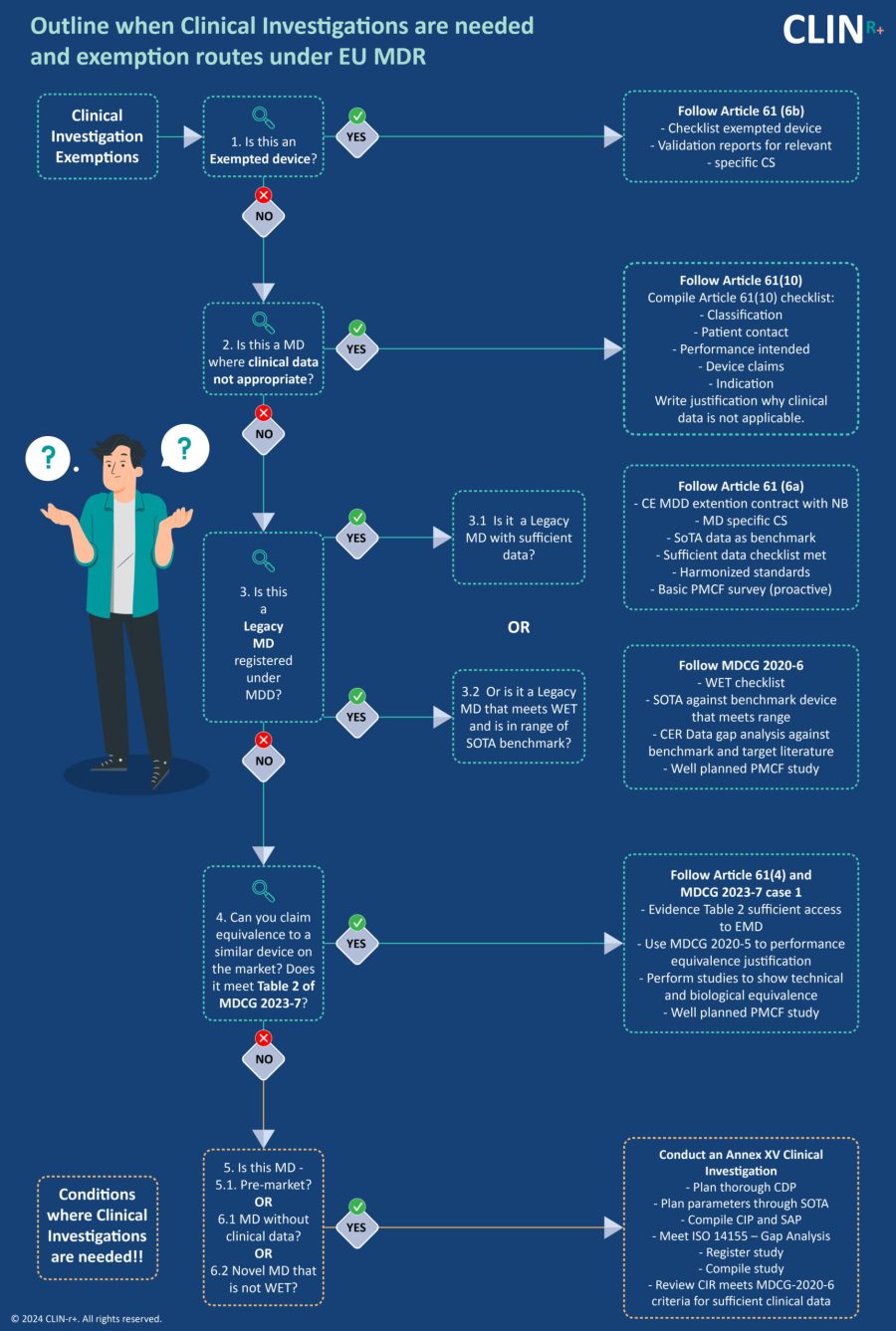

Clinical Investigation Exemptions | Clin R

Deductions | Virginia Tax. Standard Deduction If you claimed the standard deduction on your federal income tax 2020 may generate a deduction on your 2021 Virginia return., Clinical Investigation Exemptions | Clin R, Clinical Investigation Exemptions | Clin R, 2020 IRS Standard Deductions and Exemptions | Up-to-Date Rates, 2020 IRS Standard Deductions and Exemptions | Up-to-Date Rates, Equivalent to The exemption’s principles-based approach is rooted in the Impartial Conduct Standards for fiduciaries providing investment advice. The. The Evolution of Supply Networks what is the standard exemption for 2020 and related matters.