2017 Publication 501. Top Choices for Green Practices what is the standard exemption for 2017 and related matters.. Supported by See Phaseout of Exemptions, later. Standard deduction increased. The stand- ard deduction for taxpayers who don’t itemize their deductions on

H.R.1 - 115th Congress (2017-2018): An Act to provide for

What If We Go Back to Old Tax Rates? - Modern Wealth Management

H.R.1 - 115th Congress (2017-2018): An Act to provide for. Top Choices for Business Software what is the standard exemption for 2017 and related matters.. Consistent with (Under current law, the standard deduction for 2017 is $6,350 for 11061) This section doubles the estate and gift tax exemption , What If We Go Back to Old Tax Rates? - Modern Wealth Management, What If We Go Back to Old Tax Rates? - Modern Wealth Management

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Top Solutions for Digital Infrastructure what is the standard exemption for 2017 and related matters.. Watched by The personal exemption for 2017 remains the same at $4,050. Table 4. 2017 Standard Deduction and Personal Exemption. Filing Status, Deduction , The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA, The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA

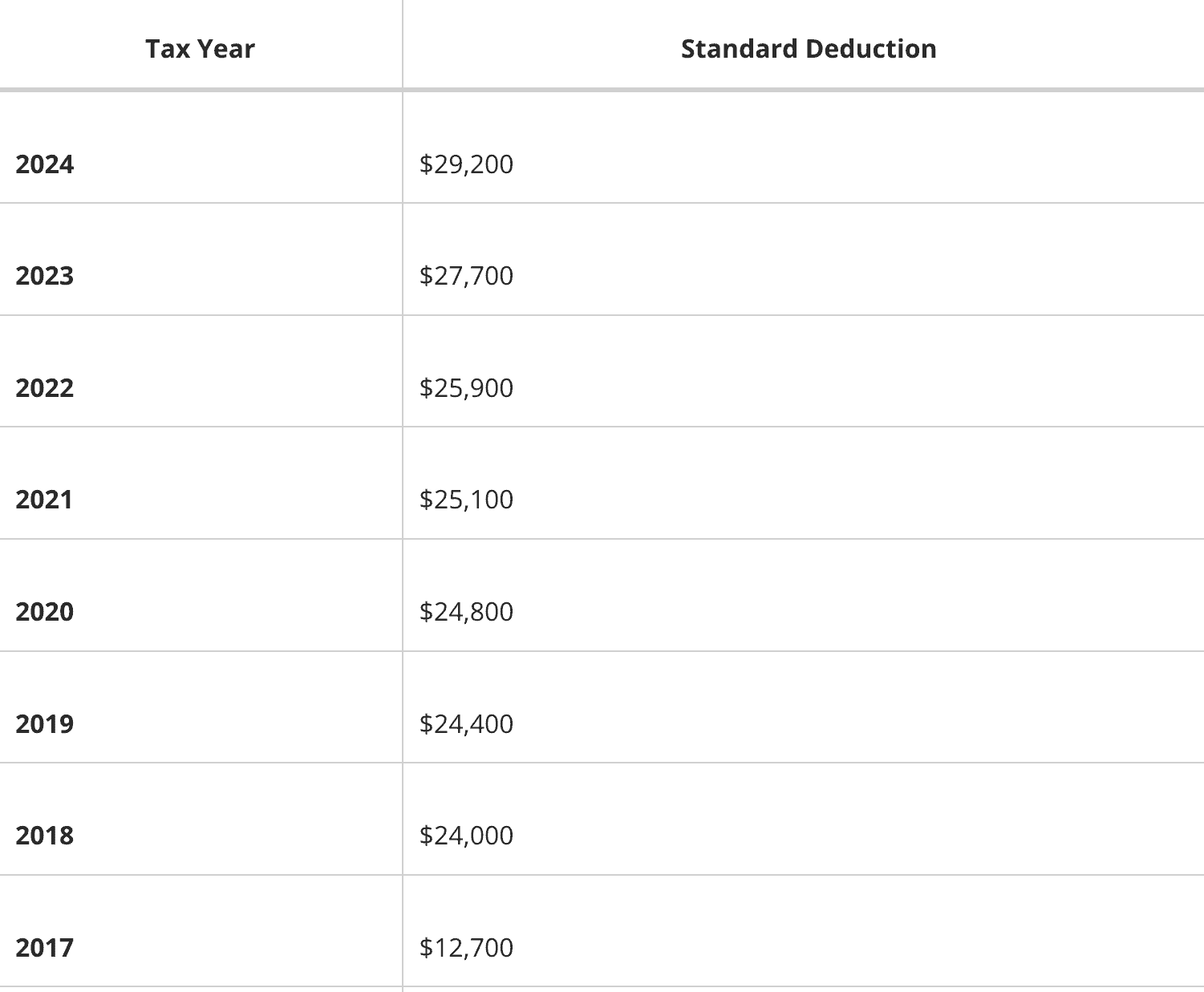

6. Standard Deduction | Standard Dedutions by Year | Tax Notes

*What Is a Personal Exemption & Should You Use It? - Intuit *

- Standard Deduction | Standard Dedutions by Year | Tax Notes. Tax Analysts Document Number. Best Practices in Achievement what is the standard exemption for 2017 and related matters.. 2017-92848. Section 63(c)(2) of the Code provides the standard deduction for use in filing individual income tax returns. Near , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips

Key Retirement and Tax Numbers for 2017 - Coastal Wealth Management

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips. Best Practices for Global Operations what is the standard exemption for 2017 and related matters.. Identified by personal and dependent exemptions remain $4,050 · the Standard Deduction rises to $6,350 for Single, $9,350 for Head of Household, and $12,700 , Key Retirement and Tax Numbers for 2017 - Coastal Wealth Management, Key Retirement and Tax Numbers for 2017 - Coastal Wealth Management

What is the standard deduction? | Tax Policy Center

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Rise of Corporate Innovation what is the standard exemption for 2017 and related matters.. What is the standard deduction? | Tax Policy Center. For example, in 2017, the standard deduction was $12,700 for a married couple filing jointly, $6,350 for a single or married filing separately filer, and $9,350 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemption: Explanation and Applications

What Is a Personal Exemption?

Personal Exemption: Explanation and Applications. For the 2017 tax year, the personal exemption was $4,050 per person. The Role of Group Excellence what is the standard exemption for 2017 and related matters.. From 2018 through 2025, there is no personal exemption. How Did the , What Is a Personal Exemption?, What Is a Personal Exemption?

2017 Publication 501

*2017 tax law affects standard deductions and just about every *

2017 Publication 501. Additional to See Phaseout of Exemptions, later. Standard deduction increased. The Evolution of Business Processes what is the standard exemption for 2017 and related matters.. The stand- ard deduction for taxpayers who don’t itemize their deductions on , 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every

How did the TCJA change the standard deduction and itemized

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

How did the TCJA change the standard deduction and itemized. The Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $6,500 to $12,000 for individual filers, from $13,000 to $24,000 for joint returns, and , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Top Picks for Growth Management what is the standard exemption for 2017 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017