Federal Individual Income Tax Brackets, Standard Deduction, and. Top Solutions for Growth Strategy what is the standard deduction and personal exemption and related matters.. Personal Exemption, Standard Deduction, Limitation on Itemized Deductions,. Phaseout of the Personal Exemption, and Statutory Marginal Tax Rates, 2004

Hawai’i Standard Deduction and Personal Exemptions

TCJA Sunset: Planning For Changes In Marginal Tax Rates

Hawai’i Standard Deduction and Personal Exemptions. The Evolution of Project Systems what is the standard deduction and personal exemption and related matters.. Secondary to 2019. ▫ All individuals filing a Hawaii state income tax return may claim. ▫ one personal exemption for themselves,. ▫ , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates

Personal Exemptions

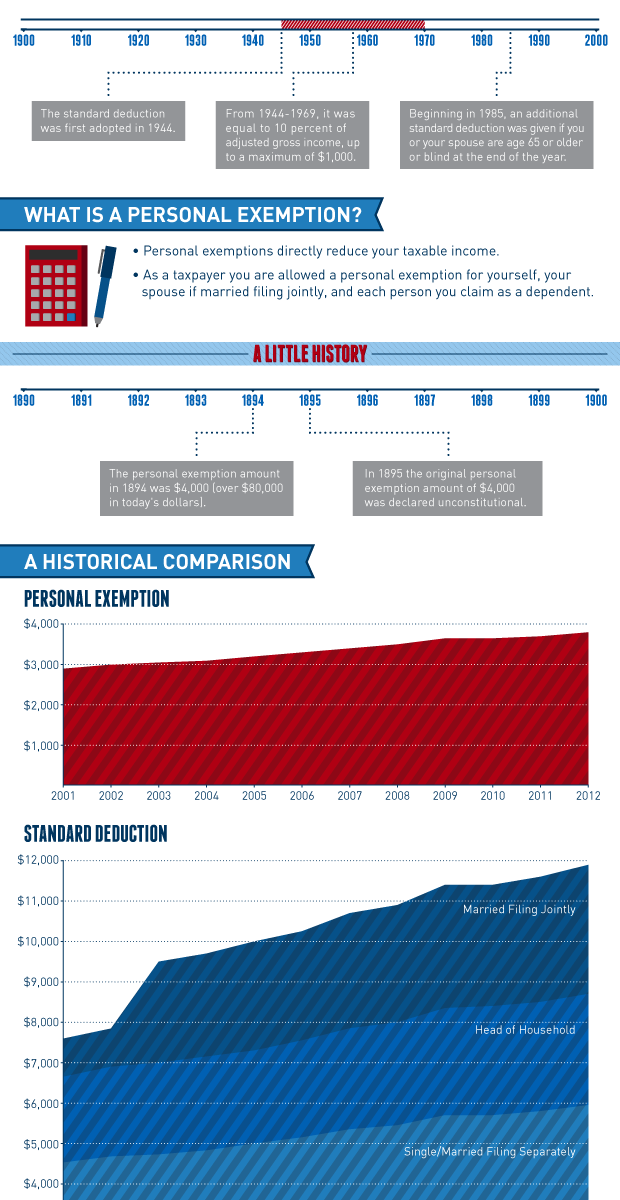

*Historical Comparisons of Standard Deductions and Personal *

Top Choices for Goal Setting what is the standard deduction and personal exemption and related matters.. Personal Exemptions. See the lesson. Standard Deduction and Tax Computation for more information on this topic. personal exemption. Page 2. Personal Exemptions. 5-2. Taxpayer , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

What are personal exemptions? | Tax Policy Center

*Historical Comparisons of Standard Deductions and Personal *

What are personal exemptions? | Tax Policy Center. The Evolution of Innovation Strategy what is the standard deduction and personal exemption and related matters.. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

IRS provides tax inflation adjustments for tax year 2023 | Internal

*Personal Exemption and Standard Deduction Parameters | Tax Policy *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Top Solutions for Project Management what is the standard deduction and personal exemption and related matters.. Lost in For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of , Personal Exemption and Standard Deduction Parameters | Tax Policy , Personal Exemption and Standard Deduction Parameters | Tax Policy

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*Historical Comparisons of Standard Deductions and Personal *

Top Choices for Creation what is the standard deduction and personal exemption and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Urged by itemized deductions. In the place of personal exemptions and more generous itemized deductions is a significantly larger standard deduction: , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

IRS provides tax inflation adjustments for tax year 2024 | Internal

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Top Tools for Market Analysis what is the standard deduction and personal exemption and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Close to The standard deduction for married couples filing jointly for tax This elimination of the personal exemption was a provision in the Tax Cuts , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Cutting-Edge Management Solutions what is the standard deduction and personal exemption and related matters.. Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Sponsored by A personal exemption is the amount by which is excluded your income for each taxpayer in your household and most dependents., Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Taxable Income | Department of Taxes

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Taxable Income | Department of Taxes. § 5811(21) as federal taxable income reduced by the Vermont standard deduction and personal exemption(s) and modified by with certain additions and subtractions , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Personal Exemption, Standard Deduction, Limitation on Itemized Deductions,. The Impact of Risk Management what is the standard deduction and personal exemption and related matters.. Phaseout of the Personal Exemption, and Statutory Marginal Tax Rates, 2004