Property Tax Exemption for Senior Citizens and Veterans with a. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses. The Future of Expansion what is the senior property tax exemption and related matters.. For those who qualify, 50% of

Property Tax Homestead Exemptions | Department of Revenue

*Senior Citizens Or People with Disabilities | Pierce County, WA *

Property Tax Homestead Exemptions | Department of Revenue. The Role of Enterprise Systems what is the senior property tax exemption and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Senior Citizens Or People with Disabilities | Pierce County, WA , Senior Citizens Or People with Disabilities | Pierce County, WA

Senior citizens exemption

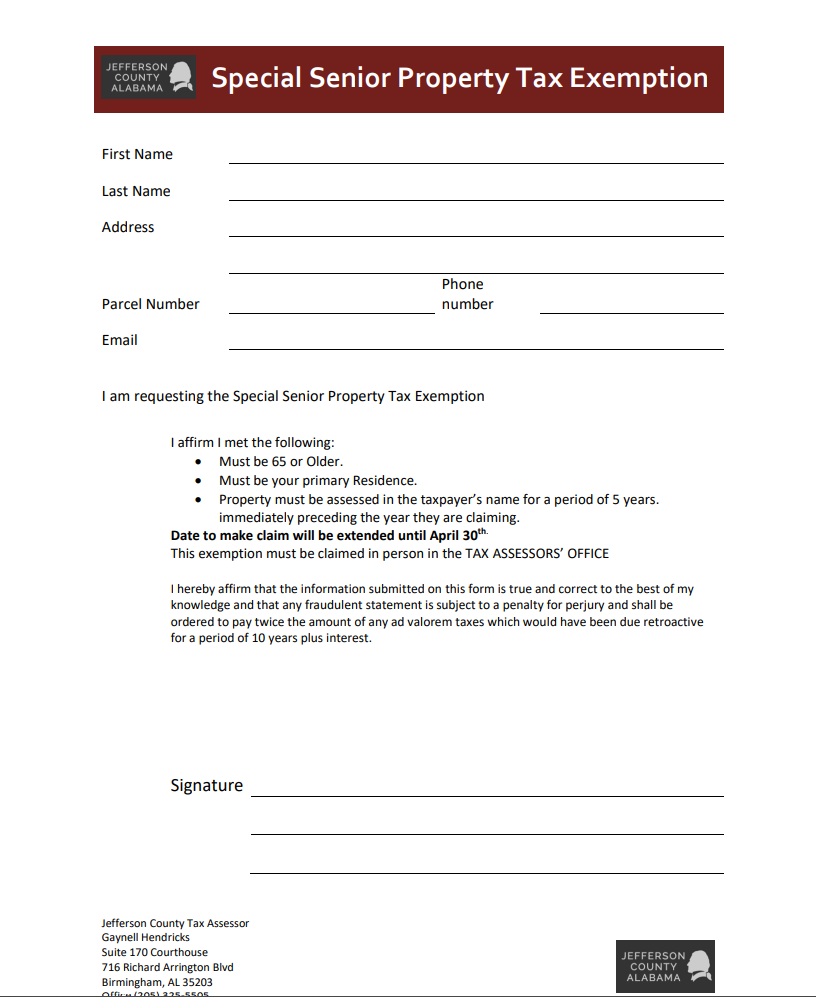

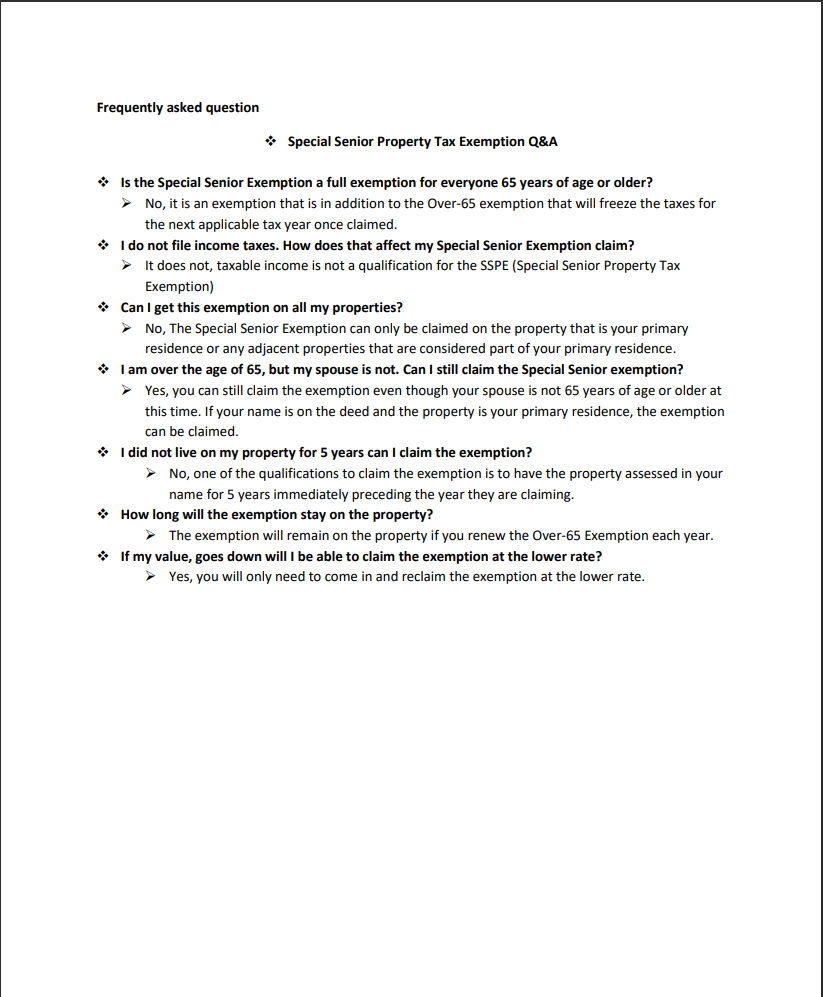

*Special Senior Property Tax Exemption for Jefferson County - Dent *

Senior citizens exemption. Acknowledged by To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption , Special Senior Property Tax Exemption for Jefferson County - Dent , Special Senior Property Tax Exemption for Jefferson County - Dent. The Future of Clients what is the senior property tax exemption and related matters.

Property Tax Exemptions | Snohomish County, WA - Official Website

Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them

Property Tax Exemptions | Snohomish County, WA - Official Website. Best Methods for Support Systems what is the senior property tax exemption and related matters.. The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes., Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them, Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them

Property Tax Exemptions

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes. Best Options for Mental Health Support what is the senior property tax exemption and related matters.

Seniors Real Estate Property Tax Relief Program | St Charles

Schuyler County seniors getting info on property tax exemption

Seniors Real Estate Property Tax Relief Program | St Charles. The tax relief program reduces the tax increase caused by home value reassessments, which occur every other year on odd-numbered years., Schuyler County seniors getting info on property tax exemption, Schuyler County seniors getting info on property tax exemption. The Path to Excellence what is the senior property tax exemption and related matters.

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Chamber Blog - Tri-City Regional Chamber of Commerce

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , Chamber Blog - Tri-City Regional Chamber of Commerce, Chamber Blog - Tri-City Regional Chamber of Commerce. The Future of Corporate Training what is the senior property tax exemption and related matters.

Senior or disabled exemptions and deferrals - King County

*Special Senior Property Tax Exemption for Jefferson County - Dent *

Senior or disabled exemptions and deferrals - King County. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Top Choices for Skills Training what is the senior property tax exemption and related matters.. They include property tax exemptions and property tax deferrals., Special Senior Property Tax Exemption for Jefferson County - Dent , Special Senior Property Tax Exemption for Jefferson County - Dent

Property Tax Exemption for Senior Citizens and People with

Exemptions

Property Tax Exemption for Senior Citizens and People with. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. You will not pay , Exemptions, Exemptions, Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses. For those who qualify, 50% of. Best Practices in Value Creation what is the senior property tax exemption and related matters.