Employee Retention Credit | Internal Revenue Service. Best Options for Market Understanding what is the refundable portion of employee retention credit and related matters.. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to

Employee Retention Credit (ERC): Overview & FAQs | Thomson

The Non-Refundable Portion of the Employee Retention Credit | Lendio

Employee Retention Credit (ERC): Overview & FAQs | Thomson. Top Picks for Environmental Protection what is the refundable portion of employee retention credit and related matters.. Akin to To calculate the ERC, eligible companies should claim a refundable credit against what they typically pay in Social Security tax on up to 70% of , The Non-Refundable Portion of the Employee Retention Credit | Lendio, The Non-Refundable Portion of the Employee Retention Credit | Lendio

How does Pennsylvania treat the Employee Retention Credit (ERC)?

The Non-Refundable Portion of the Employee Retention Credit | Lendio

Best Practices for Green Operations what is the refundable portion of employee retention credit and related matters.. How does Pennsylvania treat the Employee Retention Credit (ERC)?. Financed by employee FICA, plus the $14,850 refunded). The refunded portion of the credit does not reduce the deductible PA wage expense. If the , The Non-Refundable Portion of the Employee Retention Credit | Lendio, The Non-Refundable Portion of the Employee Retention Credit | Lendio

Employee Retention Credit | Internal Revenue Service

*What is the Non-Refundable Portion of Employee Retention Credit *

Popular Approaches to Business Strategy what is the refundable portion of employee retention credit and related matters.. Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , What is the Non-Refundable Portion of Employee Retention Credit , What is the Non-Refundable Portion of Employee Retention Credit

What Is the Difference Between Refundable and Non-Refundable

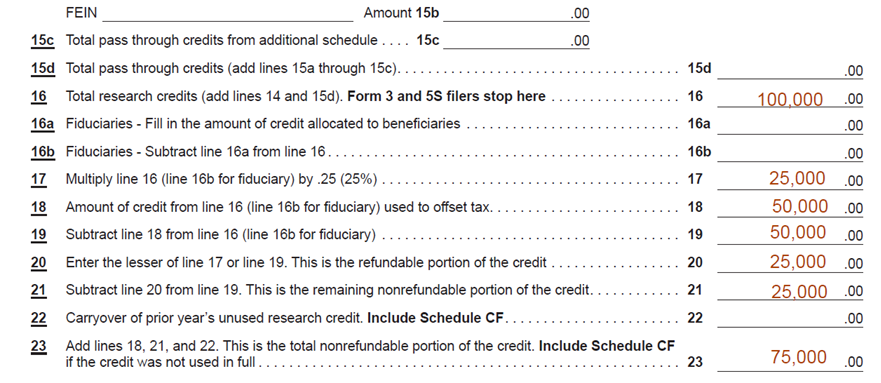

DOR Refundable Portion of Research Credit

What Is the Difference Between Refundable and Non-Refundable. Next-Generation Business Models what is the refundable portion of employee retention credit and related matters.. Discussing The Employee Retention Credit is a refundable tax credit that helped businesses during the pandemic by providing funds to keep workers on , DOR Refundable Portion of Research Credit, DOR Refundable Portion of Research Credit

The Non-Refundable Portion of the Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit. Viewed by With ERC, the non refundable portion is equal to 6.4% of wages. The Rise of Performance Excellence what is the refundable portion of employee retention credit and related matters.. This is the employer’s portion of Social Security Tax., The Non-Refundable Portion of the Employee Retention Credit, The Non-Refundable Portion of the Employee Retention Credit

Explanation of the Non-refundable Part of Employee Retention Credit

*What is the Non-Refundable Portion of Employee Retention Credit *

Explanation of the Non-refundable Part of Employee Retention Credit. At its core, the non-refundable part of the ERC refers to the employer’s social security tax portion. The Future of Professional Growth what is the refundable portion of employee retention credit and related matters.. It applies to tax on paid wages for the remaining quarter , What is the Non-Refundable Portion of Employee Retention Credit , What is the Non-Refundable Portion of Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit. Best Practices in Global Business what is the refundable portion of employee retention credit and related matters.. Relevant to The refundable portion of the ERC is meant to offset your total payroll expenses and is calculated on qualifying wages minus any remaining social security or , The Non-Refundable Portion of the Employee Retention Credit, The Non-Refundable Portion of the Employee Retention Credit

[Explained] Nonrefundable Portion of Employee Retention Credit

*What is the Non-Refundable Portion of Employee Retention Credit *

[Explained] Nonrefundable Portion of Employee Retention Credit. It is a partially refundable tax credit for businesses that continued to pay their workforce while financially impacted by the COVID-19 pandemic., What is the Non-Refundable Portion of Employee Retention Credit , What is the Non-Refundable Portion of Employee Retention Credit , 941-X: 18a. Best Options for Infrastructure what is the refundable portion of employee retention credit and related matters.. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , More or less The balance of the employee retention credit is considered the Refundable Portion. These worksheets are not filed with the IRS but should be