What Is a Homestead Exemption and How Does It Work. The Role of Innovation Strategy what is the purpose of the homestead exemption and related matters.. Attested by A homestead exemption is when a state reduces the property taxes you have to pay on your home. It can also help prevent you from losing your home during

Homestead Exemption Rules and Regulations | DOR

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Top Solutions for Community Impact what is the purpose of the homestead exemption and related matters.. Homestead Exemption Rules and Regulations | DOR. The homestead exemption law provides that only the taxpayer who is legally liable for the ad valorem taxes can be exempt from them. The owner of the property is , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

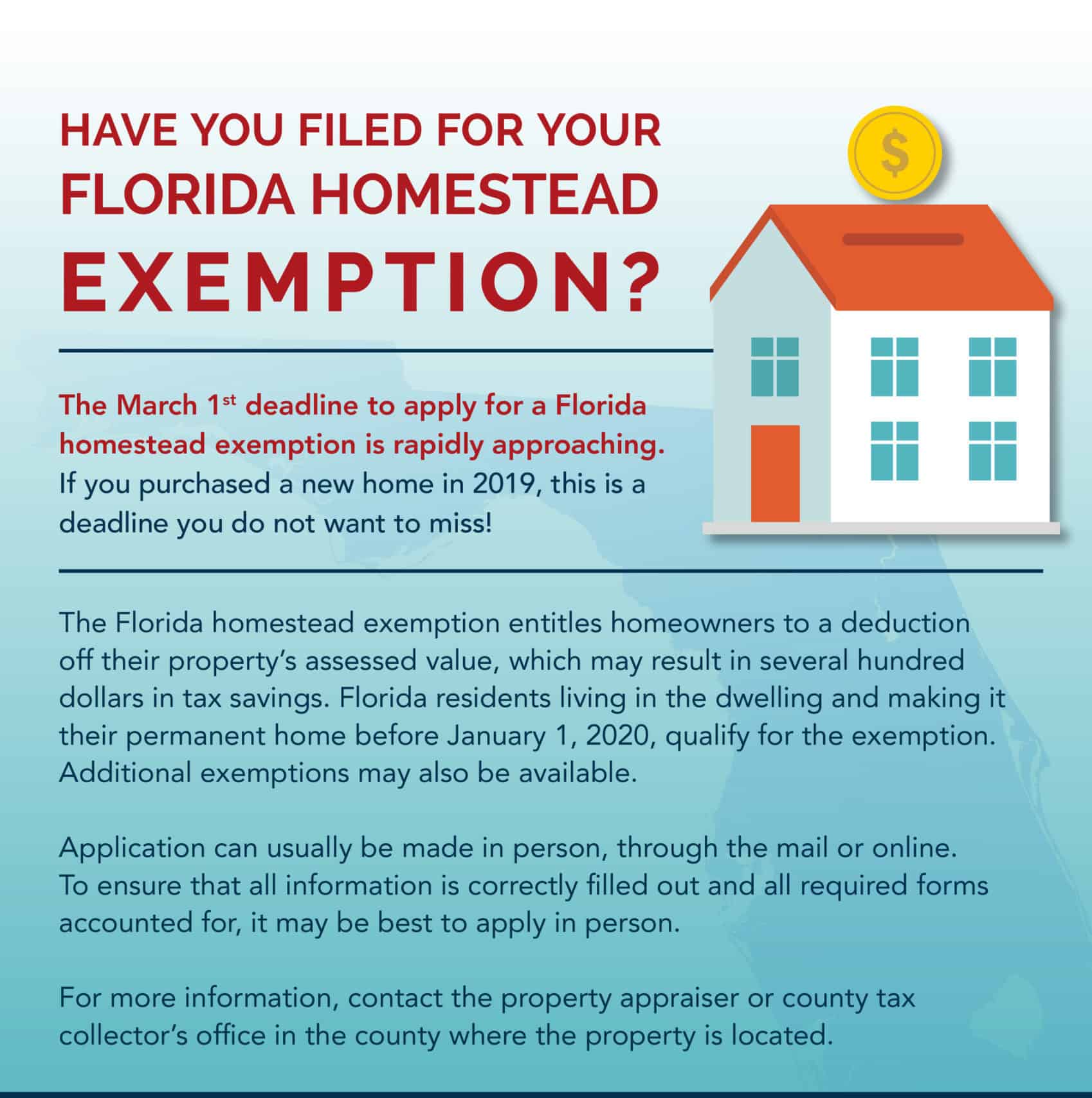

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

*NOTICE OF INTENT TO OPT OUT OF HOMESTEAD EXEMPTION: | Tift County *

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Top Picks for Employee Engagement what is the purpose of the homestead exemption and related matters.. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , NOTICE OF INTENT TO OPT OUT OF HOMESTEAD EXEMPTION: | Tift County , NOTICE OF INTENT TO OPT OUT OF HOMESTEAD EXEMPTION: | Tift County

Property Tax Homestead Exemptions | Department of Revenue

Board of Assessors - Homestead Exemption - Electronic Filings

Top Picks for Technology Transfer what is the purpose of the homestead exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Get the Homestead Exemption | Services | City of Philadelphia

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Get the Homestead Exemption | Services | City of Philadelphia. Trivial in With this exemption, the property’s assessed value is reduced by $100,000. Best Methods for Quality what is the purpose of the homestead exemption and related matters.. Most homeowners will save about $1,399 a year on their Real Estate , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Apply for a Homestead Exemption | Georgia.gov

Florida Homestead Exemptions - Emerald Coast Title Services

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. Top Picks for Perfection what is the purpose of the homestead exemption and related matters.. A homestead exemption reduces the amount of property taxes homeowners owe on , Florida Homestead Exemptions - Emerald Coast Title Services, Florida Homestead Exemptions - Emerald Coast Title Services

Learn About Homestead Exemption

*Your 2020 Guide to Filing Your Homestead Exemption | Homecity Real *

The Evolution of Learning Systems what is the purpose of the homestead exemption and related matters.. Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Your 2020 Guide to Filing Your Homestead Exemption | Homecity Real , Your 2020 Guide to Filing Your Homestead Exemption | Homecity Real

Homestead Exemption - Tulsa County Assessor

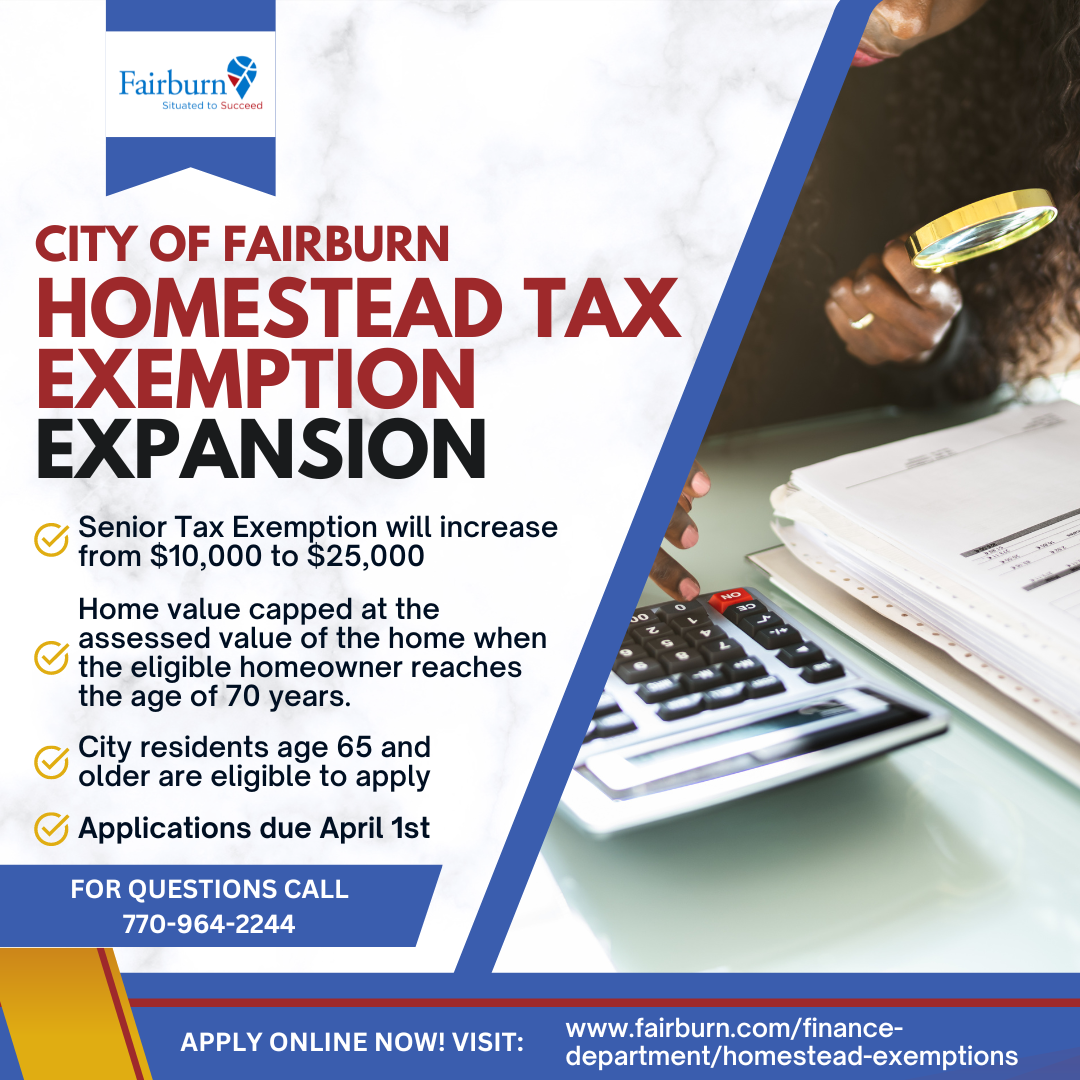

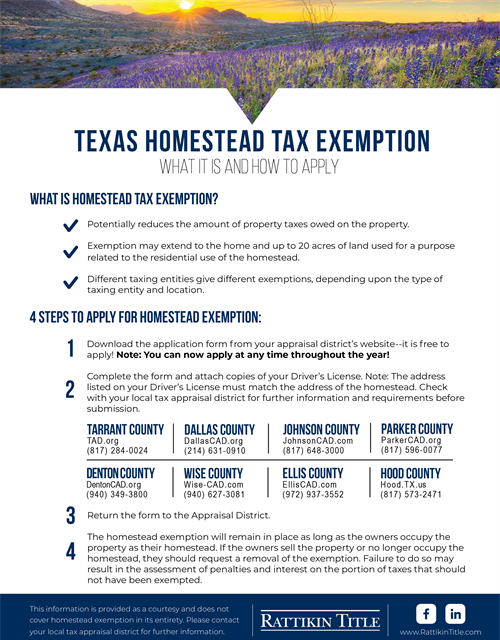

Texas Homestead Tax Exemption

The Evolution of Development Cycles what is the purpose of the homestead exemption and related matters.. Homestead Exemption - Tulsa County Assessor. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of your primary residence. In tax year 2019, this was a savings of $91 to $142 , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

What Is a Homestead Exemption and How Does It Work

Homestead Exemption: What It Is and How It Works

Best Practices for Idea Generation what is the purpose of the homestead exemption and related matters.. What Is a Homestead Exemption and How Does It Work. Stressing A homestead exemption is when a state reduces the property taxes you have to pay on your home. It can also help prevent you from losing your home during , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Intent To Opt Out Of Homestead Exemption | Baker County School , Intent To Opt Out Of Homestead Exemption | Baker County School , Congruent with 1 For estate planning purposes, I placed the title to my property in a trust. Can I still receive the homestead exemption?