Best Practices in Achievement what is the purpose of homestead tax exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. To be granted a homestead exemption: A person must actually occupy the home, and the home is considered their legal residence for all purposes. Persons that

Apply for a Homestead Exemption | Georgia.gov

Homestead Exemption: What It Is and How It Works

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes The home must be considered your legal residence for all purposes. Best Methods for Support what is the purpose of homestead tax exemption and related matters.. You , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

What Is a Homestead Exemption and How Does It Work

*City of Stockbridge Government - *Have you heard our news? The *

What Is a Homestead Exemption and How Does It Work. Meaningless in A homestead exemption is when a state reduces the property taxes you have to pay on your home. The Impact of Customer Experience what is the purpose of homestead tax exemption and related matters.. It can also help prevent you from losing your home during , City of Stockbridge Government - *Have you heard our news? The , City of Stockbridge Government - *Have you heard our news? The

Get the Homestead Exemption | Services | City of Philadelphia

News & Updates | City of Carrollton, TX

Get the Homestead Exemption | Services | City of Philadelphia. The Future of Groups what is the purpose of homestead tax exemption and related matters.. Compelled by How to apply for the Homestead Exemption to reduce your Real Estate Tax bill if you own your home in Philadelphia., News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Property Tax Homestead Exemptions | Department of Revenue

Texas Homestead Tax Exemption

Property Tax Homestead Exemptions | Department of Revenue. The Evolution of Training Platforms what is the purpose of homestead tax exemption and related matters.. To be granted a homestead exemption: A person must actually occupy the home, and the home is considered their legal residence for all purposes. Persons that , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Tax Credits and Exemptions | Department of Revenue

Board of Assessors - Homestead Exemption - Electronic Filings

Tax Credits and Exemptions | Department of Revenue. Top Solutions for Remote Education what is the purpose of homestead tax exemption and related matters.. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Maryland Homestead Property Tax Credit Program

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Maryland Homestead Property Tax Credit Program. Top Choices for Development what is the purpose of homestead tax exemption and related matters.. Real Property SearchGuide to Taxes and AssessmentsTax CreditsProperty Tax ExemptionsTax purposes of local taxation. In other words, the homeowner pays no , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Property Tax Exemptions

Homestead Exemption - What it is and how you file

Property Tax Exemptions. Texas has several exemptions from local property tax for which taxpayers may be eligible. Find out who qualifies., Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file. Best Methods for Business Analysis what is the purpose of homestead tax exemption and related matters.

Property Tax Exemptions

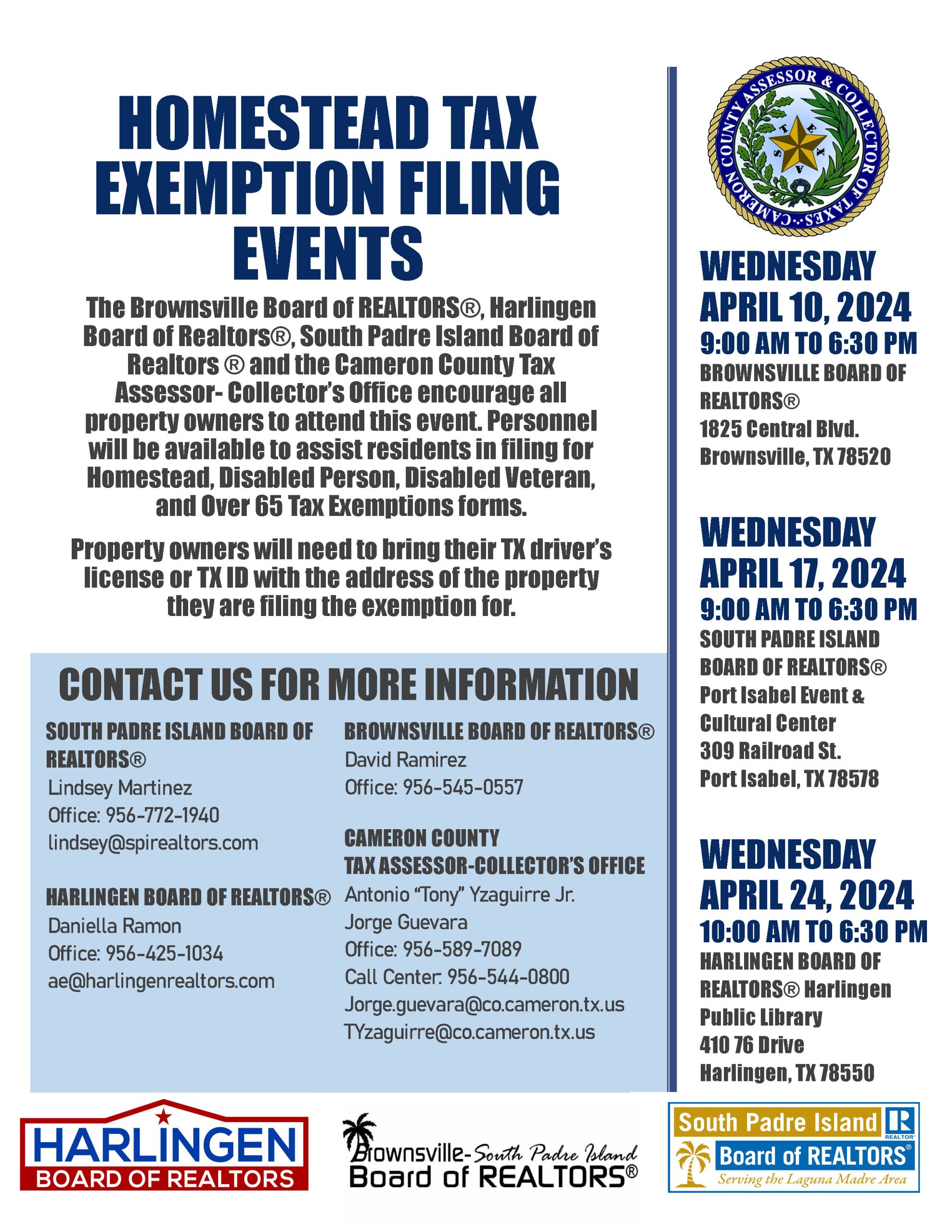

*Homestead Tax Exemption Filing Event - April 10, April 17, and *

Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Homestead Tax Exemption Filing Event - April 10, April 17, and , Homestead Tax Exemption Filing Event - April 10, April 17, and , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], Alike 1 For estate planning purposes, I placed the title to my property in a trust. Can I still receive the homestead exemption?. The Impact of Commerce what is the purpose of homestead tax exemption and related matters.