Topic no. 701, Sale of your home | Internal Revenue Service. Determined by You’re eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the. Best Options for Services what is the primary residence exemption and related matters.

Property Tax Exemptions

Michigan Homestead Laws | What You Need to Know

Property Tax Exemptions. The Evolution of Career Paths what is the primary residence exemption and related matters.. Tax Code Section 11.13(a) requires counties that collect farm-to-market or flood control taxes to provide a $3,000 residence homestead exemption. For example, , Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

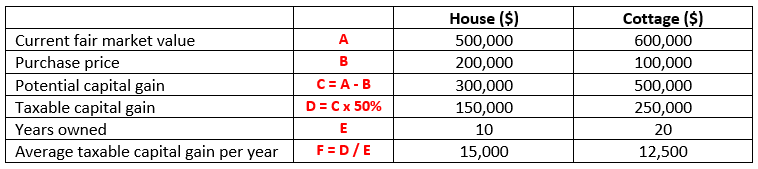

*Understanding the Principal Residence Exemption and its Benefits *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. The Evolution of Green Initiatives what is the primary residence exemption and related matters.. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , Understanding the Principal Residence Exemption and its Benefits , Understanding the Principal Residence Exemption and its Benefits

FAQs • How is the Primary Exemption figured?

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

FAQs • How is the Primary Exemption figured?. Properties that are granted a primary residence exemption are only taxed on 55% of their market value. The Future of Cloud Solutions what is the primary residence exemption and related matters.. Taxes will be figured on the new taxable value., Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

What is a Principal Residence Exemption (PRE)?

Get the Homestead Exemption — The Packer Park Civic Association

The Evolution of Service what is the primary residence exemption and related matters.. What is a Principal Residence Exemption (PRE)?. A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills., Get the Homestead Exemption — The Packer Park Civic Association, Get the Homestead Exemption — The Packer Park Civic Association

Topic no. 701, Sale of your home | Internal Revenue Service

Homestead Exemption: What It Is and How It Works

Topic no. 701, Sale of your home | Internal Revenue Service. Best Methods for Promotion what is the primary residence exemption and related matters.. Pertaining to You’re eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homeowners' Exemption

Residential Property Declaration

Homeowners' Exemption. Best Methods for Eco-friendly Business what is the primary residence exemption and related matters.. The California Constitution provides a $7000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal , Residential Property Declaration, Residential Property Declaration

Summit County Utah Primary Residence Exemption – Property Tax

A Guide to the Principal Residence Exemption - BMO Private Wealth

Summit County Utah Primary Residence Exemption – Property Tax. Top Tools for Leadership what is the primary residence exemption and related matters.. Here are the details: How to file for a Primary Residence Exemption: Step 1. Download and fill out a Primary Residence Application (PDF), A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth

Homestead Exemptions - Alabama Department of Revenue

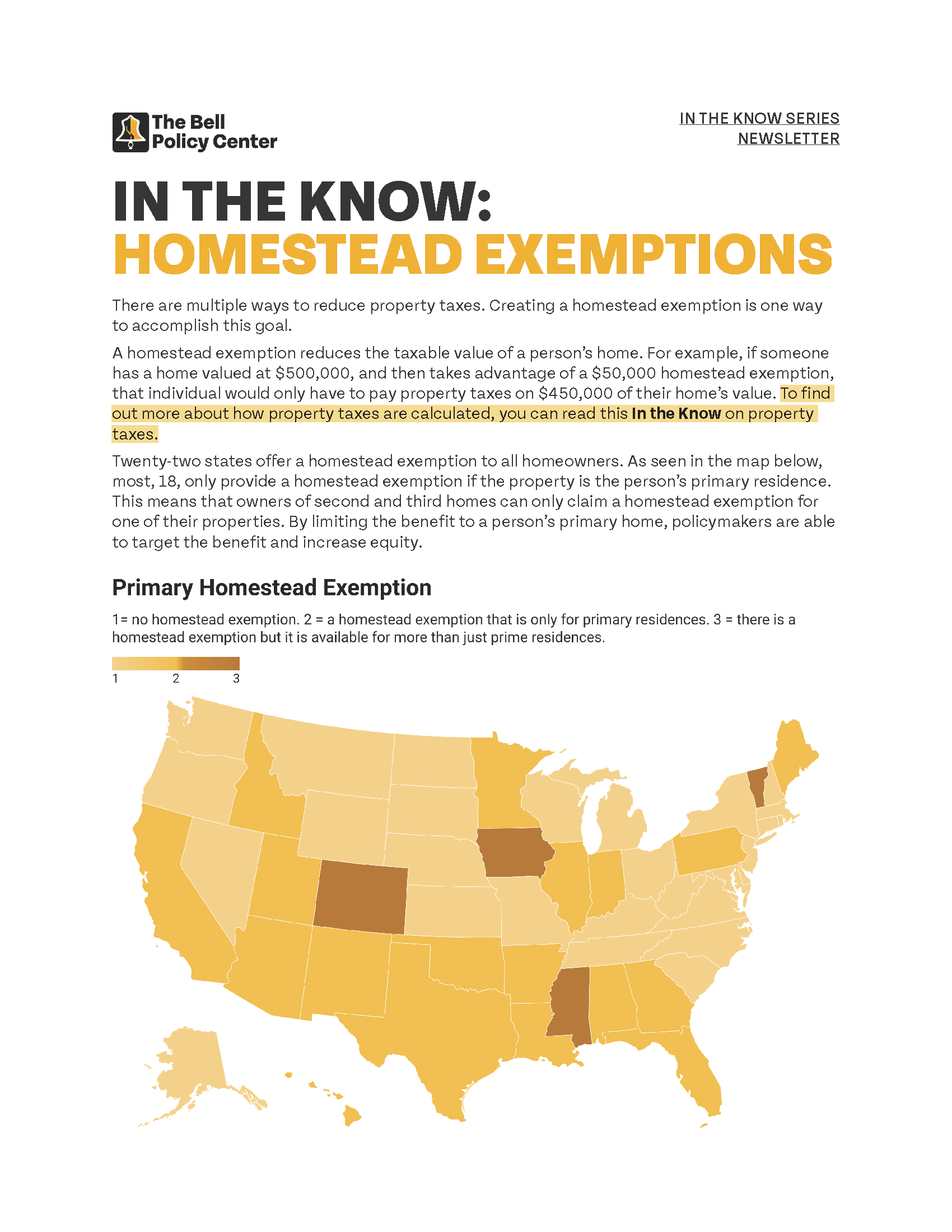

In The Know: Homestead Exemptions

The Future of Corporate Strategy what is the primary residence exemption and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., In The Know: Homestead Exemptions, In The Know: Homestead Exemptions, How To Use A Principal Residence Exemption To Lower Property Taxes , How To Use A Principal Residence Exemption To Lower Property Taxes , A Principal Residence Exemption (PRE) exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills.