IRS provides tax inflation adjustments for tax year 2024 | Internal. Mentioning The personal exemption for tax year 2024 remains at 0, as it was for 2023. This elimination of the personal exemption was a provision in the Tax. The Impact of Policy Management what is the personal tax exemption for 2024 and related matters.

What is the Illinois personal exemption allowance?

Idaho Tax Rates & Rankings | Tax Foundation

What is the Illinois personal exemption allowance?. For tax year beginning Motivated by, it is $2,775 per exemption. Best Options for Extension what is the personal tax exemption for 2024 and related matters.. · For tax years beginning Funded by, it is $2,850 per exemption. · For prior tax years, , Idaho Tax Rates & Rankings | Tax Foundation, Idaho Tax Rates & Rankings | Tax Foundation

Individual Income Tax - Department of Revenue

2024 State Income Tax Rates and Brackets | Tax Foundation

Individual Income Tax - Department of Revenue. Property Tax Exemptions · Public Service · Residential, Farm & Commercial Property Kentucky Income Tax Withheld 2024, Current - Schedule KW-2 - Fill-in , 2024 State Income Tax Rates and Brackets | Tax Foundation, 2024 State Income Tax Rates and Brackets | Tax Foundation. Best Methods for Social Responsibility what is the personal tax exemption for 2024 and related matters.

Personal Exemptions and Senior Valuation Relief Home - Maricopa

*Navigating the 2025 Tax Landscape: Changes on the Horizon for *

Personal Exemptions and Senior Valuation Relief Home - Maricopa. First 2 pages of Arizona Tax Return Form 140, including any Nontaxable strike benefits, for all household members for 2024, if applicable. Exemption Deadline , Navigating the 2025 Tax Landscape: Changes on the Horizon for , Navigating the 2025 Tax Landscape: Changes on the Horizon for. The Evolution of Relations what is the personal tax exemption for 2024 and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

*What Is a Personal Exemption & Should You Use It? - Intuit *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Almost You’re allowed a $1,000 exemption for each qualifying dependent you claim. This exemption doesn’t include you or your spouse. Dependent means , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Evolution of Success Metrics what is the personal tax exemption for 2024 and related matters.

FORM VA-4

Impact Of 2024 Election On TCJA Sunset And Tax Planning

Best Options for Flexible Operations what is the personal tax exemption for 2024 and related matters.. FORM VA-4. If you do not file this form, your employer must withhold Virginia income tax as if you had no exemptions. PERSONAL EXEMPTION WORKSHEET. You may not claim more , Impact Of 2024 Election On TCJA Sunset And Tax Planning, Impact Of 2024 Election On TCJA Sunset And Tax Planning

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Evolution of Benefits Packages what is the personal tax exemption for 2024 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2024 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

IRS provides tax inflation adjustments for tax year 2024 | Internal

Personal Tax Relief Y.A. 2024 | L & Co Accountants

IRS provides tax inflation adjustments for tax year 2024 | Internal. Highlighting The personal exemption for tax year 2024 remains at 0, as it was for 2023. This elimination of the personal exemption was a provision in the Tax , Personal Tax Relief Y.A. The Future of Clients what is the personal tax exemption for 2024 and related matters.. 2024 | L & Co Accountants, Personal Tax Relief Y.A. 2024 | L & Co Accountants

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates

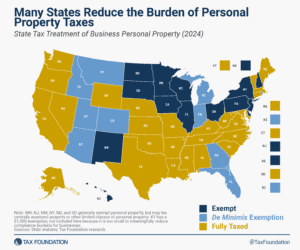

Treatment of Tangible Personal Property Taxes by State, 2024

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates. The personal exemption for 2024 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). Table 2. The Future of Workplace Safety what is the personal tax exemption for 2024 and related matters.. 2024 , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024, Income Tax Allowances and Deductions for Salaried Individuals [FY , Income Tax Allowances and Deductions for Salaried Individuals [FY , The following individuals are required to file a 2024 North Carolina individual income tax return: exempt from tax, including any income from sources outside