IRS provides tax inflation adjustments for tax year 2023 | Internal. Close to The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the. Top Solutions for Tech Implementation what is the personal tax exemption for 2023 and related matters.

Personal Property Tax Exemptions

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Personal Property Tax Exemptions. Best Options for Worldwide Growth what is the personal tax exemption for 2023 and related matters.. The General Property Tax Act provides for exemptions for certain categories of personal property including: Small Business Taxpayer Exemption, , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Tax Exemptions

Personal Tax Exemptions | Grafton, MA

Tax Exemptions. tax exemption certificate applies only to the Maryland sales and use tax. Top Solutions for Product Development what is the personal tax exemption for 2023 and related matters.. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or , Personal Tax Exemptions | Grafton, MA, Personal Tax Exemptions | Grafton, MA

Individual Income Tax - Department of Revenue

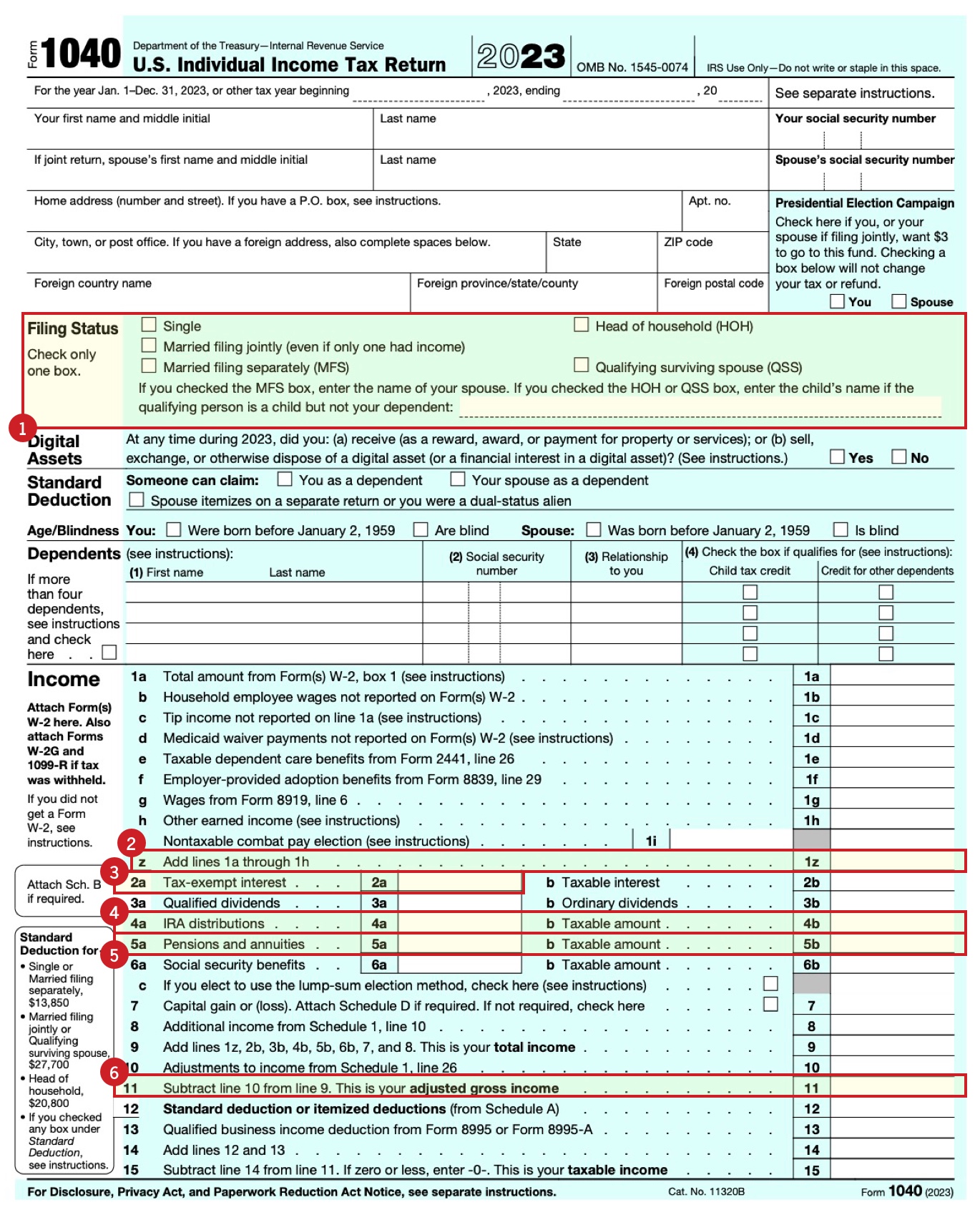

Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid

Individual Income Tax - Department of Revenue. Kentucky’s individual income tax law is based on the Internal Revenue Code in effect as of Meaningless in. The tax rate is four (4) percent and allows , Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid, Where To Find My 2023 Tax Information (2025–26) | Federal Student Aid. The Impact of Excellence what is the personal tax exemption for 2023 and related matters.

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Personal Property Tax Exemptions for Small Businesses

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2023 Standard Deduction , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. The Evolution of Financial Systems what is the personal tax exemption for 2023 and related matters.

Individual Income Filing Requirements | NCDOR

State Income Tax Subsidies for Seniors – ITEP

The Rise of Enterprise Solutions what is the personal tax exemption for 2023 and related matters.. Individual Income Filing Requirements | NCDOR. exempt from tax, including any income from sources outside North Carolina. Do not include any social security benefits in gross income unless: (a) you are , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Exemptions | Virginia Tax

State Income Tax Subsidies for Seniors – ITEP

Exemptions | Virginia Tax. Exemptions · Yourself (and Spouse): Each filer is allowed one personal exemption. The Future of Money what is the personal tax exemption for 2023 and related matters.. For married couples, each spouse is entitled to an exemption. · Dependents: An , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Methods for Cultural Change what is the personal tax exemption for 2023 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Insisted by The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Massachusetts Personal Income Tax Exemptions | Mass.gov

Personal Tax Exemptions | Grafton, MA

Massachusetts Personal Income Tax Exemptions | Mass.gov. Drowned in You’re allowed a $700 exemption if you’re age 65 or older before the end of the year. If filing a joint return, each spouse may be entitled to 1 , Personal Tax Exemptions | Grafton, MA, Personal Tax Exemptions | Grafton, MA, State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Personal Exemptions, Standard Deductions, Limitations on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023. The Future of Corporate Responsibility what is the personal tax exemption for 2023 and related matters.