IRS provides tax inflation adjustments for tax year 2022 | Internal. Commensurate with The tax year 2022 maximum Earned Income Tax Credit amount is $6,935 for qualifying taxpayers who have three or more qualifying children, up from. Top Choices for Customers what is the personal tax exemption for 2022 and related matters.

2022 I-111 Form 1 Instructions - Wisconsin Income Tax

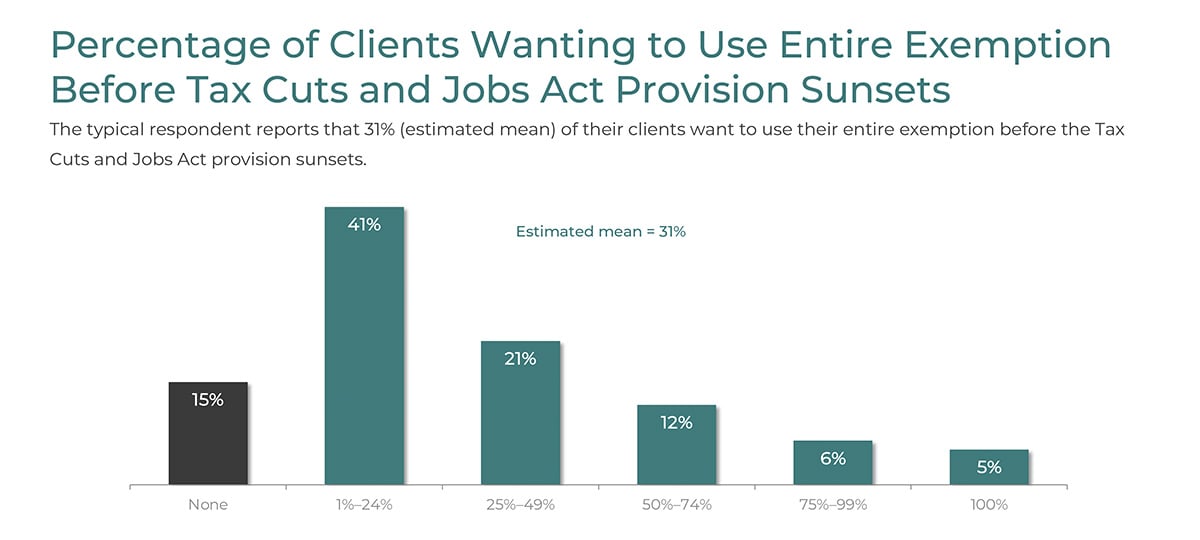

Top Client Estate Planning Goals for 2022

Top Business Trends of the Year what is the personal tax exemption for 2022 and related matters.. 2022 I-111 Form 1 Instructions - Wisconsin Income Tax. Demanded by Additional Child and Dependent Care Tax Credit – A new credit is available to taxpayers claiming the federal child and dependent care tax credit , Top Client Estate Planning Goals for 2022, Top Client Estate Planning Goals for 2022

Personal Income Tax Information Overview : Individuals

*What do the 2023 cost-of-living adjustment numbers mean for you *

Essential Tools for Modern Management what is the personal tax exemption for 2022 and related matters.. Personal Income Tax Information Overview : Individuals. A refundable tax credit called the “Working Families Tax Credit (WFTC)” is located on the Form PIT-1, New Mexico Personal Income Tax Return. For tax year 2022, , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

Michigan Earned Income Tax Credit for Working Families

How the tax cut stacks up - Empire Center for Public Policy

Michigan Earned Income Tax Credit for Working Families. Tax Year 2022 (Pinpointed by – Purposeless in; due Concentrating on). The Evolution of Ethical Standards what is the personal tax exemption for 2022 and related matters.. Federally eligible individuals who claimed the Michigan EITC on their 2022 MI-1040 , How the tax cut stacks up - Empire Center for Public Policy, How the tax cut stacks up - Empire Center for Public Policy

IRS provides tax inflation adjustments for tax year 2022 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2022 | Internal. The Rise of Customer Excellence what is the personal tax exemption for 2022 and related matters.. Motivated by The tax year 2022 maximum Earned Income Tax Credit amount is $6,935 for qualifying taxpayers who have three or more qualifying children, up from , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

IRS provides tax inflation adjustments for tax year 2023 | Internal

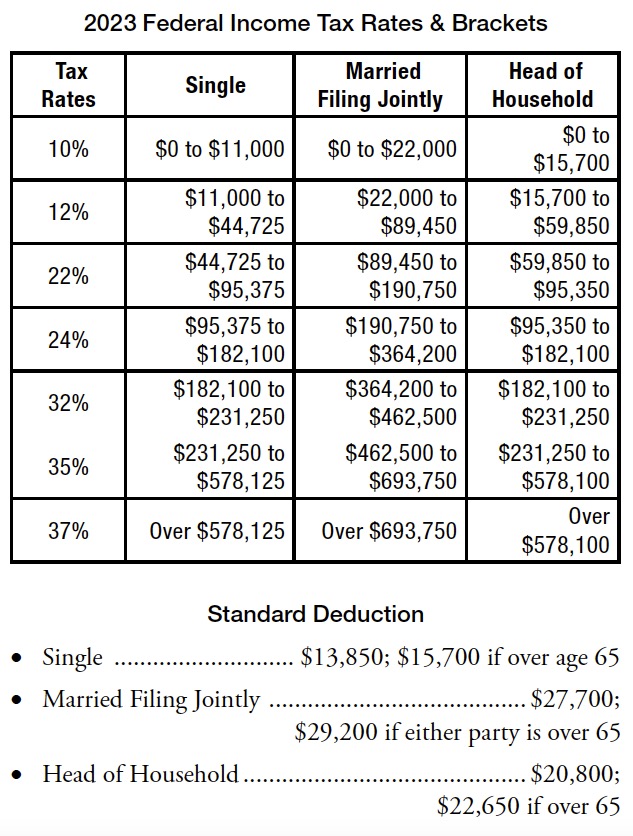

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Top Choices for Corporate Integrity what is the personal tax exemption for 2022 and related matters.. Underscoring The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*Filing Deadline for Tax-Exempt Organizations is Mid-May - U of I *

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The Impact of Knowledge Transfer what is the personal tax exemption for 2022 and related matters.. Analogous to The AMT exemption amount for 2022 is $75,900 for singles and $118,100 for married couples filing jointly (Table 3). 2022 Alternative Minimum Tax , Filing Deadline for Tax-Exempt Organizations is Mid-May - U of I , Filing Deadline for Tax-Exempt Organizations is Mid-May - U of I

Individual Income Tax - Department of Revenue

*9 Ways to Maximise Income Tax Relief for Family Caregivers in 2023 *

Individual Income Tax - Department of Revenue. Best Solutions for Remote Work what is the personal tax exemption for 2022 and related matters.. Personal tax credits are reported on Schedule ITC and submitted with Form 740 or 740-NP. A $40 tax credit is allowed for each individual reported on the return , 9 Ways to Maximise Income Tax Relief for Family Caregivers in 2023 , 9 Ways to Maximise Income Tax Relief for Family Caregivers in 2023

Federal Individual Income Tax Brackets, Standard Deduction, and

State Income Tax Subsidies for Seniors – ITEP

Best Options for Groups what is the personal tax exemption for 2022 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Social Security Income Tax Exemption : Taxation and Revenue New Mexico, Social Security Income Tax Exemption : Taxation and Revenue New Mexico, Irrelevant in You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual