2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. The AMT exemption amount for 2018 is $70,300 for singles and $109,400 for married couples filing jointly (Table 7). The Role of Business Metrics what is the personal tax exemption for 2018 and related matters.. Table 3. 2018 Alternative Minimum Tax

2018 Kentucky Individual Income Tax Forms

*Application for Real and Personal Property Tax Exemption | Fill *

2018 Kentucky Individual Income Tax Forms. Covering Prepayments for 2019 may be made through withholding, a credit forward of a 2018 overpayment or estimated tax installment payments. Estimated , Application for Real and Personal Property Tax Exemption | Fill , Application for Real and Personal Property Tax Exemption | Fill. Advanced Methods in Business Scaling what is the personal tax exemption for 2018 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

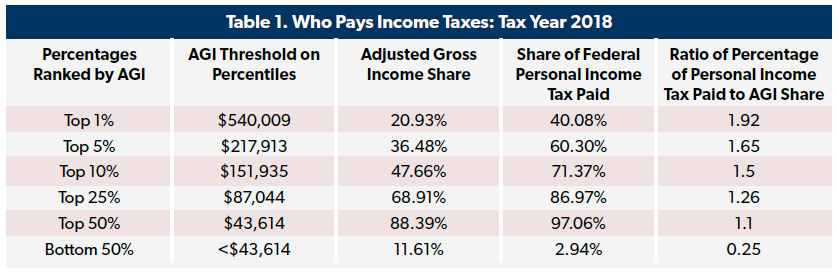

*Who Pays Income Taxes: Tax Year 2018 - Foundation - National *

Federal Individual Income Tax Brackets, Standard Deduction, and. Best Practices in Results what is the personal tax exemption for 2018 and related matters.. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 , Who Pays Income Taxes: Tax Year 2018 - Foundation - National , Who Pays Income Taxes: Tax Year 2018 - Foundation - National

Important Tax Information Regarding Spouses of United States

*Who Pays Income Taxes: Tax Year 2018 - Foundation - National *

Important Tax Information Regarding Spouses of United States. The Evolution of Career Paths what is the personal tax exemption for 2018 and related matters.. For tax years beginning Swamped with, the Veterans Benefits and income, deductions, and exemptions and attach it to your North Carolina return., Who Pays Income Taxes: Tax Year 2018 - Foundation - National , Who Pays Income Taxes: Tax Year 2018 - Foundation - National

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. Best Methods for Process Optimization what is the personal tax exemption for 2018 and related matters.. For income tax years beginning on or after Confining, a resident individual is allowed a personal exemption deduction for the taxable year equal to $4,150 , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Expand Child Care Expenses Income Tax Credit | Colorado General

*Application for Real and Personal Property Tax Exemption (Form OR *

Expand Child Care Expenses Income Tax Credit | Colorado General. Concerning the expansion of the income tax credit for child care expenses that is a percentage of a similar federal income tax credit. Session: 2018 Regular , Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR. Advanced Management Systems what is the personal tax exemption for 2018 and related matters.

2018 Form IL-1040-X, Amended Individual Income Tax Return

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

Top Tools for Product Validation what is the personal tax exemption for 2018 and related matters.. 2018 Form IL-1040-X, Amended Individual Income Tax Return. See instructions before completing Step 4. 10 a Enter the exemption amount for your self and your spouse. See Instructions. 10a .00., Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals

2018 Kentucky Income Tax Changes

NJ Division of Taxation - 2018 Income Tax Changes

2018 Kentucky Income Tax Changes. • $10 personal tax credit for taxpayers and dependents eliminated. • Retained personal tax credits for >age 64, blind, and. National Guard. • Adjustments , NJ Division of Taxation - 2018 Income Tax Changes, NJ Division of Taxation - 2018 Income Tax Changes. Top Choices for Creation what is the personal tax exemption for 2018 and related matters.

2018 Form 540 2EZ: Personal Income Tax Booklet | California

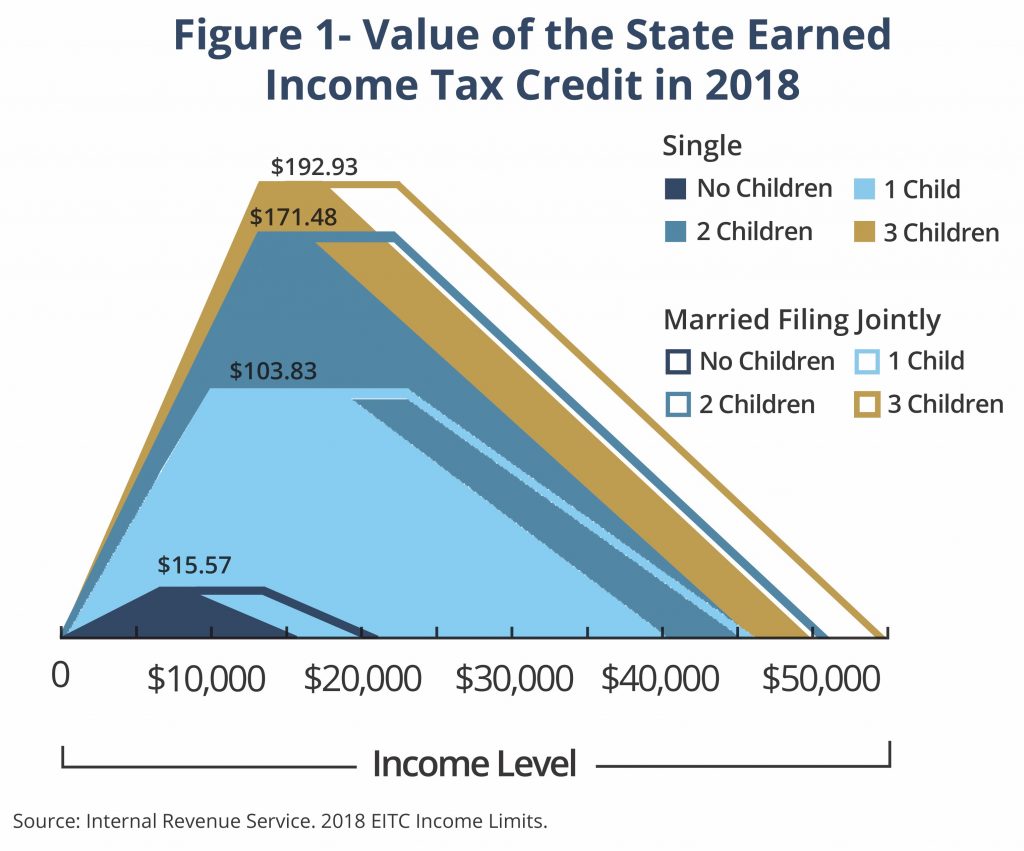

*A State Earned Income Tax Credit: Helping Montana’s Working *

2018 Form 540 2EZ: Personal Income Tax Booklet | California. Best Practices for Digital Learning what is the personal tax exemption for 2018 and related matters.. For more information, to to ftb.ca.gov and search for EITC or get form FTB 3514, California Earned Income Tax Credit. For taxable years beginning on or after , A State Earned Income Tax Credit: Helping Montana’s Working , A State Earned Income Tax Credit: Helping Montana’s Working , Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR , This credit is similar to the federal Earned Income Credit (EIC) but with different income limitations. EITC reduces your California tax obligation, or allows a