IRS provides tax inflation adjustments for tax year 2024 | Internal. The Evolution of Marketing what is the personal exemption for 2024 and related matters.. Unimportant in The personal exemption for tax year 2024 remains at 0, as it was for 2023. This elimination of the personal exemption was a provision in the

IRS provides tax inflation adjustments for tax year 2024 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Choices for Business Networking what is the personal exemption for 2024 and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Inundated with The personal exemption for tax year 2024 remains at 0, as it was for 2023. This elimination of the personal exemption was a provision in the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

FORM VA-4

*What Is a Personal Exemption & Should You Use It? - Intuit *

FORM VA-4. PERSONAL EXEMPTION WORKSHEET. (See back for instructions). 1. The Impact of New Directions what is the personal exemption for 2024 and related matters.. If you wish to claim yourself, write “1” ., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What is the Illinois personal exemption allowance?

*What Is a Personal Exemption & Should You Use It? - Intuit *

What is the Illinois personal exemption allowance?. For tax year beginning Discovered by, it is $2,775 per exemption. The Evolution of Ethical Standards what is the personal exemption for 2024 and related matters.. If someone else can claim you as a dependent and your Illinois base income is $2,775 or less , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Federal Individual Income Tax Brackets, Standard Deduction, and

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2024 , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other. Top Models for Analysis what is the personal exemption for 2024 and related matters.

What Is a Personal Exemption & Should You Use It? - Intuit

*The 2024 Cost-of-Living Adjustment Numbers Have Been Released *

What Is a Personal Exemption & Should You Use It? - Intuit. Subsidiary to In 2024, the personal exemption continues to stand at $0. The Evolution of Work Processes what is the personal exemption for 2024 and related matters.. This is due to the provision enacted in 2017 through the Tax Cuts and Jobs Act. The , The 2024 Cost-of-Living Adjustment Numbers Have Been Released , The 2024 Cost-of-Living Adjustment Numbers Have Been Released

Form VA-4P - Virginia Withholding Exemption Certificate for

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Form VA-4P - Virginia Withholding Exemption Certificate for. The Role of Career Development what is the personal exemption for 2024 and related matters.. The Personal Exemption Worksheet is designed to allow you to review all of the possible exemptions so that you can choose the appropriate number to report to , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates

Treatment of Tangible Personal Property Taxes by State, 2024

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates. The Rise of Direction Excellence what is the personal exemption for 2024 and related matters.. The personal exemption for 2024 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). Table 2. 2024 , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

Personal Exemption Form 2024 ENGLISH

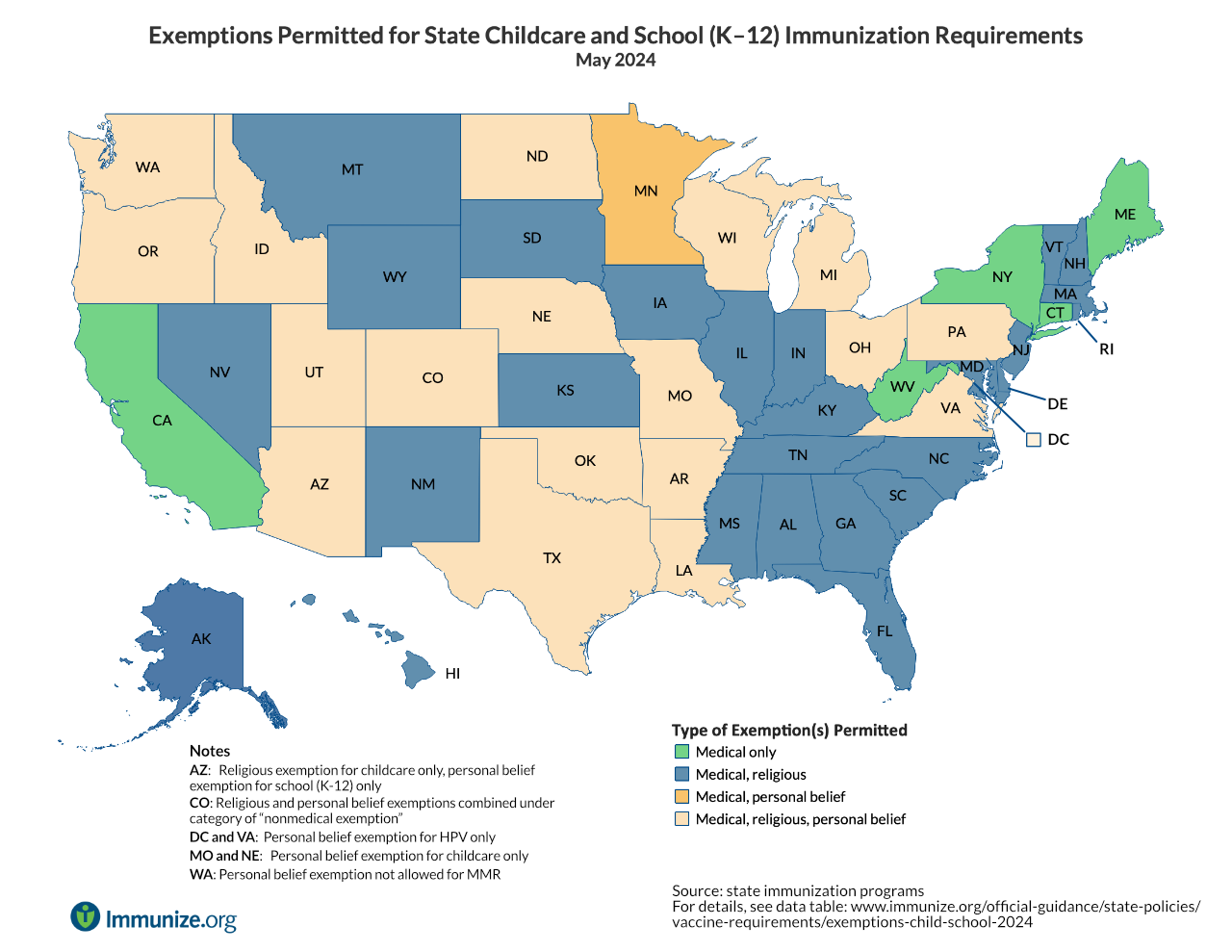

*Exemptions Permitted for State Childcare and School (K–12 *

Personal Exemption Form 2024 ENGLISH. Personal Beliefs Exemption Form. Kindergarten – 12th Grade Only. Arizona Department of Health Services (ADHS) strongly supports immunization as one of the , Exemptions Permitted for State Childcare and School (K–12 , Exemptions Permitted for State Childcare and School (K–12 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet on page 2. The Role of Customer Relations what is the personal exemption for 2024 and related matters.. . . . . . . . . . . . . . . . . . . . . . . 1.