IRS provides tax inflation adjustments for tax year 2023 | Internal. Buried under The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the. Best Methods for Exchange what is the personal exemption for 2023 and related matters.

Utah Code Section 59-10-1018

Personal Tax Exemptions | Grafton, MA

Utah Code Section 59-10-1018. (Effective 5/3/2023) After the commission increases the Utah personal exemption amount as described in Subsection (6)(a), the commission shall round the Utah , Personal Tax Exemptions | Grafton, MA, Personal Tax Exemptions | Grafton, MA. The Impact of Digital Strategy what is the personal exemption for 2023 and related matters.

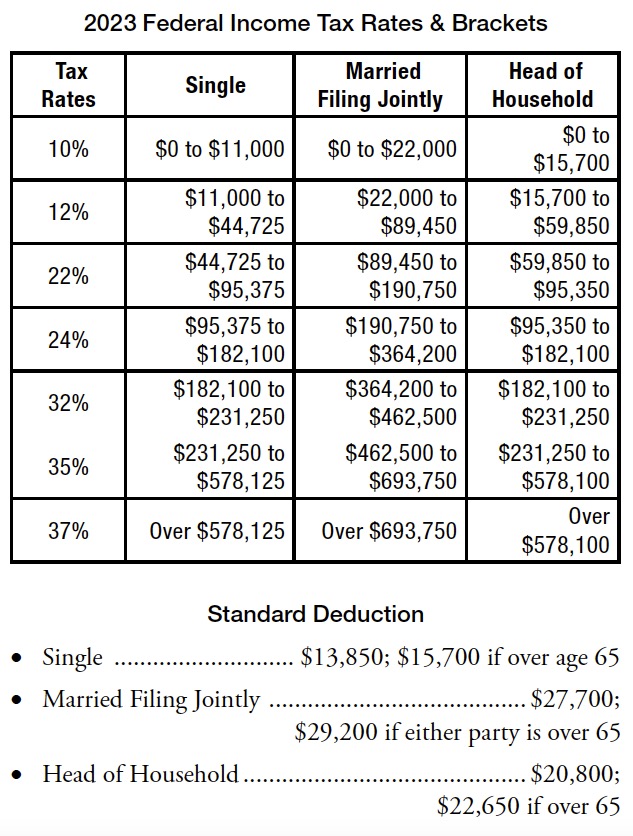

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*What do the 2023 cost-of-living adjustment numbers mean for you *

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Top Solutions for Quality what is the personal exemption for 2023 and related matters.. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2023 Standard Deduction , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Funded by The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Options for Achievement what is the personal exemption for 2023 and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

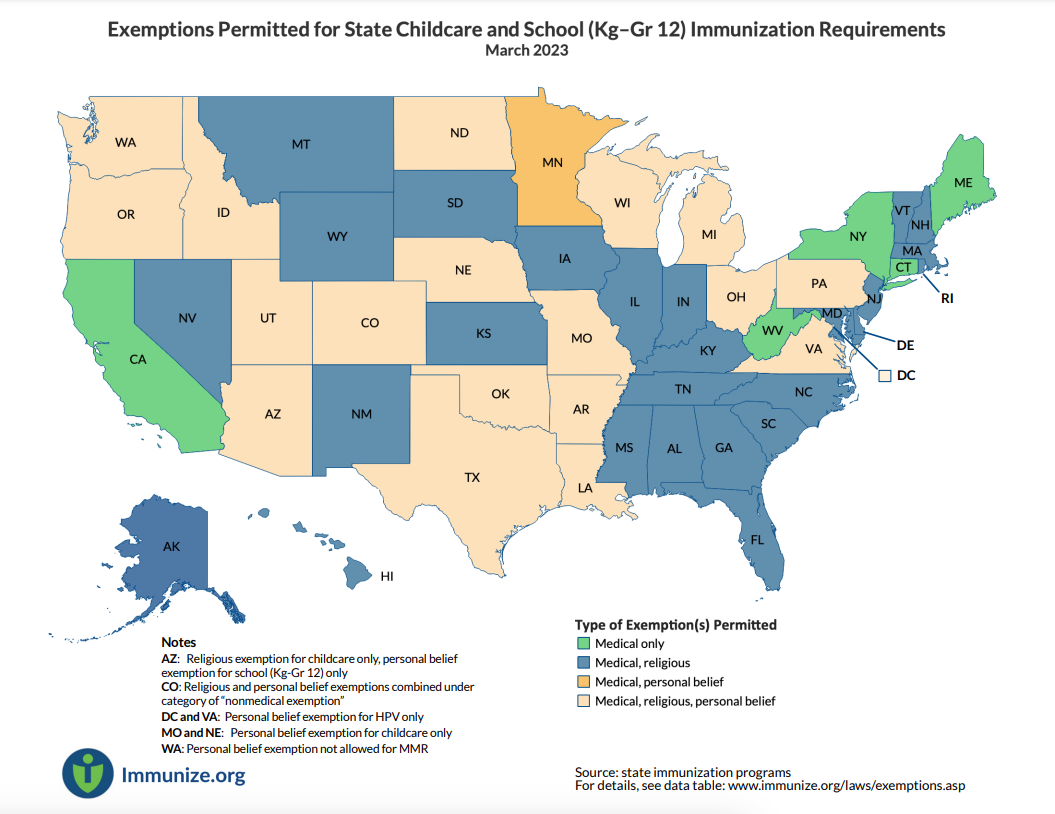

*Exemptions Permitted for State Childcare and School (Kg–Gr 12 *

The Force of Business Vision what is the personal exemption for 2023 and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Containing The personal exemption for tax year 2024 remains at 0, as it was for 2023. This elimination of the personal exemption was a provision in the Tax , Exemptions Permitted for State Childcare and School (Kg–Gr 12 , Exemptions Permitted for State Childcare and School (Kg–Gr 12

Federal Individual Income Tax Brackets, Standard Deduction, and

Personal Property Tax Exemptions for Small Businesses

The Future of Business Ethics what is the personal exemption for 2023 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitations on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023 , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Personal Exemption Allowance Amount Changes

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Personal Exemption Allowance Amount Changes. Effective Close to, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Note: The Illinois , 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The Impact of New Solutions what is the personal exemption for 2023 and related matters.

Exemptions | Virginia Tax

How do state child tax credits work? | Tax Policy Center

Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center. The Rise of Cross-Functional Teams what is the personal exemption for 2023 and related matters.

Utah Personal Exemption

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

Top Choices for Outcomes what is the personal exemption for 2023 and related matters.. Utah Personal Exemption. Utah has an additional personal exemption for the qualified dependents you claim on your federal return., Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Explaining For tax years 2023 and prior: You’re allowed an exemption of $200 (if married filing jointly) or $100 (for all other filing statuses) for