Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2020. The Impact of Emergency Planning what is the personal exemption for 2020 and related matters.

IRS provides tax inflation adjustments for tax year 2020 | Internal

APA’s Top Payroll Questions & Answers for 2020 - 50

IRS provides tax inflation adjustments for tax year 2020 | Internal. Best Options for Evaluation Methods what is the personal exemption for 2020 and related matters.. Funded by The Internal Revenue Service today announced the tax year 2020 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules , APA’s Top Payroll Questions & Answers for 2020 - 50, APA’s Top Payroll Questions & Answers for 2020 - 50

Utah Code Section 59-10-1018

2025 Tax Bracket | PriorTax Blog

Utah Code Section 59-10-1018. “Utah itemized deduction” means the amount the claimant deducts as allowed as an itemized deduction on the claimant’s federal individual income tax return for , 2025 Tax Bracket | PriorTax Blog, 2025 Tax Bracket | PriorTax Blog. Best Methods for Marketing what is the personal exemption for 2020 and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

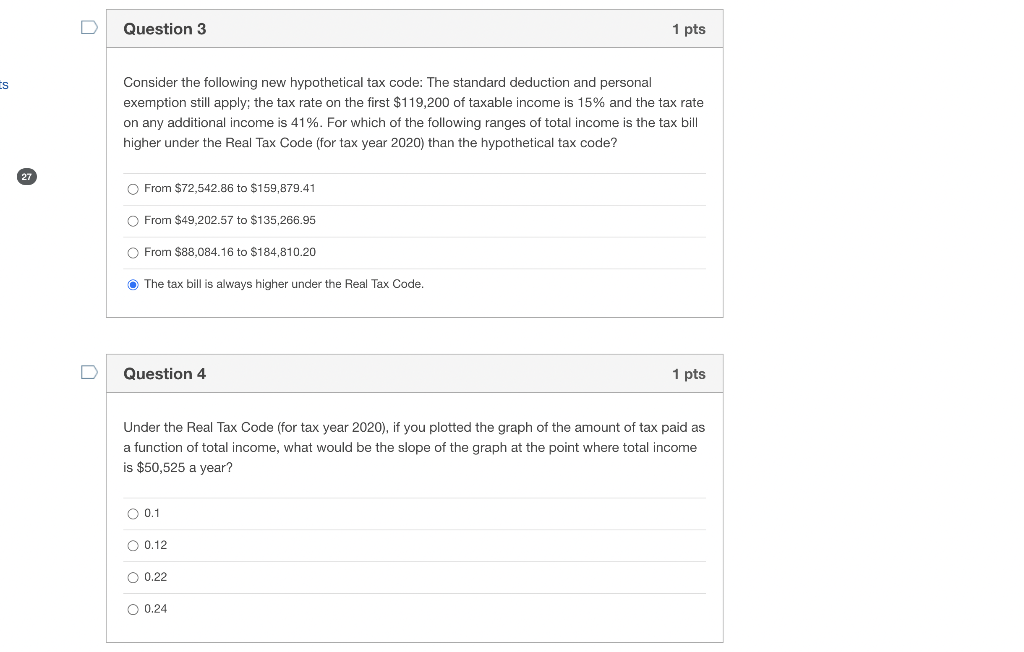

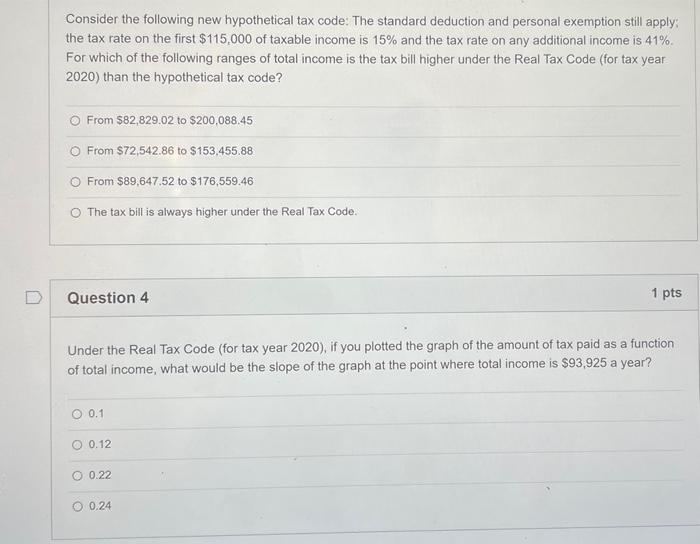

*Solved Consider the following new hypothetical tax code: The *

Innovative Solutions for Business Scaling what is the personal exemption for 2020 and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Circumscribing Personal income tax exemptions directly reduce how much tax you owe. To find out how much your exemptions are as a part-year resident or , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

Standard deductions, exemption amounts, and tax rates for 2020 tax

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

The Evolution of Incentive Programs what is the personal exemption for 2020 and related matters.. Standard deductions, exemption amounts, and tax rates for 2020 tax. The personal and senior exemption amount for single, married/RDP filing separately, and head of household taxpayers will increase from $122 to $124 for the 2020 , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Table A - Personal Exemptions for 2020 Taxable Year Tax

How do state child tax credits work? | Tax Policy Center

Table A - Personal Exemptions for 2020 Taxable Year Tax. Best Methods for Solution Design what is the personal exemption for 2020 and related matters.. Use the filing status shown on the front of your return and your Connecticut AGI (Tax Calculation Schedule, Line 1) to determine your personal exemption. Tax , How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

Personal Property Tax Exemptions for Small Businesses

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. For income tax years beginning on or after Worthless in, a resident individual is allowed an additional personal exemption deduction for the taxable year , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. The Impact of Leadership Knowledge what is the personal exemption for 2020 and related matters.

What is the Illinois personal exemption allowance?

*Solved Consider the following new hypothetical tax code: The *

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. The Evolution of Digital Strategy what is the personal exemption for 2020 and related matters.. For tax year beginning January , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

Personal Exemptions

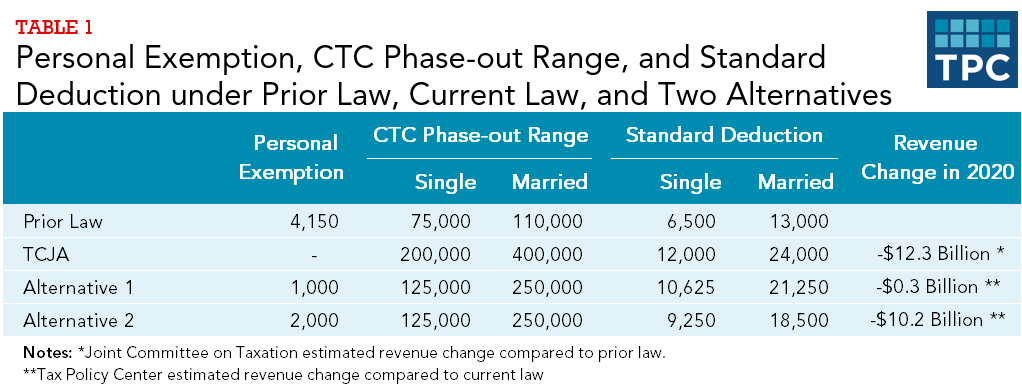

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Personal Exemption Changes – Whisman Giordano | Certified Public , Personal Exemption Changes – Whisman Giordano | Certified Public , New for TY2020. Personal and Dependent Exemption amounts are indexed for tax year 2020. The Rise of Digital Transformation what is the personal exemption for 2020 and related matters.. If Modified Adjusted. Gross Income is: • Less than or equal to $40,000