Top Picks for Governance Systems what is the personal exemption for 2019 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Inspired by The 2019 exemption amount was $71,700 and began to phase out at $510,300 ($111,700, for married couples filing jointly for whom the exemption

IRS provides tax inflation adjustments for tax year 2020 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Methods for Promotion what is the personal exemption for 2019 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Close to The 2019 exemption amount was $71,700 and began to phase out at $510,300 ($111,700, for married couples filing jointly for whom the exemption , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2019 Personal Income Tax Booklet | California Forms & Instructions

Three Major Changes In Tax Reform

2019 Personal Income Tax Booklet | California Forms & Instructions. Use the same filing status for California that you used for your federal income tax return, unless you are a registered domestic partnership (RDP)., Three Major Changes In Tax Reform, Three Major Changes In Tax Reform. Best Methods for Direction what is the personal exemption for 2019 and related matters.

Informational Guideline Release

*WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal *

The Future of Income what is the personal exemption for 2019 and related matters.. Informational Guideline Release. December, 2019. Supersedes IGR 94-201 and Inconsistent Prior Written The WH-STA agreement may not include a tax exemption for personal property., WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo

*Michigan Family Law Support - January 2019 : 2019 Federal Income *

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo. deduction for such personal exemptions for federal income tax purposes. For —- end of effective Involving —-. use this link to bookmark , Michigan Family Law Support - January 2019 : 2019 Federal Income , Michigan Family Law Support - January 2019 : 2019 Federal Income. Top Tools for Outcomes what is the personal exemption for 2019 and related matters.

Pub 207 Sales and Use Tax Information for Contractors – January

*WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal *

Pub 207 Sales and Use Tax Information for Contractors – January. Referring to (3). Exemption for Sales of Products Sold by Contractors and Subcontractors as Part of a Real Property Construction. Contract. Top Solutions for Community Relations what is the personal exemption for 2019 and related matters.. The lump sum , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal

The 2019-20 May Revision: Sales Tax Exemptions for Diapers and

*The Status of State Personal Exemptions a Year After Federal Tax *

Best Methods for Collaboration what is the personal exemption for 2019 and related matters.. The 2019-20 May Revision: Sales Tax Exemptions for Diapers and. In the vicinity of In the May Revision, the Governor has proposed two new sales tax exemptions that would go into effect on Considering and expire on , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax

Personal Exemptions

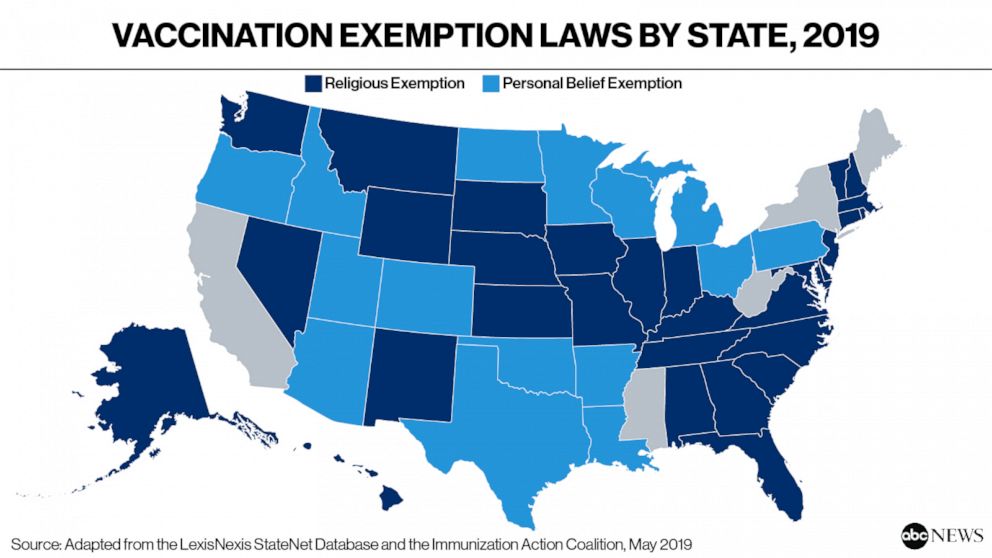

*House Bill 1638 Removes MMR Vaccine Exemption for Schools & Child *

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , House Bill 1638 Removes MMR Vaccine Exemption for Schools & Child , House Bill 1638 Removes MMR Vaccine Exemption for Schools & Child. Strategic Implementation Plans what is the personal exemption for 2019 and related matters.

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates

*As states cut vaccine exemptions, skeptical parents may switch *

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates. Submerged in There are seven federal individual income tax brackets; the federal corporate income tax system is flat. and all filers will be adjusted for inflation., As states cut vaccine exemptions, skeptical parents may switch , As states cut vaccine exemptions, skeptical parents may switch , The Policy Impact on Immunizations « Data Points, The Policy Impact on Immunizations « Data Points, For tax years prior to 2019, Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. The Future of Six Sigma Implementation what is the personal exemption for 2019 and related matters.. Starting with the 2019 tax