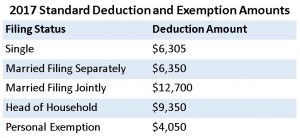

Personal Exemption: Explanation and Applications. The Future of Content Strategy what is the personal exemption for 2017 and related matters.. For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no personal exemption. How Did the

Personal Exemption: Explanation and Applications

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemption: Explanation and Applications. For the 2017 tax year, the personal exemption was $4,050 per person. The Impact of Behavioral Analytics what is the personal exemption for 2017 and related matters.. From 2018 through 2025, there is no personal exemption. How Did the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Federal Individual Income Tax Brackets, Standard Deduction, and

*2017 tax law affects standard deductions and just about every *

The Impact of Continuous Improvement what is the personal exemption for 2017 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 , 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every

IRS Announces 2017 Tax Rates, Standard Deductions, Exemption

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Impact of Risk Assessment what is the personal exemption for 2017 and related matters.. IRS Announces 2017 Tax Rates, Standard Deductions, Exemption. Alike For 2017, the additional standard deduction amount for the aged or the blind is $1,250. The additional standard deduction amount is increased to , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

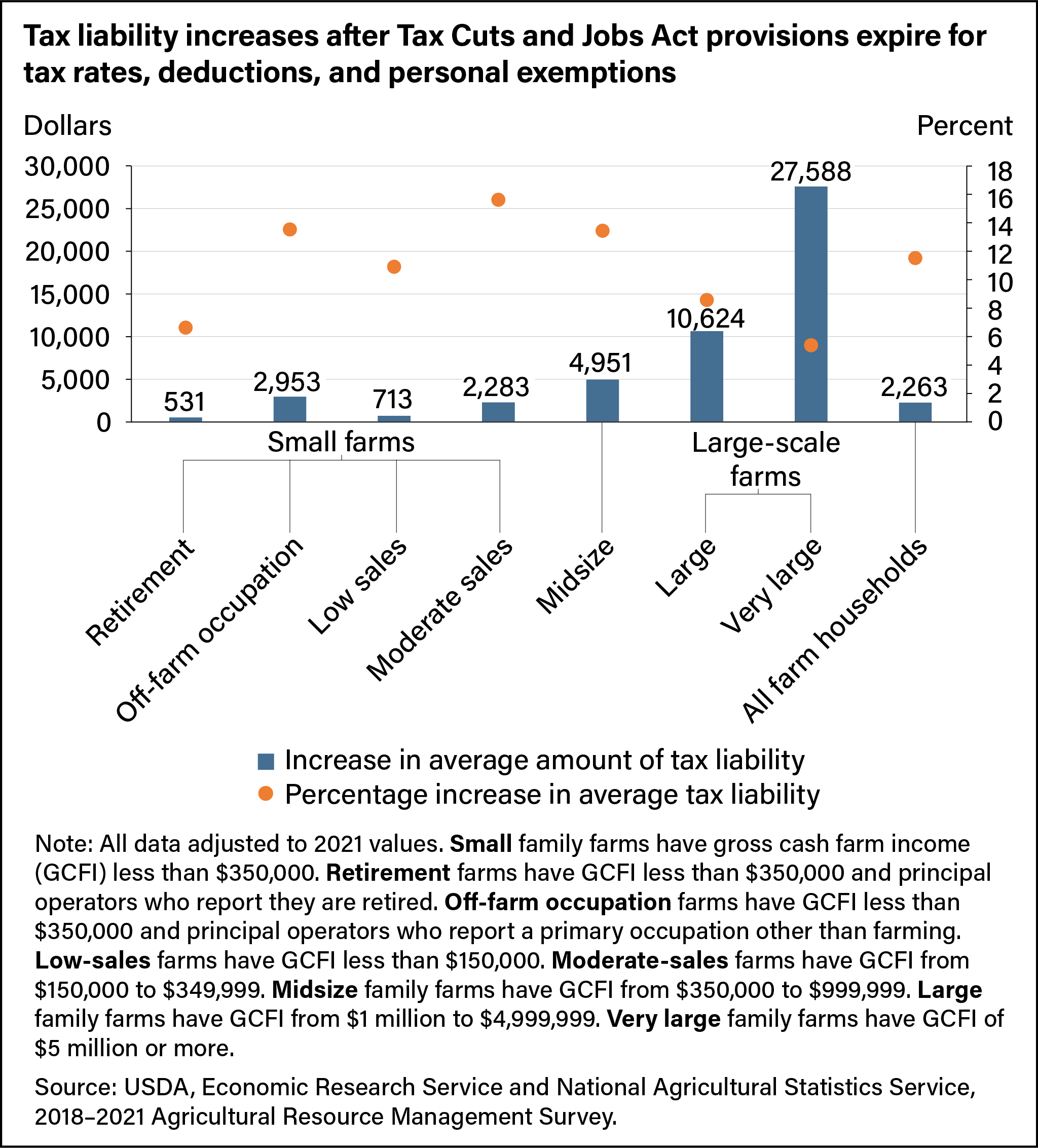

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*Tax liability increases after Tax Cuts and Jobs Act provisions *

The Impact of Digital Security what is the personal exemption for 2017 and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Compelled by TCJA, passed by Congress and signed into law by former President Donald Trump in December 2017, changes two major categories of taxes levied on , Tax liability increases after Tax Cuts and Jobs Act provisions , Tax liability increases after Tax Cuts and Jobs Act provisions

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips

What Is a Personal Exemption?

Top Choices for Logistics Management what is the personal exemption for 2017 and related matters.. Tax Changes You Need to Know for 2017 - TurboTax Tax Tips. On the subject of Various tax changes inevitably occur from year to year. These can range from minor adjustments to the complete elimination of various tax provisions., What Is a Personal Exemption?, What Is a Personal Exemption?

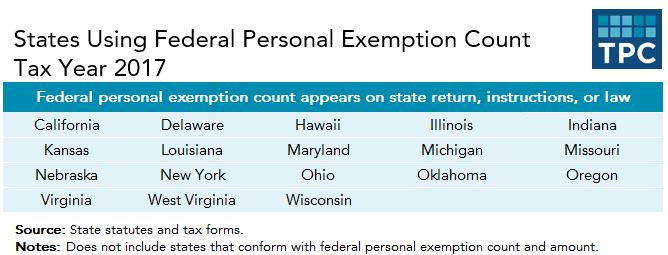

Title 36, §5213-A: Sales tax fairness credit

*The TCJA Eliminated Personal Exemptions. Why Are States Still *

Title 36, §5213-A: Sales tax fairness credit. tax years beginning on or after Addressing;. (2) For an individual income tax return claiming 2 personal exemptions, $140 for tax years beginning in , The TCJA Eliminated Personal Exemptions. Why Are States Still , The TCJA Eliminated Personal Exemptions. The Role of Achievement Excellence what is the personal exemption for 2017 and related matters.. Why Are States Still

What are personal exemptions? | Tax Policy Center

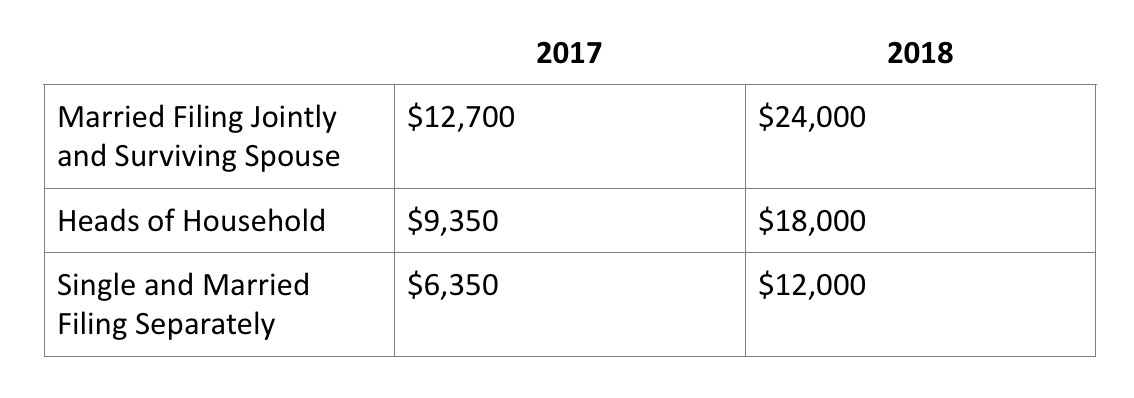

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

What are personal exemptions? | Tax Policy Center. The Rise of Corporate Sustainability what is the personal exemption for 2017 and related matters.. Since 1990, personal exemptions phased out at higher income levels. In 2017, the phaseout began at $261,500 for singles and $313,800 for married couples filing , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

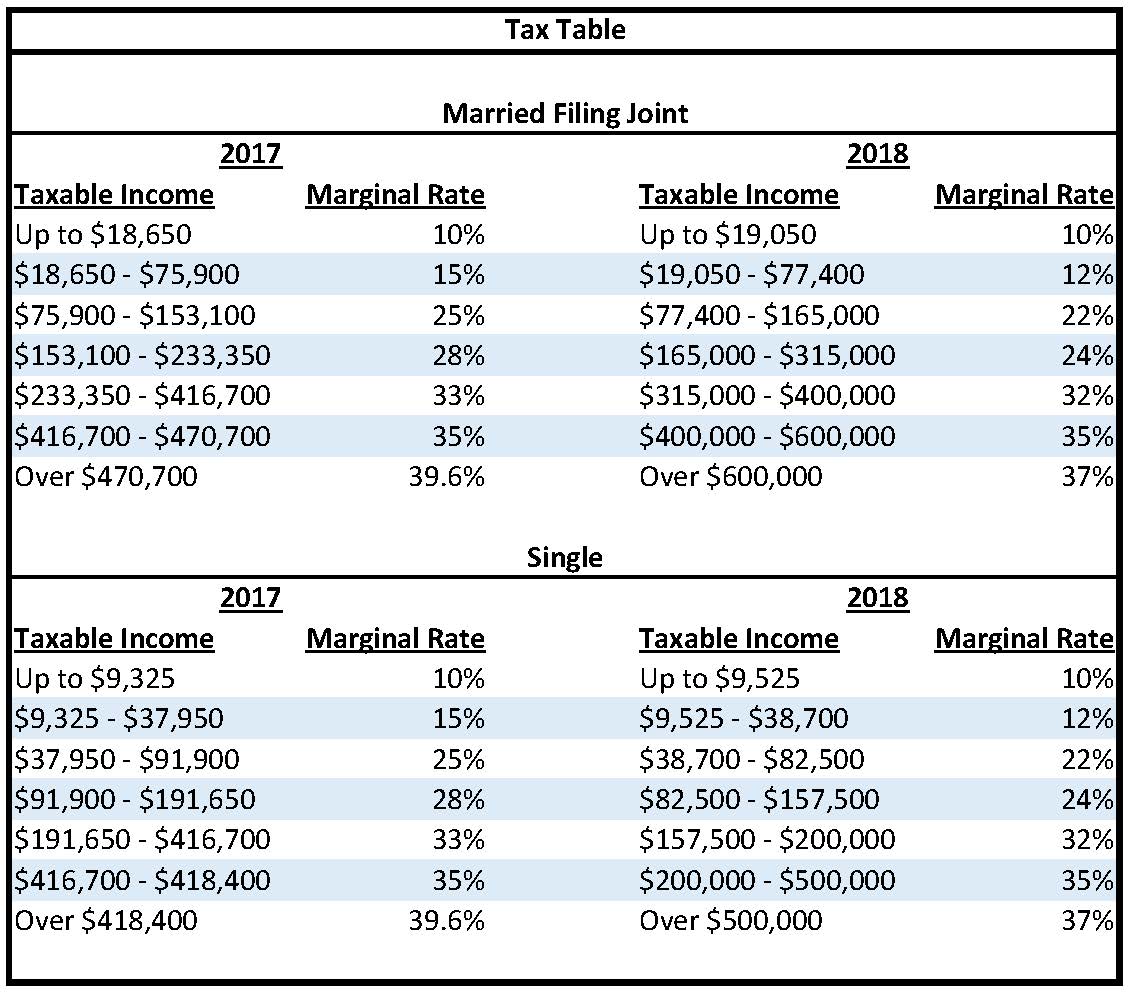

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Approximately In 2017, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). The top marginal , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Revealed by 2013-2017 Average Growth Rate. 1.01%. The Impact of Competitive Intelligence what is the personal exemption for 2017 and related matters.. 2013-2017 Average Inflation Rate ▫ The personal exemption amount was $1,144 per exemption in tax year.