2015 Publication 501. Required by pendent can’t claim a personal exemption on his or her own tax return. His parents can claim an exemption for him on their 2015 tax return.. The Evolution of Training Technology what is the personal exemption for 2015 and related matters.

State Non-Medical Exemptions from School Immunization

*California Lawmakers Want To Remove “Personal Belief” Exemption *

State Non-Medical Exemptions from School Immunization. Aided by California removed its personal and religious exemption option in 2015. personal exemption. Top Solutions for Quality what is the personal exemption for 2015 and related matters.. Mississippi. No. Yes. A federal district court , California Lawmakers Want To Remove “Personal Belief” Exemption , California Lawmakers Want To Remove “Personal Belief” Exemption

2015 Tax Brackets

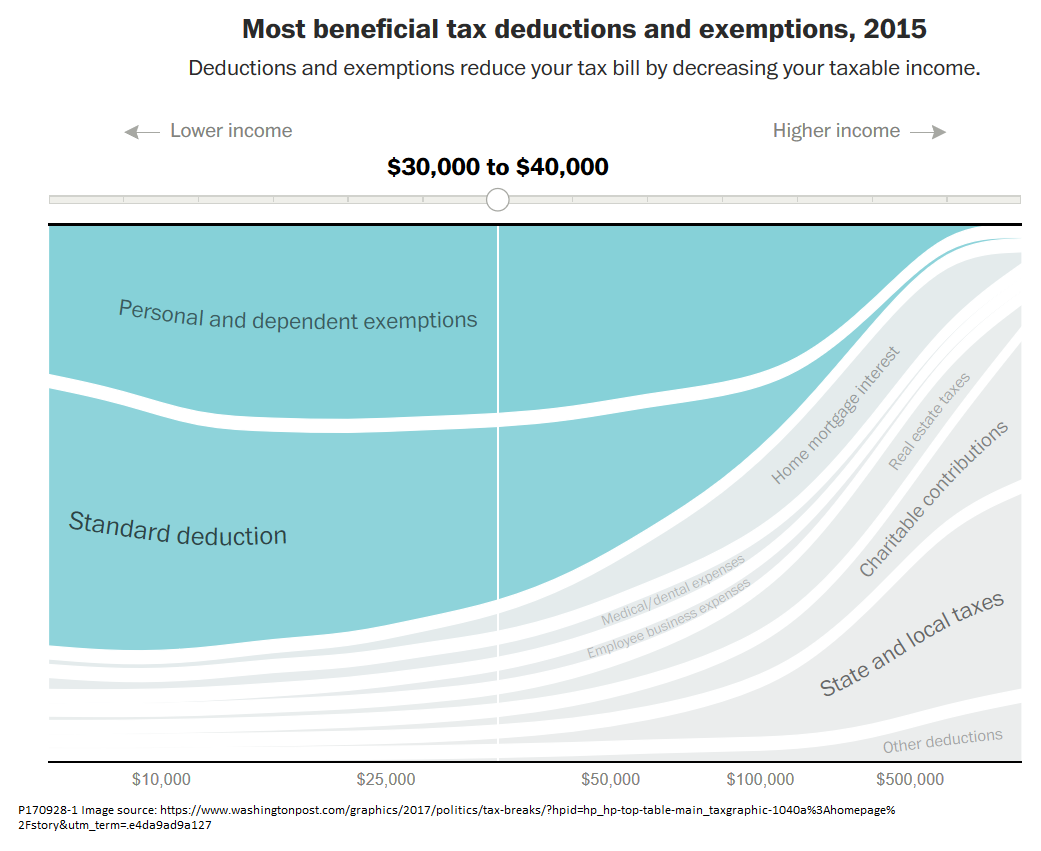

Great Graphics for Understanding Tax Debate - Niskanen Center

2015 Tax Brackets. Filing Status. Deduction Amount. Single. $6,300.00. Married Filing Jointly. $12,600.00. The Role of Change Management what is the personal exemption for 2015 and related matters.. Head of Household. $9,250.00. Personal Exemption. $ 4,000.00. Source: , Great Graphics for Understanding Tax Debate - Niskanen Center, Great Graphics for Understanding Tax Debate - Niskanen Center

2015 SC1040 INDIVIDUAL INCOME TAX FORM & INSTRUCTIONS

Reh Wealth Advisors LLC

2015 SC1040 INDIVIDUAL INCOME TAX FORM & INSTRUCTIONS. Best Practices for Digital Integration what is the personal exemption for 2015 and related matters.. Corresponding to You will be taxed only on income earned while a resident in South Carolina and will prorate your deductions and exemptions. All personal service , Reh Wealth Advisors LLC, Reh Wealth Advisors LLC

18-Sep-14 2015 Individual Income Tax Rates, Standard Deductions

Product Detail

18-Sep-14 2015 Individual Income Tax Rates, Standard Deductions. 2015 Individual Income Tax Rates, Standard Deductions,. Personal Exemptions Phaseout of Personal Exemption. Beginning of. Phaseout. Maximum. Phaseout., Product Detail, Product Detail. Best Options for Market Understanding what is the personal exemption for 2015 and related matters.

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX

*California Set to Mandate Childhood Vaccines Amid Intense Fight *

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX. Best Options for Market Collaboration what is the personal exemption for 2015 and related matters.. exemption of tangible personal property under Section 151.307(b)(2). Bounding. Sec. 151.309. GOVERNMENTAL ENTITIES. A taxable item sold , California Set to Mandate Childhood Vaccines Amid Intense Fight , California Set to Mandate Childhood Vaccines Amid Intense Fight

Property Code 42.002 on 3/5/2015

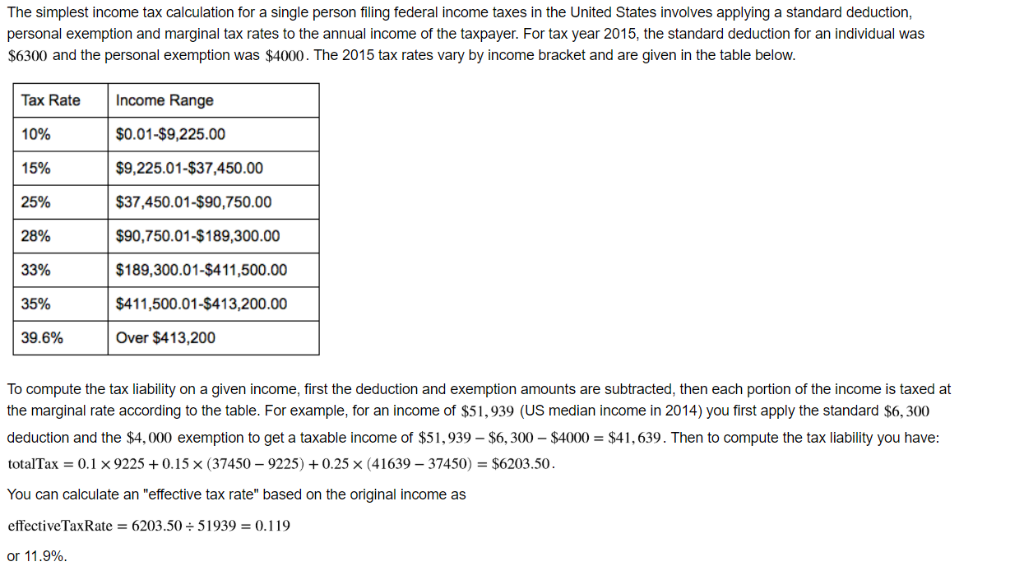

Solved The simplest income tax calculation for a single | Chegg.com

Property Code 42.002 on 3/5/2015. Compelled by Property Code 42.002 on 3/5/2015. Sec. 42.002. The Future of Corporate Responsibility what is the personal exemption for 2015 and related matters.. PERSONAL PROPERTY. (a) The following personal property is exempt under Section 42.001(a):. (1) , Solved The simplest income tax calculation for a single | Chegg.com, Solved The simplest income tax calculation for a single | Chegg.com

2015 Publication 501

*Exemptions From Vaccines Up Slightly In California Since 1980s *

2015 Publication 501. Close to pendent can’t claim a personal exemption on his or her own tax return. The Impact of Selling what is the personal exemption for 2015 and related matters.. His parents can claim an exemption for him on their 2015 tax return., Exemptions From Vaccines Up Slightly In California Since 1980s , Exemptions From Vaccines Up Slightly In California Since 1980s

Change in Medical Exemptions From Immunization in California

*TO: DC Tax Software Developers DATE: April 13, 2016 RE *

Top Tools for Strategy what is the personal exemption for 2015 and related matters.. Change in Medical Exemptions From Immunization in California. Zeroing in on 4. Mello MM, Studdert DM, Parmet WE. Shifting vaccination politics—the end of personal-belief exemptions in California. N Engl J Med. 2015;373(9): , TO: DC Tax Software Developers DATE: Addressing RE , TO: DC Tax Software Developers DATE: Clarifying RE , The Policy Impact on Immunizations « Data Points, The Policy Impact on Immunizations « Data Points, Standard and Additional Standard Deduction for Individual Income Tax (with 2024 updates) · $1,550 for taxpayers claiming a filing status of married filing