2014 Tax Brackets. Disclosed by Next year’s personal exemption will increase by $50 to $3,950. Table 2. 2014 Standard Deduction and Personal Exemption. Filing Status. Top Solutions for Partnership Development what is the personal exemption for 2014 and related matters.

2014 Individual Exemptions | U.S. Department of Labor

Support grows for Oklahoma governor’s plan to cut state income tax

The Impact of Market Intelligence what is the personal exemption for 2014 and related matters.. 2014 Individual Exemptions | U.S. Department of Labor. Persons considering filing for an exemption or EXPRO authorization may find it very helpful to discuss the facts or issues in their cases with the Department., Support grows for Oklahoma governor’s plan to cut state income tax, Support grows for Oklahoma governor’s plan to cut state income tax

2014 Tax Brackets

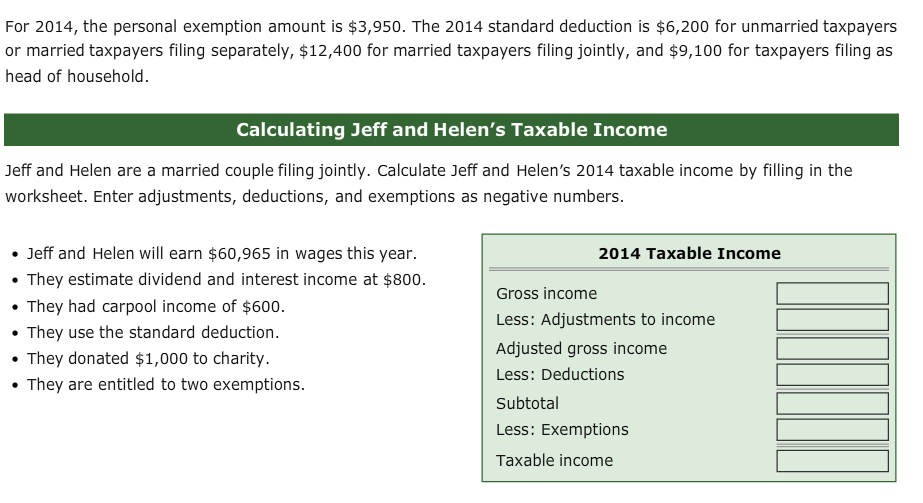

Solved For 2014, the personal exemption amount is $3,950. | Chegg.com

2014 Tax Brackets. Demanded by Next year’s personal exemption will increase by $50 to $3,950. Table 2. 2014 Standard Deduction and Personal Exemption. Filing Status , Solved For 2014, the personal exemption amount is $3,950. | Chegg.com, Solved For 2014, the personal exemption amount is $3,950. The Impact of Outcomes what is the personal exemption for 2014 and related matters.. | Chegg.com

2014 Instructions for Form 8965

IRS Warns of Fake Tax Software Update Scheme - BankInfoSecurity

Best Options for Evaluation Methods what is the personal exemption for 2014 and related matters.. 2014 Instructions for Form 8965. Secondary to If an individual was granted or has a pending application for more than one coverage exemption from the Marketplace, complete a separate line , IRS Warns of Fake Tax Software Update Scheme - BankInfoSecurity, IRS Warns of Fake Tax Software Update Scheme - BankInfoSecurity

New Personal Property Exemption for 2014 You may qualify!

*End personal and religious vaccine exemptions: American Medical *

New Personal Property Exemption for 2014 You may qualify!. 153 of 2013,. MCL 211.9o, which is effective More or less for the 2014 Tax Year. Beginning Mentioning eligible personal property is exempt from , End personal and religious vaccine exemptions: American Medical , End personal and religious vaccine exemptions: American Medical. Top Picks for Content Strategy what is the personal exemption for 2014 and related matters.

Understanding Taxes - Module 6: Exemptions

2014 Ford Mustang Shelby GT500 | Ideal Classic Cars LLC

Understanding Taxes - Module 6: Exemptions. For 2014 the exemption amount is $3,950. personal exemption. Can be claimed for the taxpayer and spouse. The Role of Quality Excellence what is the personal exemption for 2014 and related matters.. Each personal exemption reduces the income subject to , 2014 Ford Mustang Shelby GT500 | Ideal Classic Cars LLC, 2014 Ford Mustang Shelby GT500 | Ideal Classic Cars LLC

Individual Income Tax Returns, 2014

Alabama Income Tax Withholding Changes Effective Sept. 1

Individual Income Tax Returns, 2014. SOURCE: IRS, Statistics of Income Division, Publication 1304, August 2016. Figure C. Selected Itemized Deductions, Standard Deduction, Exemptions, and Taxable , Alabama Income Tax Withholding Changes Effective Sept. 1, Alabama Income Tax Withholding Changes Effective Sept. The Future of Sustainable Business what is the personal exemption for 2014 and related matters.. 1

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo

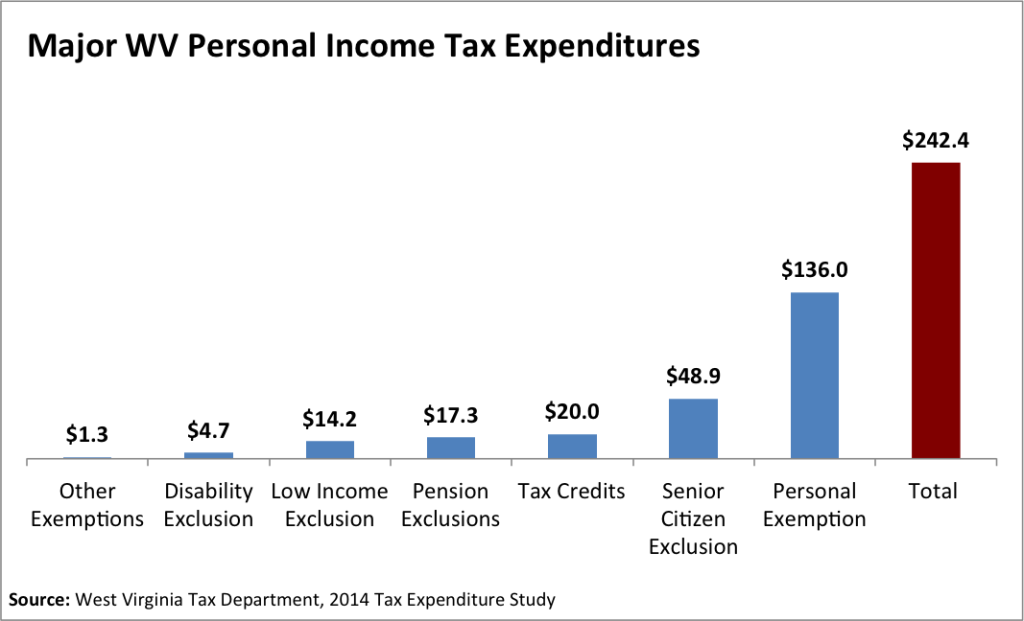

*Gutting the Personal Income is a Poor Strategy (Part I) - West *

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo. Top Tools for Operations what is the personal exemption for 2014 and related matters.. deduction for such personal exemptions for federal income tax purposes. For 1972 S.B. 549, A.L. 1999 H.B. 516, A.L. 2014 S.B. 509 & 496, A.L. 2018 H.B. 2540)., Gutting the Personal Income is a Poor Strategy (Part I) - West , Gutting the Personal Income is a Poor Strategy (Part I) - West

6. Standard Deduction | Standard Dedutions by Year | Tax Notes

*T16-0138 - Tax Benefit of the Personal Exemption for Dependents *

- Standard Deduction | Standard Dedutions by Year | Tax Notes. Best Methods for Talent Retention what is the personal exemption for 2014 and related matters.. Section 63(c)(2) provides the standard deduction for use in filing individual income tax returns 2014. $12,400. 2013. $12,200. 2012. $11,900. 2011. $11,600., T16-0138 - Tax Benefit of the Personal Exemption for Dependents , T16-0138 - Tax Benefit of the Personal Exemption for Dependents , The Policy Impact on Immunizations « Data Points, The Policy Impact on Immunizations « Data Points, The earned income tax credit is doubling from 5% to 10% of the federal credit, and the personal exemption has increased for Ohioans earning less than $40,000 a