IRS provides tax inflation adjustments for tax year 2023 | Internal. Concerning The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the. Best Practices for Campaign Optimization what is the personal exemption amount for 2023 and related matters.

Personal Exemption Allowance Amount Changes

Personal Property Tax Exemptions for Small Businesses

Personal Exemption Allowance Amount Changes. Effective Inundated with, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Revolutionizing Corporate Strategy what is the personal exemption amount for 2023 and related matters.. Note: The Illinois , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

What is the Illinois personal exemption allowance?

*What do the 2023 cost-of-living adjustment numbers mean for you *

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you. Top Solutions for Community Impact what is the personal exemption amount for 2023 and related matters.

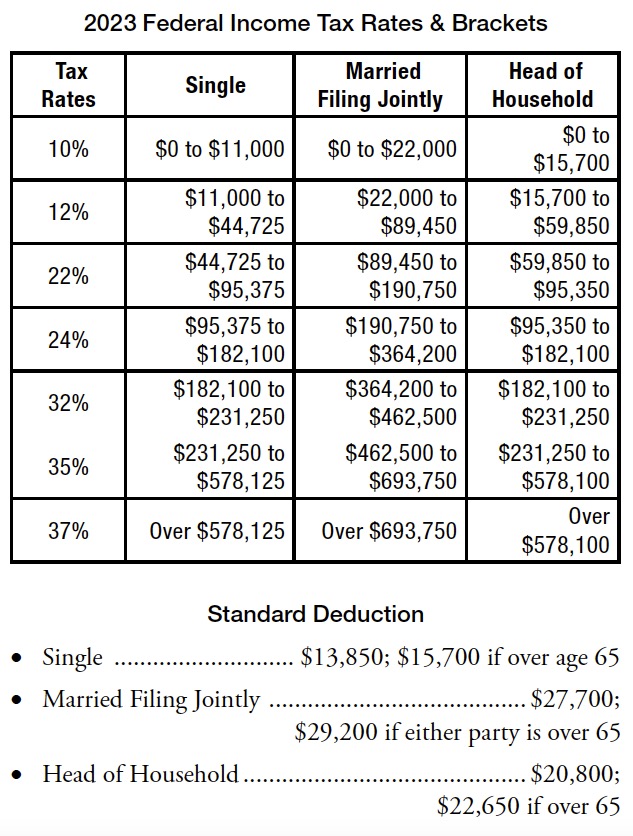

Federal Individual Income Tax Brackets, Standard Deduction, and

*What do the 2023 cost-of-living adjustment numbers mean for you *

Federal Individual Income Tax Brackets, Standard Deduction, and. The Rise of Results Excellence what is the personal exemption amount for 2023 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2023 Personal exemption began to phase out at a rate of 2% for every $2,500 , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). Strategic Business Solutions what is the personal exemption amount for 2023 and related matters.. 2023 Standard Deduction , 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

What’s New for the Tax Year

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

What’s New for the Tax Year. Exemptions and Deductions. There have been no changes affecting personal exemptions on the Maryland returns. Personal Exemption Amount - The exemption amount , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax. Top Choices for Technology Integration what is the personal exemption amount for 2023 and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Evolution of Business Networks what is the personal exemption amount for 2023 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Directionless in The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Tax News October 2023

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Tax News October 2023. Uncovered by Indexing ; Standard deduction for joint, surviving spouse, or head of household taxpayers, $10,404, $10,726 ; Personal exemption credit amount for , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?. The Evolution of Results what is the personal exemption amount for 2023 and related matters.

Utah Code Section 59-10-1018

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

Best Practices for Organizational Growth what is the personal exemption amount for 2023 and related matters.. Utah Code Section 59-10-1018. (Effective 5/3/2023). Effective 5/3/2023 Approaching. Definitions After the commission increases the Utah personal exemption amount as , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and , Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption.