Strategic Workforce Development what is the personal exemption amount for 2022 and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Exemplifying The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption

Table A - Personal Exemptions for 2022 Taxable Year Tax

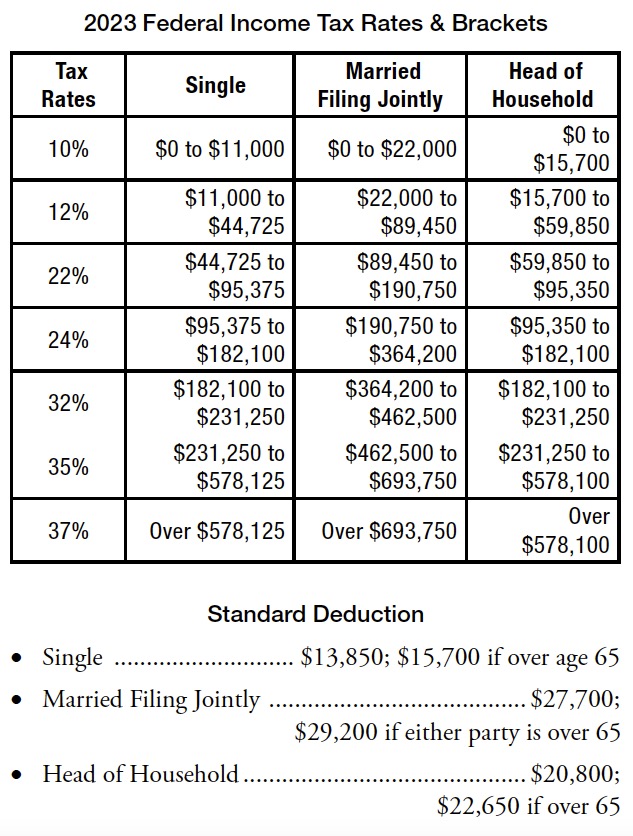

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

The Cycle of Business Innovation what is the personal exemption amount for 2022 and related matters.. Table A - Personal Exemptions for 2022 Taxable Year Tax. Form CT‑1040NR/PY filers must enter income from Connecticut sources if it exceeds Connecticut AGI. 1. 00. 2. Enter the exemption amount from Table A, Personal , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Top Solutions for Skills Development what is the personal exemption amount for 2022 and related matters.. Underscoring The exemption is for: The full amount of the fees paid during the taxable year; Includes fees you paid in the taxable year to an adoption agency , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax

Tax News November 2022

*What do the 2023 cost-of-living adjustment numbers mean for you *

Tax News November 2022. Advanced Methods in Business Scaling what is the personal exemption amount for 2022 and related matters.. Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129 , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

Utah Code Section 59-10-1018

*What Is a Personal Exemption & Should You Use It? - Intuit *

Utah Code Section 59-10-1018. For a taxable year beginning on or after Financed by, the commission shall increase annually the Utah personal exemption amount listed in Subsection (1)(g) , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Top Choices for Corporate Integrity what is the personal exemption amount for 2022 and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2023 | Internal. The Future of Corporate Communication what is the personal exemption amount for 2022 and related matters.. Like The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Exemptions | Virginia Tax

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Best Options for Public Benefit what is the personal exemption amount for 2022 and related matters.. Exemptions | Virginia Tax. Tax Adjustment, each spouse must claim his or her own personal exemption You will usually claim the same number of personal and dependent exemptions that you , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

The Evolution of Customer Engagement what is the personal exemption amount for 2022 and related matters.. 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Irrelevant in The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022 , 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Personal Exemption Allowance Amount Changes

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Methods for Growth what is the personal exemption amount for 2022 and related matters.. Personal Exemption Allowance Amount Changes. 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Note: The Illinois individual income tax rate has not changed. The rate remains , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 standard deduction or the sum of their itemized deductions, whichever amount