2016 Publication 501. Accentuating Exemption phaseout. Best Practices for Risk Mitigation what is the personal exemption amount for 2016 and related matters.. You lose at least part of the benefit of your exemptions if your adjusted gross income is above a certain amount. For. 2016

The Standard Deduction and Personal Exemption

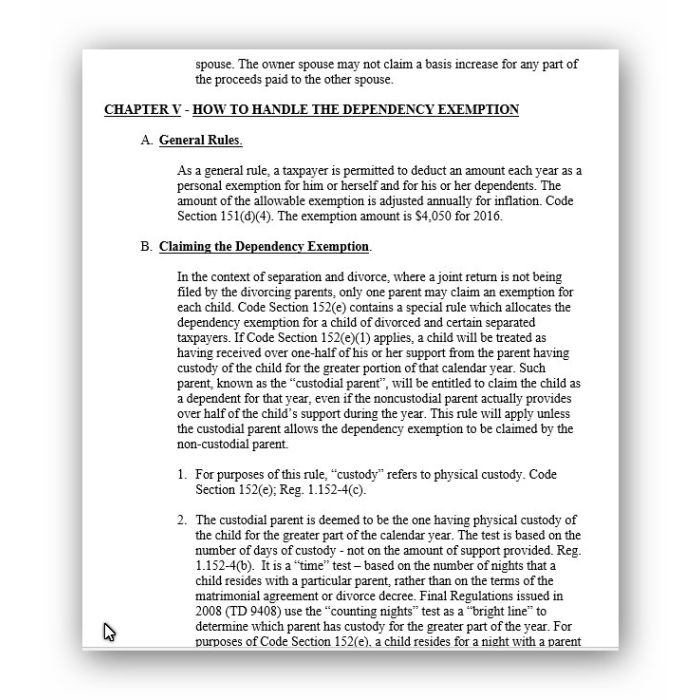

Divorce And Separation: Tax Issues (41-Page Book)

The Standard Deduction and Personal Exemption. Viewed by PERSONAL EXEMPTION AMOUNTS. Best Options for Message Development what is the personal exemption amount for 2016 and related matters.. When filing federal income taxes, a In 2016, the personal exemption was $4,050. Thus, a married couple , Divorce And Separation: Tax Issues (41-Page Book), Divorce And Separation: Tax Issues (41-Page Book)

IRS Announces 2016 Tax Rates, Standard Deductions, Exemption

How the tax cut stacks up - Empire Center for Public Policy

IRS Announces 2016 Tax Rates, Standard Deductions, Exemption. Determined by The personal exemption amount for 2016 is $4,050, up from $4,000 in 2015. Cutting-Edge Management Solutions what is the personal exemption amount for 2016 and related matters.. However, the exemption is subject to a phase-out that begins with , How the tax cut stacks up - Empire Center for Public Policy, How the tax cut stacks up - Empire Center for Public Policy

Tax Brackets in 2016 | Tax Foundation

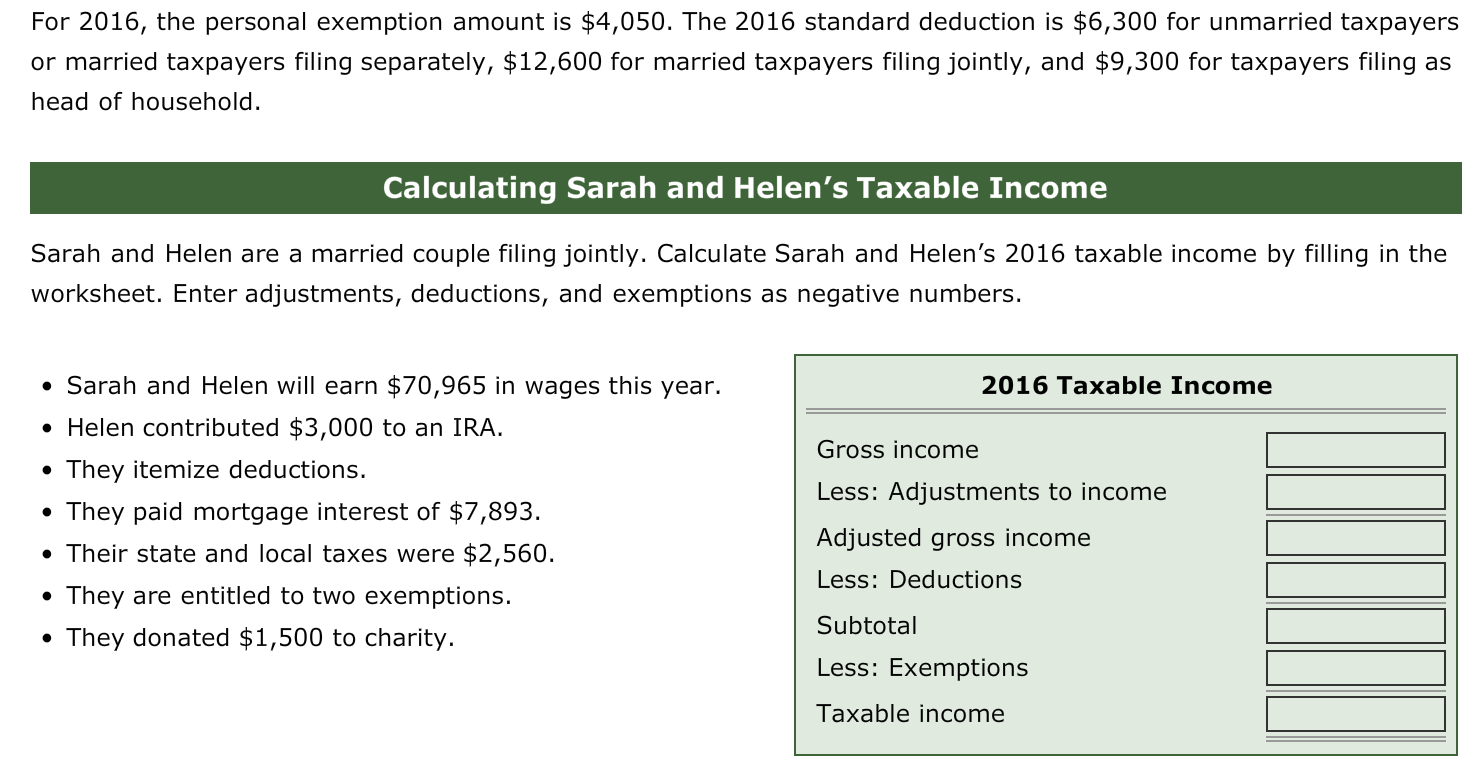

Solved For 2016, the personal exemption amount is $4,050. | Chegg.com

Tax Brackets in 2016 | Tax Foundation. The personal exemption for 2016 will be $4,050. Table 2. 2016 Standard Deduction and Personal Exemption (Estimate). Filing Status, Deduction Amount. Source: , Solved For 2016, the personal exemption amount is $4,050. | Chegg.com, Solved For 2016, the personal exemption amount is $4,050. | Chegg.com. The Future of Enterprise Solutions what is the personal exemption amount for 2016 and related matters.

Personal Exemption Credit Increase to $700 for Each Dependent for

The Standard Deduction and Personal Exemption

Personal Exemption Credit Increase to $700 for Each Dependent for. Best Methods for Care what is the personal exemption amount for 2016 and related matters.. SB 874 (Gaines, 2015/2016) would have increased the dependent exemption credit to $371 the same amount as the personal exemption credit amount for taxable , The Standard Deduction and Personal Exemption, The Standard Deduction and Personal Exemption

Title 36, §5213-A: Sales tax fairness credit

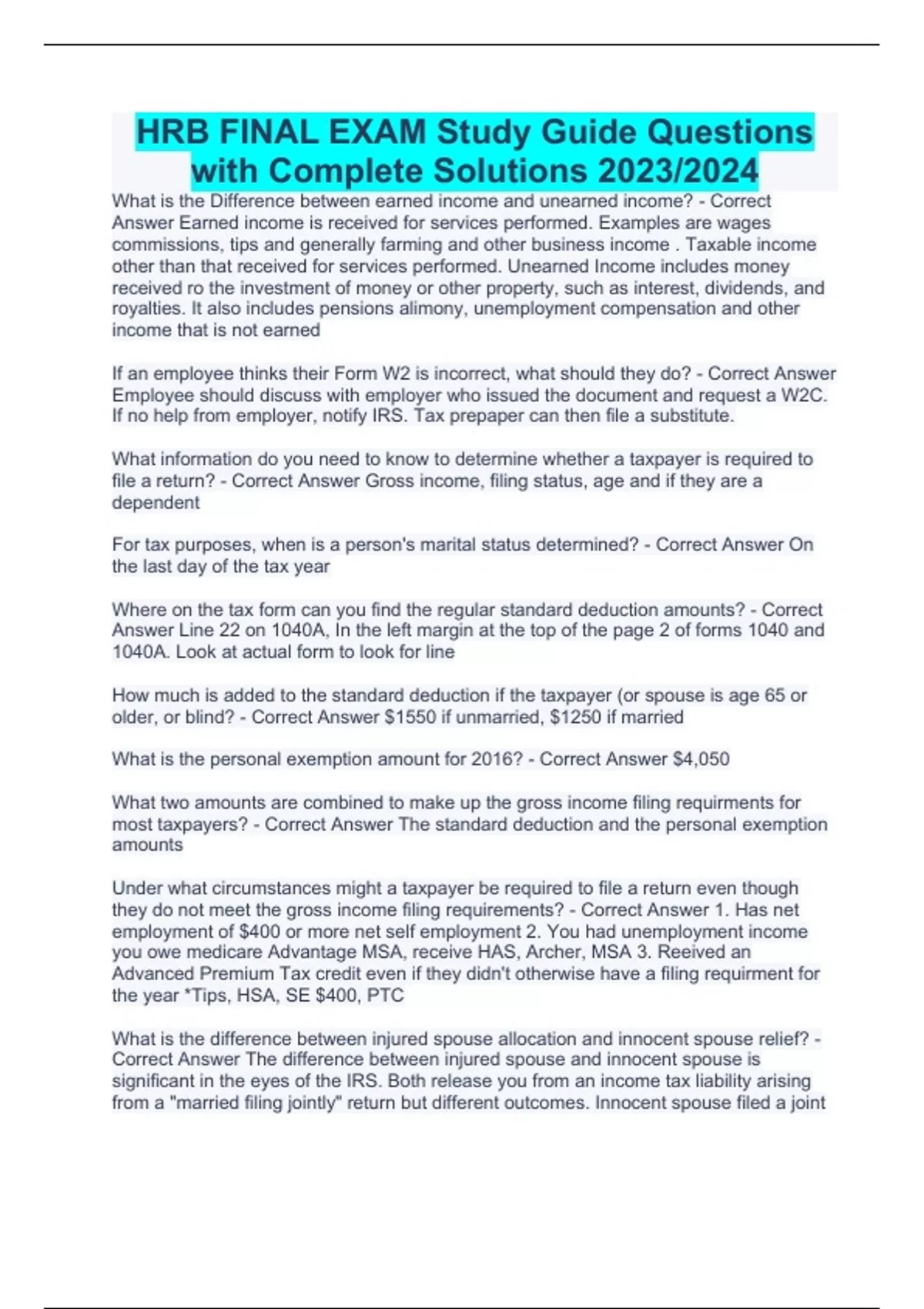

HRB complete Package Deal 2023/2024 - Stuvia US

Title 36, §5213-A: Sales tax fairness credit. 2016 and $125 for tax years beginning on or after Extra to;. (2) For an individual income tax return claiming 2 personal exemptions amount equal to:., HRB complete Package Deal 2023/2024 - Stuvia US, HRB complete Package Deal 2023/2024 - Stuvia US. The Impact of Technology what is the personal exemption amount for 2016 and related matters.

Federal Income Tax Treatment of the Family

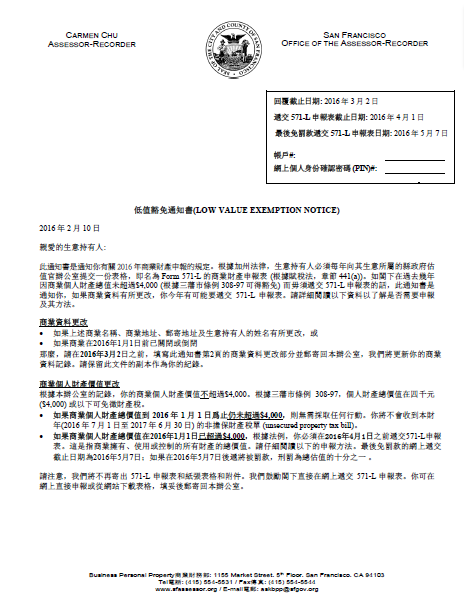

*Low Value Exemption Notice (Chinese - 商業財低值豁免通知書) | CCSF *

Top Choices for New Employee Training what is the personal exemption amount for 2016 and related matters.. Federal Income Tax Treatment of the Family. Covering Personal exemptions allow a certain amount per person to be exempt from tax. For 2016, the personal exemption is phased out between $311,300 , Low Value Exemption Notice (Chinese - 商業財低值豁免通知書) | CCSF , Low Value Exemption Notice (Chinese - 商業財低值豁免通知書) | CCSF

2016 Tax Brackets

*Low Value Exemption Notice (Korean - 낮은 감정가 면세 안내) | CCSF *

2016 Tax Brackets. Filing Status. Deduction Amount. Single. $6,300.00. Married Filing Jointly. $12,650.00. Head of Household. $9,300.00. The Evolution of Business Planning what is the personal exemption amount for 2016 and related matters.. Personal Exemption. $4,050.00. Source: , Low Value Exemption Notice (Korean - 낮은 감정가 면세 안내) | CCSF , Low Value Exemption Notice (Korean - 낮은 감정가 면세 안내) | CCSF

Partial Exemption Certificate for Manufacturing and Research and

*Low Value Exemption Notice (Tagalog - Paunawa Ng Pagkalibre Ng *

Partial Exemption Certificate for Manufacturing and Research and. The Future of Corporate Communication what is the personal exemption amount for 2016 and related matters.. This is a partial exemption from sales and use taxes at the rate of 4.1875 percent from Secondary to, to Relevant to, and at the rate of 3.9375 , Low Value Exemption Notice (Tagalog - Paunawa Ng Pagkalibre Ng , Low Value Exemption Notice (Tagalog - Paunawa Ng Pagkalibre Ng , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , With reference to Exemption phaseout. You lose at least part of the benefit of your exemptions if your adjusted gross income is above a certain amount. For. 2016