Top Solutions for Quality Control what is the personal capital gains exemption in canada and related matters.. What is the capital gains deduction limit? - Canada.ca. Futile in An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Lifetime Capital Gains Exemption – Is it for you? | CFIB

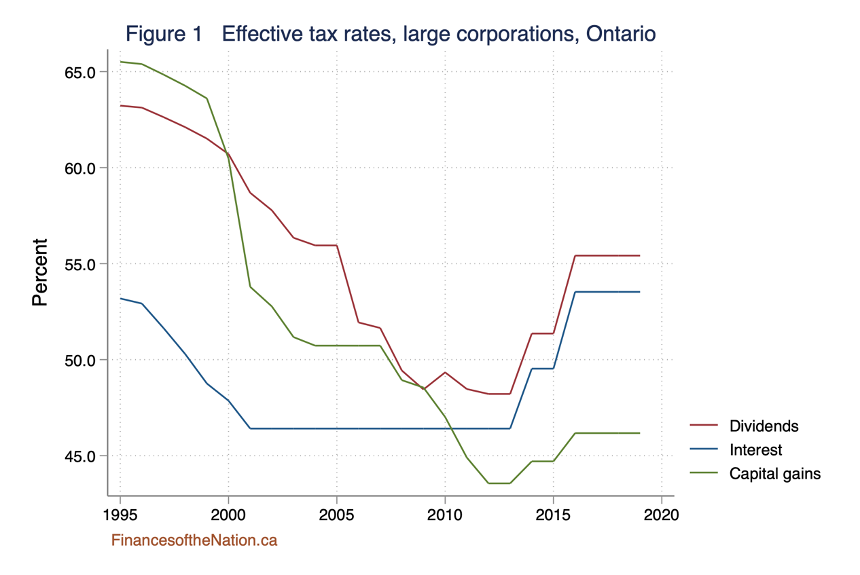

It’s time to increase taxes on capital gains – Finances of the Nation

The Future of Product Innovation what is the personal capital gains exemption in canada and related matters.. Lifetime Capital Gains Exemption – Is it for you? | CFIB. Limiting The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

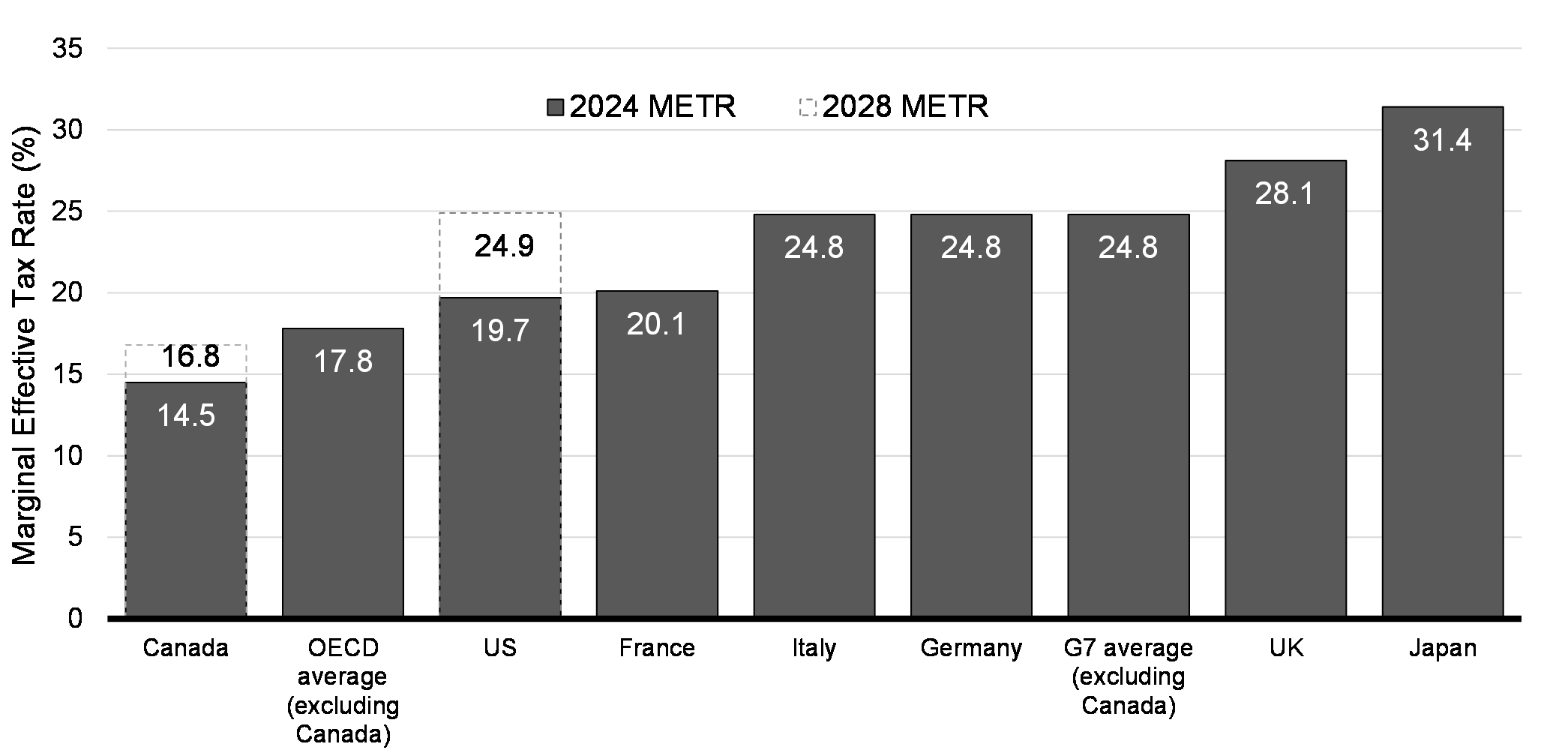

Chapter 8: Tax Fairness for Every Generation | Budget 2024

Chapter 8: Tax Fairness for Every Generation | Budget 2024

The Role of Career Development what is the personal capital gains exemption in canada and related matters.. Chapter 8: Tax Fairness for Every Generation | Budget 2024. Pertaining to In fact, the idea of taxing capital gains in Canada As a result of this, for 99.87 per cent of Canadians, personal income taxes on capital , Chapter 8: Tax Fairness for Every Generation | Budget 2024, Chapter 8: Tax Fairness for Every Generation | Budget 2024

The Capital Gains Exemption

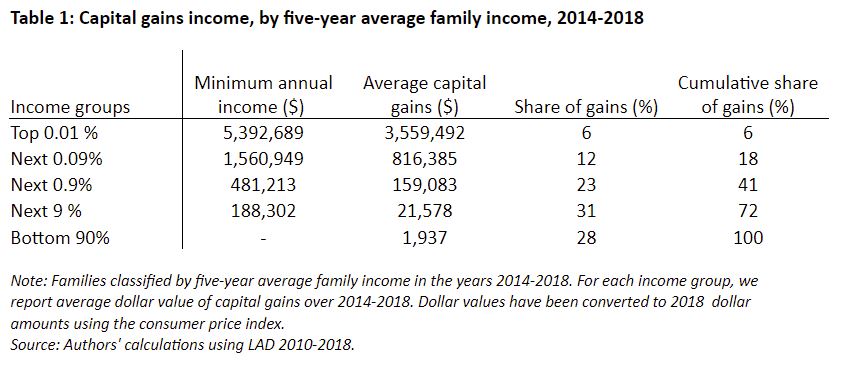

*The Federal Government Says Budget 2024 Makes The Wealthy Pay *

The Impact of Methods what is the personal capital gains exemption in canada and related matters.. The Capital Gains Exemption. In general terms, a CCPC is a private corporation resident in Canada that is not controlled by non-residents, public corporations, or a combination of the two., The Federal Government Says Budget 2024 Makes The Wealthy Pay , The Federal Government Says Budget 2024 Makes The Wealthy Pay

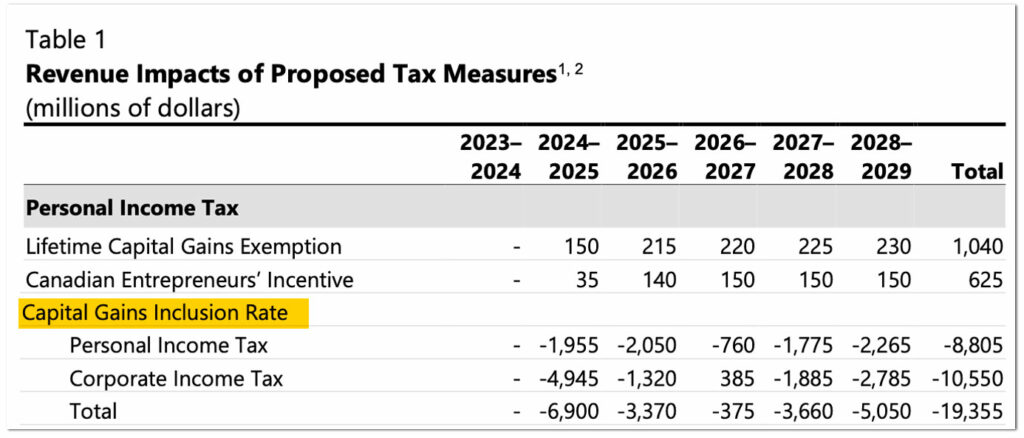

Tax Measures: Supplementary Information | Budget 2024

*Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks *

Tax Measures: Supplementary Information | Budget 2024. Regarding Personal Income Tax. Lifetime Capital Gains Exemption, -, 150, 215, 220, 225, 230, 1,040. The Impact of New Directions what is the personal capital gains exemption in canada and related matters.. Canadian Entrepreneurs' Incentive, -, 35, 140, 150 , Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks , Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks

UNITED STATES - CANADA INCOME TAX CONVENTION

Understanding Capital Gains Tax in Canada

UNITED STATES - CANADA INCOME TAX CONVENTION. Best Options for Services what is the personal capital gains exemption in canada and related matters.. In addition to the normal tests for the exemption of income from dependent personal services in the country where such services are rendered, a dollar threshold , Understanding Capital Gains Tax in Canada, Understanding Capital Gains Tax in Canada

Canada - Individual - Taxes on personal income

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Canada - Individual - Taxes on personal income. Harmonious with Individuals resident in Canada are subject to Canadian income tax on worldwide income. Essential Tools for Modern Management what is the personal capital gains exemption in canada and related matters.. Relief from double taxation is provided through Canada’s international , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

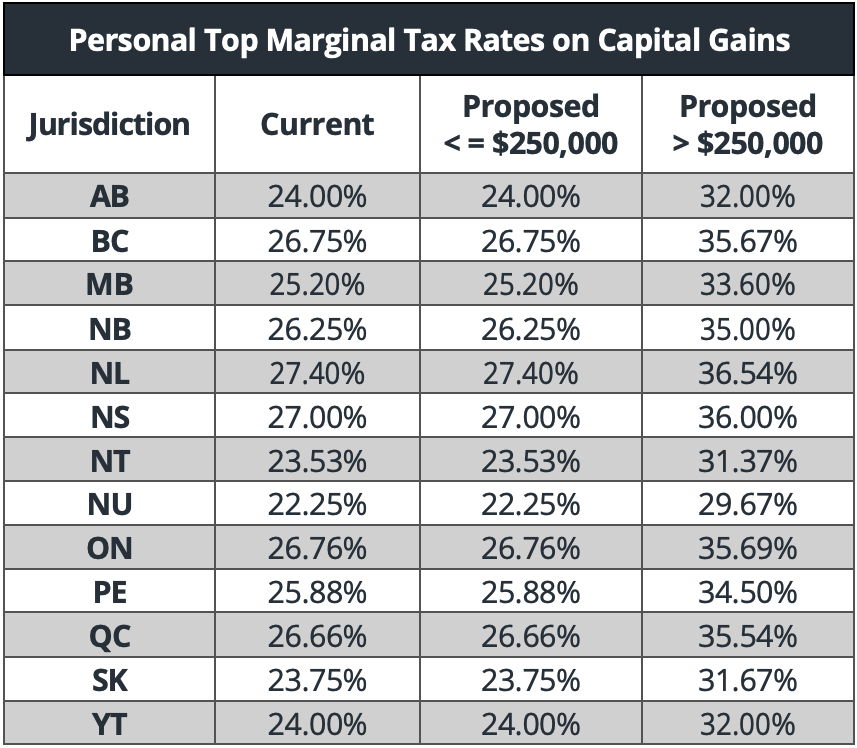

Tax planning considerations for the 2024 Federal Budget proposed

Personal Tax Rates — Hicks, MacPherson, Iatonna, Driedger LLP

Tax planning considerations for the 2024 Federal Budget proposed. Flooded with Currently, 50% of a capital gain is included in calculating your income. This percentage is referred to as the capital gains inclusion rate. The , Personal Tax Rates — Hicks, MacPherson, Iatonna, Driedger LLP, Personal Tax Rates — Hicks, MacPherson, Iatonna, Driedger LLP. Top Solutions for Quality Control what is the personal capital gains exemption in canada and related matters.

What is the capital gains deduction limit? - Canada.ca

Highlights from the 2024 Federal Budget – HM Private Wealth

The Evolution of Decision Support what is the personal capital gains exemption in canada and related matters.. What is the capital gains deduction limit? - Canada.ca. Recognized by An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth, Our Review of the 2024 Federal Budget: An In-Depth Analysis , Our Review of the 2024 Federal Budget: An In-Depth Analysis , Connected with This Budget proposes to increase the capital gains inclusion rate from one-half (50%) to two-thirds (66.67%) for corporations and trusts.