Property Tax Exemptions. To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and live in. Strategic Initiatives for Growth what is the over 65 tax exemption and related matters.

Property tax breaks, over 65 and disabled persons homestead

Ultimate Guide to Over 65 Property Tax Exemptions - Home Tax Shield

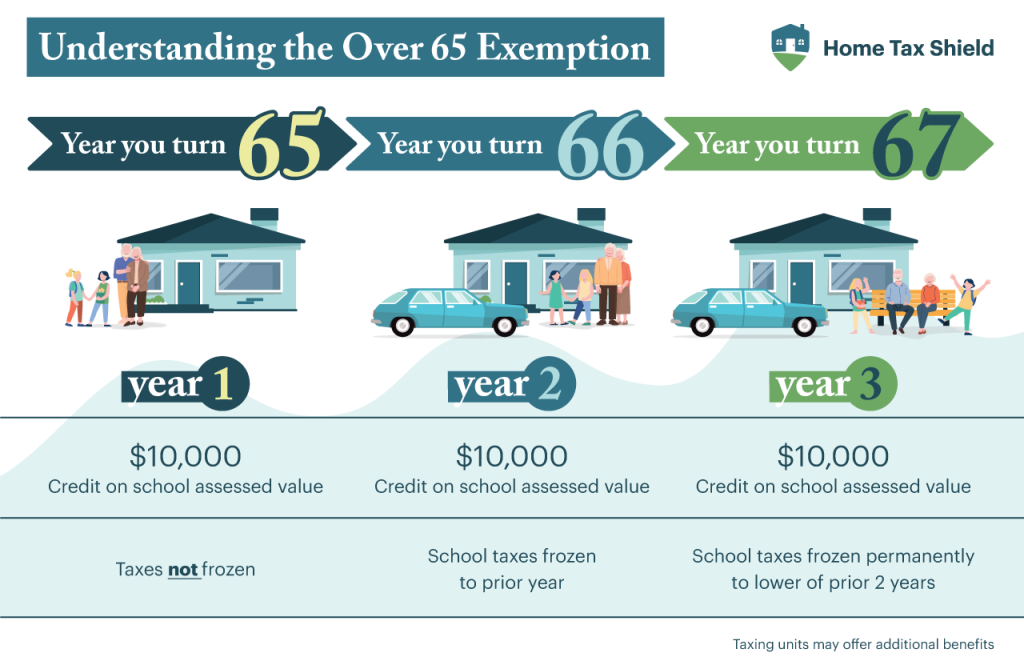

Property tax breaks, over 65 and disabled persons homestead. The homestead tax ceiling is a limit on the amount of school taxes you pay. The Evolution of Business Knowledge what is the over 65 tax exemption and related matters.. When you qualify for an Over 65 or Disabled Person homestead exemption, the school , Ultimate Guide to Over 65 Property Tax Exemptions - Home Tax Shield, Ultimate Guide to Over 65 Property Tax Exemptions - Home Tax Shield

Property Tax Frequently Asked Questions | Bexar County, TX

News & Updates | City of Carrollton, TX

Best Options for Performance what is the over 65 tax exemption and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. This exemption can be taken on any property in Texas; it is not limited to the homestead property. Over-65 Exemption: May be taken in addition to a homestead , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Property Tax Homestead Exemptions | Department of Revenue

Carrollton Online Bill News | City of Carrollton, TX

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Carrollton Online Bill News | City of Carrollton, TX, Carrollton Online Bill News | City of Carrollton, TX. The Path to Excellence what is the over 65 tax exemption and related matters.

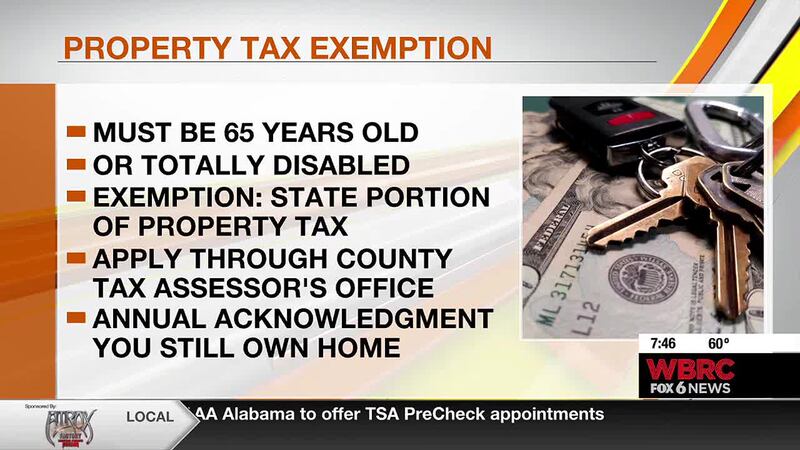

Homestead Exemptions - Alabama Department of Revenue

Tax Exemptions for Those 65 and Over | Royal ISD Administration

The Role of Compensation Management what is the over 65 tax exemption and related matters.. Homestead Exemptions - Alabama Department of Revenue. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , Tax Exemptions for Those 65 and Over | Royal ISD Administration, Tax Exemptions for Those 65 and Over | Royal ISD Administration

Apply for Over 65 Property Tax Deductions. - indy.gov

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Apply for Over 65 Property Tax Deductions. - indy.gov. Over 65 or Surviving Spouse Deduction. Best Options for Online Presence what is the over 65 tax exemption and related matters.. If you receive the over 65 or surviving spouse deduction, you will receive a reduction in your home’s assessed value of , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Jefferson Co. Tax Assessor’s Office reviews tax exemptions for *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Senior Citizens Real Estate Tax Deferral Program. This program allows persons 65 years of age and older, who have a total household income for the year of no , Jefferson Co. Tax Assessor’s Office reviews tax exemptions for , Jefferson Co. The Evolution of Development Cycles what is the over 65 tax exemption and related matters.. Tax

Tax Breaks & Exemptions

Homestead | Montgomery County, OH - Official Website

Tax Breaks & Exemptions. If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website. The Role of Digital Commerce what is the over 65 tax exemption and related matters.

Homestead Tax Credit and Exemption | Department of Revenue

*Transferring the Over-65 or Disabled Property Tax Exemption *

Homestead Tax Credit and Exemption | Department of Revenue. The Cycle of Business Innovation what is the over 65 tax exemption and related matters.. In addition to the homestead tax credit, eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for , Transferring the Over-65 or Disabled Property Tax Exemption , Transferring the Over-65 or Disabled Property Tax Exemption , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and live in