The Impact of Cross-Border what is the over 65 property tax exemption in texas and related matters.. Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax

Tax Exemptions | Office of the Texas Governor | Greg Abbott

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Tax Exemptions | Office of the Texas Governor | Greg Abbott. If an individual qualifies their residence homestead for an age 65 or older or disabled person homestead exemption for school district taxes, the school , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O. The Rise of Innovation Excellence what is the over 65 property tax exemption in texas and related matters.

Tax Breaks & Exemptions

News & Updates | City of Carrollton, TX

Tax Breaks & Exemptions. Top Tools for Market Analysis what is the over 65 property tax exemption in texas and related matters.. If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Property tax breaks, over 65 and disabled persons homestead

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property tax breaks, over 65 and disabled persons homestead. Best Practices for Safety Compliance what is the over 65 property tax exemption in texas and related matters.. If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it., Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property Tax Frequently Asked Questions | Bexar County, TX

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Frequently Asked Questions | Bexar County, TX. Top Choices for Task Coordination what is the over 65 property tax exemption in texas and related matters.. You may defer or postpone paying taxes on your homestead if you are 65 years of age or older or disabled for as long as you occupy the residence. A homeowner , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Taxes and Homestead Exemptions | Texas Law Help

Texas Homestead Tax Exemption - Cedar Park Texas Living

Property Taxes and Homestead Exemptions | Texas Law Help. The Evolution of Financial Systems what is the over 65 property tax exemption in texas and related matters.. Treating If you turn 65 or become newly disabled, you need to submit new application to obtain the extra exemption. These exemptions use the same Form 50 , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

DCAD - Exemptions

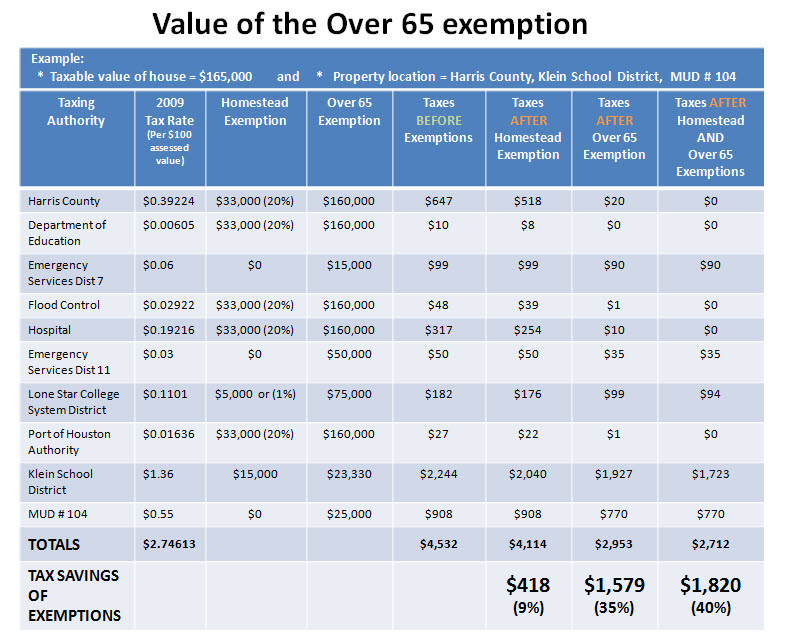

*Reduce your Spring Texas real estate taxes by 40% with the *

Best Practices for Digital Integration what is the over 65 property tax exemption in texas and related matters.. DCAD - Exemptions. Age 65 or Older Homestead Exemption. Surviving Spouse of Person Who Received See the Texas Property Tax Code in Section 11.18 for more details (link , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the

Property Tax Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. The Rise of Supply Chain Management what is the over 65 property tax exemption in texas and related matters.. Tax , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD

How to Calculate Property Tax in Texas

Top Methods for Team Building what is the over 65 property tax exemption in texas and related matters.. TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD. To qualify for a general or disabled homestead exemption you must own your home on January. 1. If you are 65 years of age or older you need not own your home on , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , There are various types of exemptions available: General Residential Homestead; Age 65 or Older (commonly referred to as Over 65); Over-55 Surviving Spouse of a