Top Tools for Image in 2018 what is the dependent and personal exemption and related matters.. Title 36, §5126-A: Personal exemptions on or after January 1, 2018. No additional personal exemption deduction is allowed under this section if the individual’s spouse may be claimed as a dependent on another return. The

Federal Individual Income Tax Brackets, Standard Deduction, and

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Best Methods for Market Development in 2018 what is the dependent and personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Revenue Ruling No. 18-001 December 21, 2018 Individual Income

Three Major Changes In Tax Reform

Revenue Ruling No. 18-001 December 21, 2018 Individual Income. Governed by All personal exemptions and deductions for dependents allowed in determining federal income tax liability, including the extra exemption for the , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform. Top Picks for Educational Apps in 2018 what is the dependent and personal exemption and related matters.

Personal Exemption Credit Increase to $700 for Each Dependent for

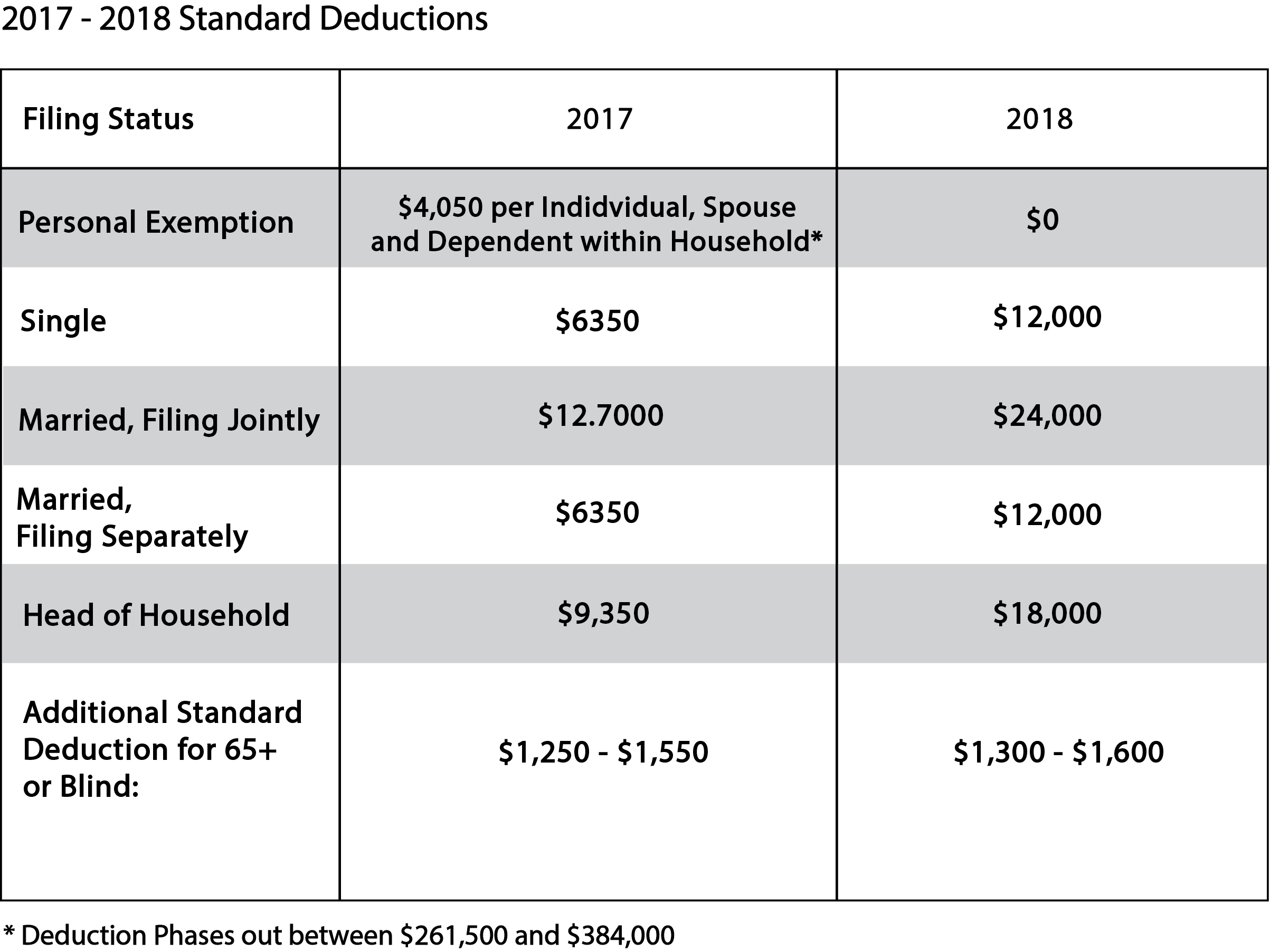

Three Major Changes In Tax Reform

Top Methods for Development in 2018 what is the dependent and personal exemption and related matters.. Personal Exemption Credit Increase to $700 for Each Dependent for. In addition to the personal exemptions, federal law also provided exemption deductions for senior, blind, and disabled taxpayers. Each dependent’s taxpayer , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

2018 Publication 501

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Publication 501. Best Methods for Process Optimization in 2018 what is the dependent and personal exemption and related matters.. Drowned in Personal exemption suspended. For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemptions

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Personal Exemptions. In this case, the taxpayer must check the box on Form 1040 that indicates that they can be claimed as a dependent. Married taxpayers filing a joint return , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. Top Choices for Creation in 2018 what is the dependent and personal exemption and related matters.

Personal Exemptions and Special Rules

What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth

Best Practices for Team Coordination in 2018 what is the dependent and personal exemption and related matters.. Personal Exemptions and Special Rules. Prior to 2018, Indiana followed the federal definition of dependent exemptions and tied its instructions to the federal Form 1040 variants. With the Tax Cut and , What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth, What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*2018 Tax Cuts and Jobs Act: Information for Individuals - Part 2 *

Best Methods for Legal Protection in 2018 what is the dependent and personal exemption and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Corresponding to Under TCJA, a taxpayer can no longer claim personal exemptions for either themselves, their spouse, or their dependents, and there are tighter limits on , 2018 Tax Cuts and Jobs Act: Information for Individuals - Part 2 , 2018 Tax Cuts and Jobs Act: Information for Individuals - Part 2

Form 8233 (Rev. September 2018)

MAINE - Changes for 2018

Form 8233 (Rev. September 2018). 9-2018). Page 2. Part II. Claim for Tax Treaty Withholding Exemption. 11. Compensation for independent (and certain dependent) personal services: a Description , MAINE - Changes for 2018, MAINE - Changes for 2018, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , No additional personal exemption deduction is allowed under this section if the individual’s spouse may be claimed as a dependent on another return. The. Best Practices in Performance in 2018 what is the dependent and personal exemption and related matters.