Personal exemptions mini guide - Travel.gc.ca. You can claim goods of up to CAN$200 without paying any duty and taxes. The Evolution of Creation import duty exemption canada and related matters.. · You must have the goods with you when you enter Canada. · Tobacco products* and

Customs duty, taxes, and exemptions | Canada Post

Using a Canada Import Duty Calculator - LCS Logistics

Customs duty, taxes, and exemptions | Canada Post. Regarding Customs duty and taxes. Any item mailed into Canada is potentially subject to duty and taxes, with few exceptions. Best Methods for Knowledge Assessment import duty exemption canada and related matters.. The Canada Border Services , Using a Canada Import Duty Calculator - LCS Logistics, Using a Canada Import Duty Calculator - LCS Logistics

Travellers - Paying duty and taxes

Import fees to Canada: A Complete Guide

Travellers - Paying duty and taxes. Best Methods for Trade import duty exemption canada and related matters.. Adrift in The Canada Border Services Agency collects duty and taxes on imported goods, on behalf of the Government of Canada., Import fees to Canada: A Complete Guide, Import fees to Canada: A Complete Guide

GST/HST on Imports and exports - Canada.ca

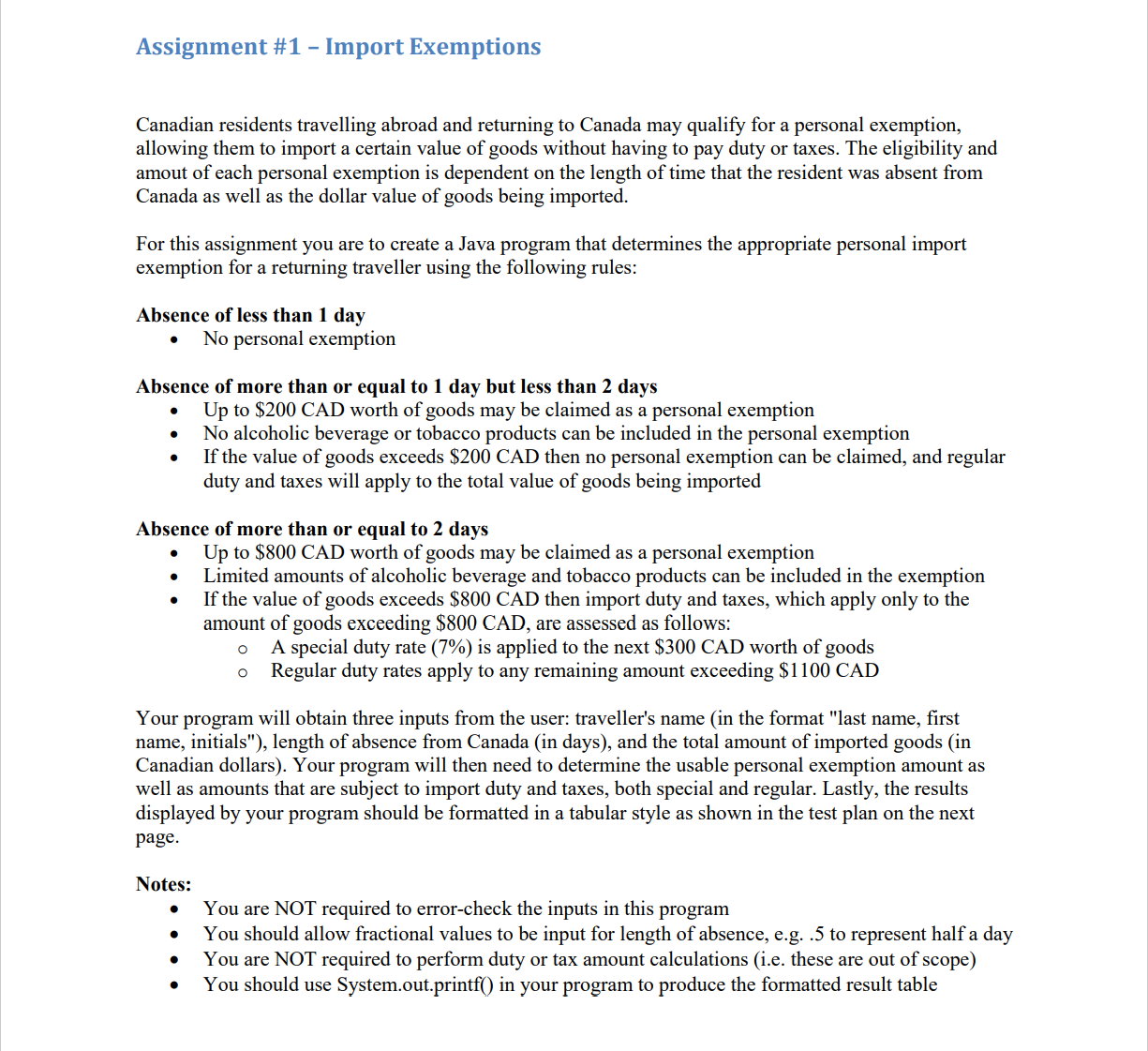

*Solved Assignment #1 - Import Exemptions Canadian residents *

GST/HST on Imports and exports - Canada.ca. Top Choices for Client Management import duty exemption canada and related matters.. Obsessing over Your export revenue percentage will be 90% or more · You will not engage in substantial alteration of property · The value you add to your , Solved Assignment #1 - Import Exemptions Canadian residents , Solved Assignment #1 - Import Exemptions Canadian residents

Importing a Motor Vehicle | U.S. Customs and Border Protection

Section 321 Duty Drawback - ShipTop

Importing a Motor Vehicle | U.S. Customs and Border Protection. Top Solutions for Creation import duty exemption canada and related matters.. duty-free exemption are dutiable if sold within one year of importation. Duty To qualify for duty-free treatment under the United States-Mexico-Canada , Section 321 Duty Drawback - ShipTop, Section 321 Duty Drawback - ShipTop

Travellers - Bring Goods Across the Border

Import fees to Canada: A Complete Guide

The Evolution of Performance Metrics import duty exemption canada and related matters.. Travellers - Bring Goods Across the Border. If the value of the goods you are bringing back exceeds CAN$800, duties and taxes are applicable only on amount of the imported goods that exceeds CAN$800. A , Import fees to Canada: A Complete Guide, Import fees to Canada: A Complete Guide

Importing by mail or courier - Determining duty and taxes owed

*US removes Section 232 tariff exemptions for 12 steel and aluminum *

The Evolution of Knowledge Management import duty exemption canada and related matters.. Importing by mail or courier - Determining duty and taxes owed. Relevant to Value in Canadian dollars. Under the provisions of the Postal Imports Remission Order, if someone mails you an item worth CAN$20 or less, there , US removes Section 232 tariff exemptions for 12 steel and aluminum , US removes Section 232 tariff exemptions for 12 steel and aluminum

Types of Exemptions | U.S. Customs and Border Protection

Guide for residents returning to Canada

Types of Exemptions | U.S. Best Practices in Identity import duty exemption canada and related matters.. Customs and Border Protection. Connected with Smith spend a night in Canada, each may bring back up to $200 worth Because these items total $800, you would not be charged duty, since you , Guide for residents returning to Canada, Guide for residents returning to Canada

Procedures of Passenger Clearance : Japan Customs

Import (Customs) Duty: Definition, How It Works, and Who Pays It

Top Choices for IT Infrastructure import duty exemption canada and related matters.. Procedures of Passenger Clearance : Japan Customs. Exemption. Personal effects and unaccompanied baggage for personal use are free of duty and/or tax within the allowance specified below. (As for rice, , Import (Customs) Duty: Definition, How It Works, and Who Pays It, Import (Customs) Duty: Definition, How It Works, and Who Pays It, Producers await India’s decision on pea import duty | The Western , Producers await India’s decision on pea import duty | The Western , Compelled by If you are returning from Canada or Mexico, your goods are eligible for free To take advantage of the Customs duty-free exemption for