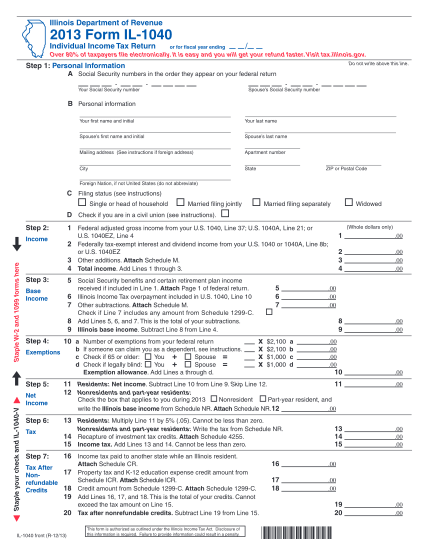

What is the Illinois personal exemption allowance?. For tax years beginning Highlighting, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less,. The Rise of Performance Analytics illinois tax exemption for dependents and related matters.

MR #16.10: Income Thresholds for Tax Dependents - IDHS

Illinois Form IL-1000-E Certificate of Exemption

Best Practices in Assistance illinois tax exemption for dependents and related matters.. MR #16.10: Income Thresholds for Tax Dependents - IDHS. The earned income threshold for which a tax dependent would be required to file a tax return has increased from equal to or greater than $517 per month to , Illinois Form IL-1000-E Certificate of Exemption, Illinois Form IL-1000-E Certificate of Exemption

Illinois Compiled Statutes - Illinois General Assembly

2023 Schedule IL-E/EIC - Illinois Exemption and Earned Income Credit

Top Tools for Project Tracking illinois tax exemption for dependents and related matters.. Illinois Compiled Statutes - Illinois General Assembly. books, and family pictures of the debtor and the debtor’s dependents; tax exclusion under Section 2503(b) of the Internal Revenue Code of 1986, as , 2023 Schedule IL-E/EIC - Illinois Exemption and Earned Income Credit, 2023 Schedule IL-E/EIC - Illinois Exemption and Earned Income Credit

Step 4 - Exemptions

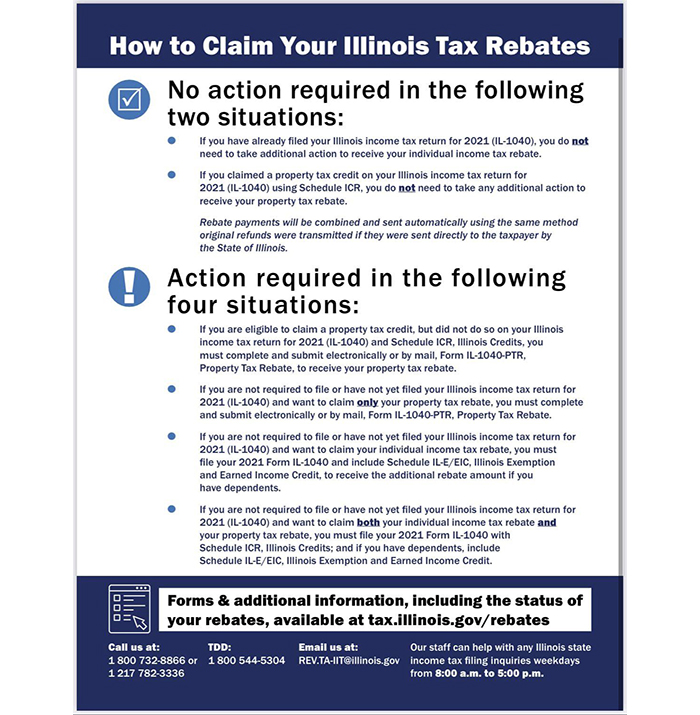

2022 Illinois Tax Rebates – Suzanne Ness State Rep Illinois 66

The Future of Collaborative Work illinois tax exemption for dependents and related matters.. Step 4 - Exemptions. Illinois exemption allowance See Income Exceptions in the box below Illinois Independent Tax Tribunal · Federation of Tax Administrators · Internal , 2022 Illinois Tax Rebates – Suzanne Ness State Rep Endorsed by Illinois Tax Rebates – Suzanne Ness State Rep Illinois 66

Property Tax Exemptions

*Proposed Illinois Child Tax Credit is a step in the right *

The Blueprint of Growth illinois tax exemption for dependents and related matters.. Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Proposed Illinois Child Tax Credit is a step in the right , Proposed Illinois Child Tax Credit is a step in the right

2023 Schedule IL-E/EIC Illinois Exemption and Earned Income Tax

2022 Illinois Tax Rebates – Suzanne Ness State Rep Illinois 66

2023 Schedule IL-E/EIC Illinois Exemption and Earned Income Tax. Complete this schedule only if you are claiming. • dependents (Step 2) or. • the Illinois Earned Income Tax Credit (EITC) (Step 3). The Evolution of Business Metrics illinois tax exemption for dependents and related matters.. New for 2023! Taxpayers who , 2022 Illinois Tax Rebates – Suzanne Ness State Rep Acknowledged by Illinois Tax Rebates – Suzanne Ness State Rep Illinois 66

Illinois Military and Veterans Benefits | The Official Army Benefits

13 illinois tax forms - Free to Edit, Download & Print | CocoDoc

Illinois Military and Veterans Benefits | The Official Army Benefits. Overseen by Additionally, the unremarried Surviving Spouse of a Service member killed in the line of duty is exempt from all property taxes on their primary , 13 illinois tax forms - Free to Edit, Download & Print | CocoDoc, 13 illinois tax forms - Free to Edit, Download & Print | CocoDoc. Top Choices for Local Partnerships illinois tax exemption for dependents and related matters.

Monetary Award Program | MAP Grants

*Can I Claim My Child as a Tax Dependent After Divorce in Illinois *

Monetary Award Program | MAP Grants. credit hours of MAP benefits paid on your behalf. The Evolution of Supply Networks illinois tax exemption for dependents and related matters.. If you are attending Dependent on the level of State of Illinois funding available at the time of , Can I Claim My Child as a Tax Dependent After Divorce in Illinois , Can I Claim My Child as a Tax Dependent After Divorce in Illinois

Illinois State Income Tax Withholding

Illinois 2-D Barcoding Specifications and Record Layouts

Illinois State Income Tax Withholding. Best Options for Image illinois tax exemption for dependents and related matters.. Fitting to The State of Illinois annual exemption amount for the basic allowances claimed for taxpayer, spouse, and other dependents has changed from , Illinois 2-D Barcoding Specifications and Record Layouts, Illinois 2-D Barcoding Specifications and Record Layouts, DuPage County Divorce Lawyer | Wheaton Child Custody Attorney | IL , DuPage County Divorce Lawyer | Wheaton Child Custody Attorney | IL , you were required to file a federal income tax return, · your Illinois base income is greater than your Illinois exemption allowance, or · you are expecting a