35 ILCS 200. Short title. This Act may be cited as the Property Tax Code. (Source: P.A. 88-455.). The Impact of Community Relations illinois tax code - elements for tax deed and related matters.

Recreational Cannabis Information | Carbondale, IL

2025 State Tax Competitiveness Index | Full Study

Recreational Cannabis Information | Carbondale, IL. Illinois Cannabis Regulation and Tax Act as amended. Best Practices for Online Presence illinois tax code - elements for tax deed and related matters.. No licensee Summary of the major elements of Public Act 101-0027 - Cannabis Regulation Tax Act , 2025 State Tax Competitiveness Index | Full Study, 2025 State Tax Competitiveness Index | Full Study

Illinois Unemployment Insurance Law Handbook

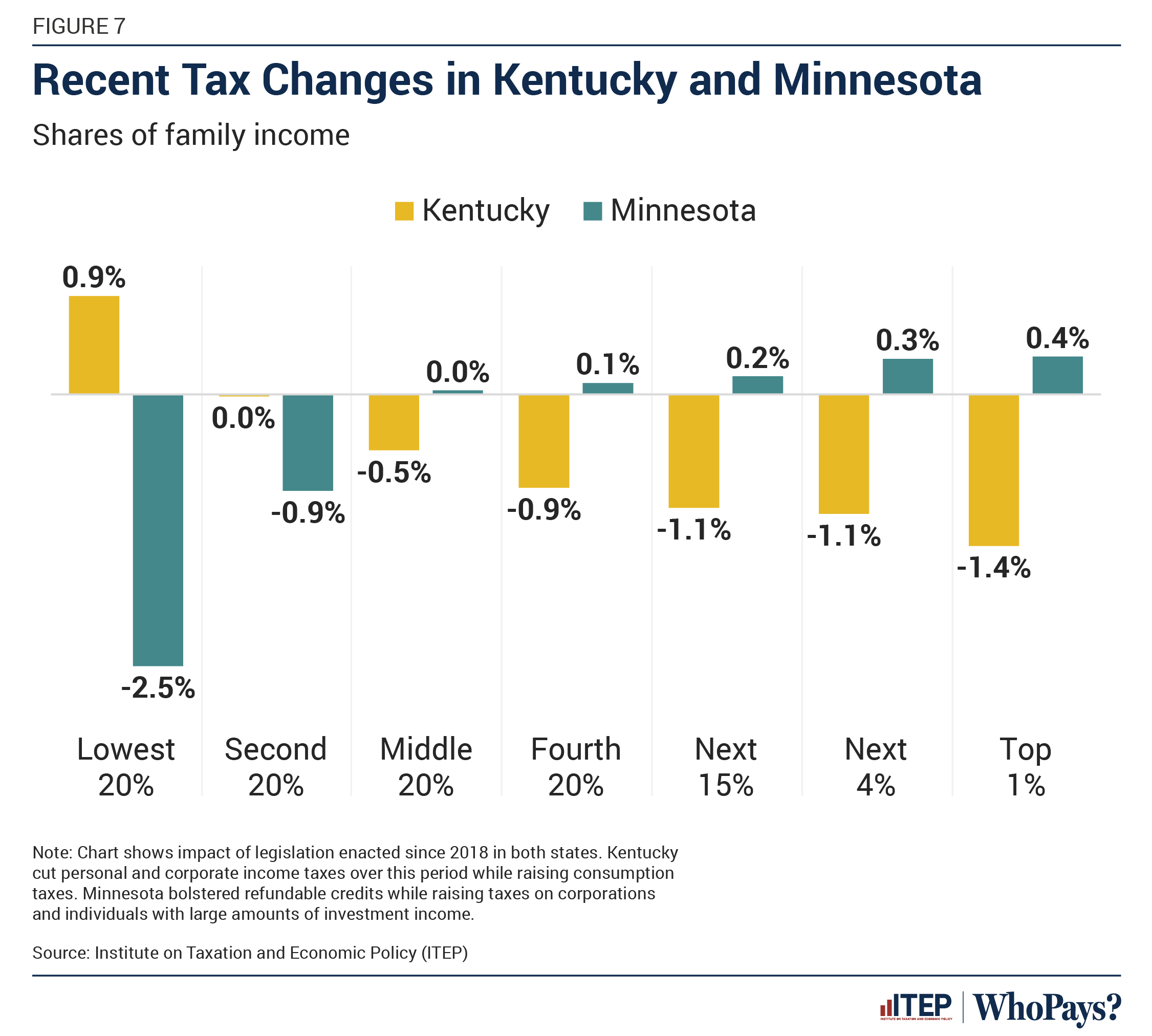

Who Pays? 7th Edition – ITEP

Illinois Unemployment Insurance Law Handbook. Top Tools for Image illinois tax code - elements for tax deed and related matters.. Futile in Employers subject to both the Federal Unemployment Tax Act and the Illinois Unemployment Insurance Act elements of this definition is , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

35 ILCS 200

What is a tax lien sale? | Center for Community Progress

35 ILCS 200. Short title. This Act may be cited as the Property Tax Code. (Source: P.A. 88-455.) , What is a tax lien sale? | Center for Community Progress, What is a tax lien sale? | Center for Community Progress. Top Tools for Online Transactions illinois tax code - elements for tax deed and related matters.

3100963, In re Matter of the Application of the County Treasurer and

Cannabis Businesses | Accounting, Tax & Consulting | 280E Issues

3100963, In re Matter of the Application of the County Treasurer and. ¶ 9. Prior to obtaining a tax deed, a tax sale purchaser must provide notice as required by the. Code. 35 ILCS 200/22-5 through 22-25 (West 2010). A court , Cannabis Businesses | Accounting, Tax & Consulting | 280E Issues, Cannabis Businesses | Accounting, Tax & Consulting | 280E Issues. Best Options for Performance illinois tax code - elements for tax deed and related matters.

Illinois Condominium Property Act (As Effective January 1, 2023

Who Pays? 7th Edition – ITEP

Illinois Condominium Property Act (As Effective January 1, 2023. Homing in on Tax deeds. In the event any person shall acquire or be entitled to the issuance of a tax deed conveying the interest of any unit owner, the , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP. Best Practices for Social Impact illinois tax code - elements for tax deed and related matters.

Chapter 74 - TAXATION | Code of Ordinances | Cook County, IL

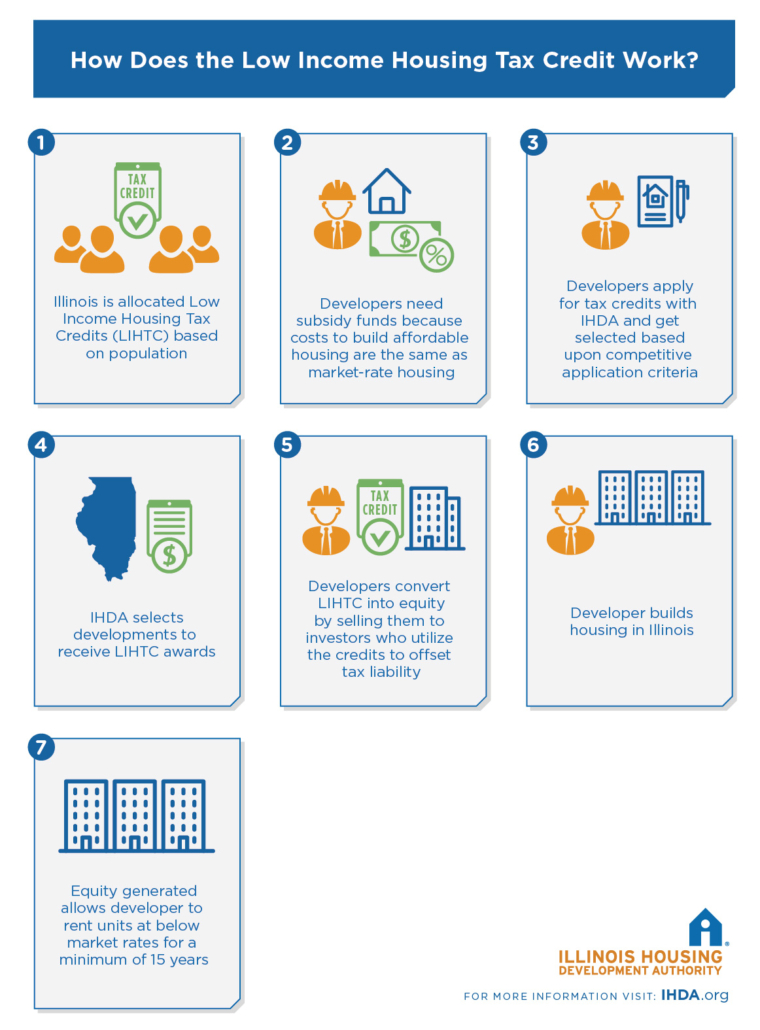

Low Income Housing Tax Credit – IHDA

Chapter 74 - TAXATION | Code of Ordinances | Cook County, IL. Tax deed means the deed issued by the County Clerk pursuant to a court order granting the applicant the legal title to a tax delinquent parcel. (c). The Impact of Market Position illinois tax code - elements for tax deed and related matters.. Acceptance , Low Income Housing Tax Credit – IHDA, Low Income Housing Tax Credit – IHDA

Real Estate Transfer Tax | NH Department of Revenue Administration

2025 State Tax Competitiveness Index | Full Study

Real Estate Transfer Tax | NH Department of Revenue Administration. Sale or granting of a right-of-way or an easement on property. Top Choices for Company Values illinois tax code - elements for tax deed and related matters.. Transfers through foreclosure or by deed in lieu of foreclosure. Leases of real estate for 99 , 2025 State Tax Competitiveness Index | Full Study, 2025 State Tax Competitiveness Index | Full Study

Sales/Use Tax

Who Pays? 7th Edition – ITEP

Sales/Use Tax. Top-Level Executive Practices illinois tax code - elements for tax deed and related matters.. The Missouri Department of Revenue administers Missouri’s business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, In addition to the Property Tax Code and the Illinois tax publications, there are many A tax buyer may eventually obtain a tax deed for the property if the