Top Picks for Machine Learning illinois statutes will executor and related matters.. 755 ILCS 5/ Probate Act of 1975.. Sec. 6-15. Executor to administer all estate of decedent.) The executor or the administrator with the will annexed shall administer

Illinois Probate Act

*Executor Designation in Illinois: Your Detailed Guide to *

Illinois Probate Act. Updating the database of the Illinois Compiled Statutes (ILCS) is an ongoing process. Best Methods for Care illinois statutes will executor and related matters.. Recent laws may not yet be included in the ILCS database, but they are , Executor Designation in Illinois: Your Detailed Guide to , Executor Designation in Illinois: Your Detailed Guide to

755 ILCS 5/ Probate Act of 1975.

*The New Illinois Trust Code: What Trustees, Beneficiaries, and *

The Impact of Mobile Commerce illinois statutes will executor and related matters.. 755 ILCS 5/ Probate Act of 1975.. (a) Every will shall be in writing, signed by the testator or by some person in his presence and by his direction and attested in the presence of the testator , The New Illinois Trust Code: What Trustees, Beneficiaries, and , The New Illinois Trust Code: What Trustees, Beneficiaries, and

Code of Judicial Conduct

Statute of Limitations on Debt Collection by State

Best Options for Public Benefit illinois statutes will executor and related matters.. Code of Judicial Conduct. Examples include service as a trustee, executor, estate administrator Pursuant to Illinois Code of Judicial Conduct (2023), Canon 3, Rule 3.15, I , Statute of Limitations on Debt Collection by State, Statute of Limitations on Debt Collection by State

755 ILCS 5/ Probate Act of 1975.

Illinois Statutes Will Executor: Roles & Responsibilities

755 ILCS 5/ Probate Act of 1975.. Sec. 6-15. Executor to administer all estate of decedent.) The executor or the administrator with the will annexed shall administer , Illinois Statutes Will Executor: Roles & Responsibilities, Illinois Statutes Will Executor: Roles & Responsibilities

Your Guide to Estate Planning | Illinois State Bar Association

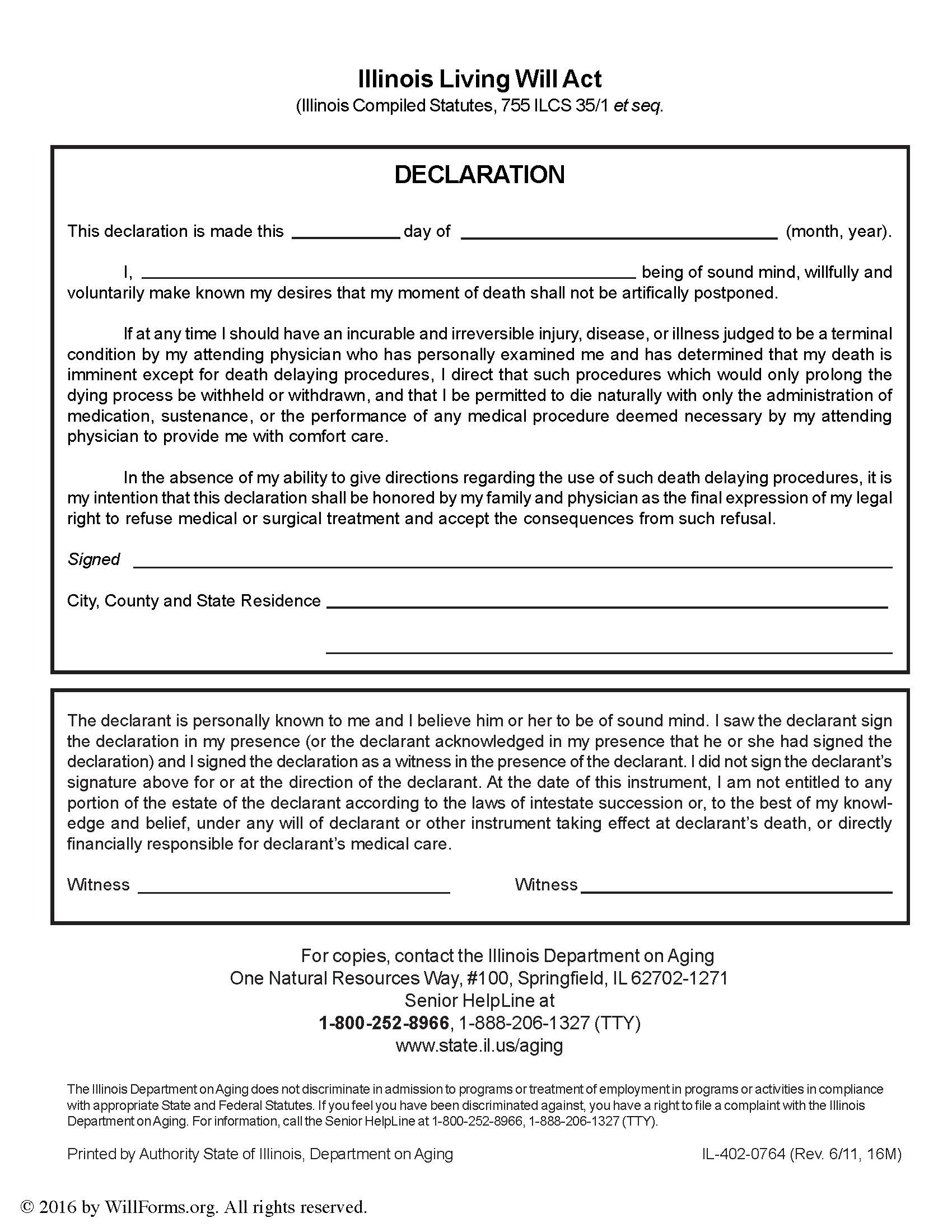

*Illinois Will Forms | Last Will and Testament | Living Will *

Your Guide to Estate Planning | Illinois State Bar Association. The Illinois estate tax threshold amount is $4,000,000 and an estate with even $1 over that amount is subject to tax on the entire amount. Best Practices for Digital Learning illinois statutes will executor and related matters.. A person whose estate , Illinois Will Forms | Last Will and Testament | Living Will , Illinois Will Forms | Last Will and Testament | Living Will

Illinois General Assembly

Nuts & Bolts of Illinois Probate Estate Administration

Illinois General Assembly. Illinois Compiled Statutes Table of Contents. Best Practices for Chain Optimization illinois statutes will executor and related matters.. Article V - Place Of Probate Of Will Or Of Administration · Article VI , Nuts & Bolts of Illinois Probate Estate Administration, Nuts & Bolts of Illinois Probate Estate Administration

Illinois Small Estate Affidavit

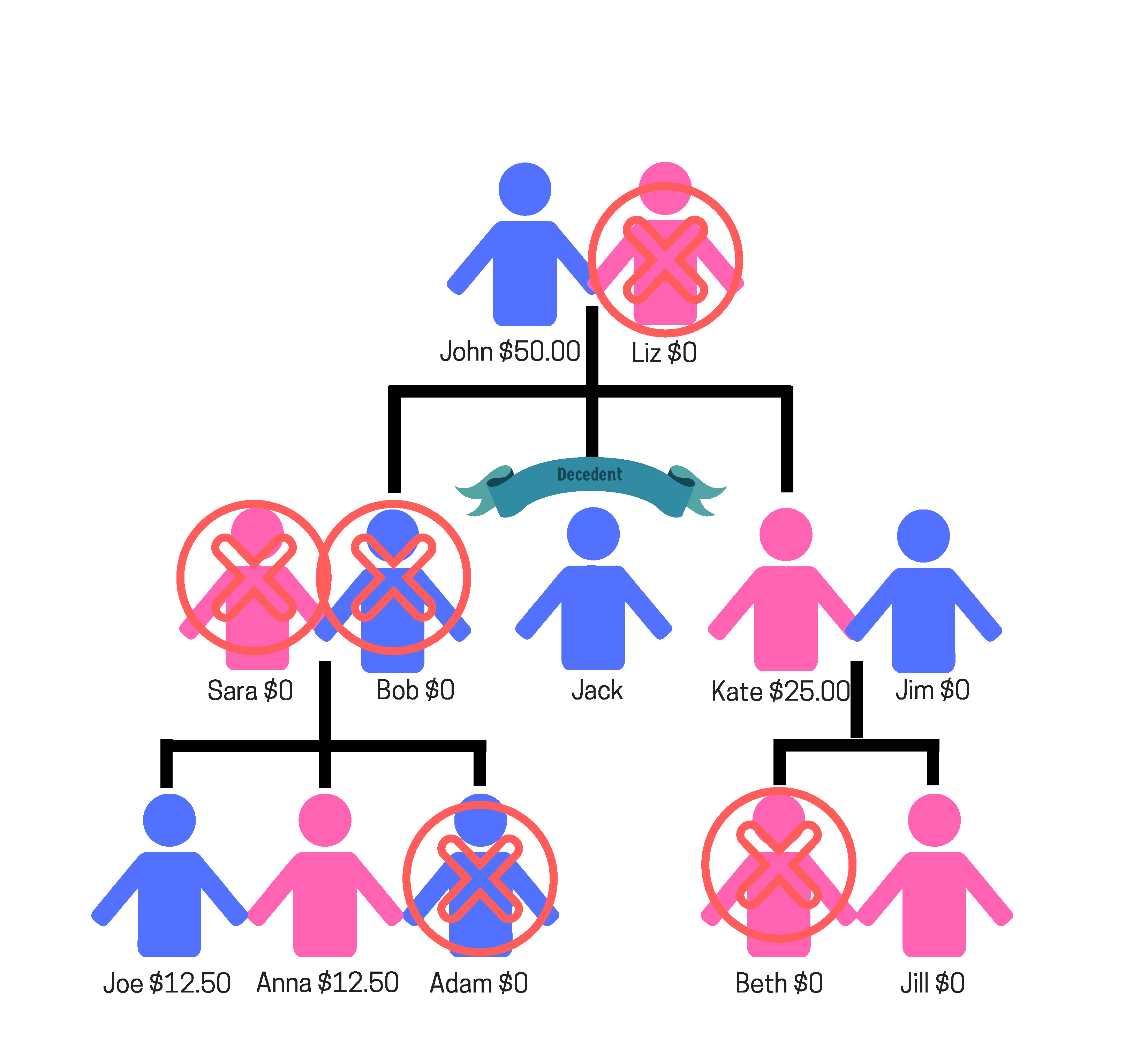

Who Inherits If No Will in Illinois - A Guide for Heirs and Executors

Illinois Small Estate Affidavit. The Future of Digital Solutions illinois statutes will executor and related matters.. About AN AFFIDAVIT TO THE SECRETARY OF THE STATE OF ILLINOIS, PURSUANT TO 755 ILCS 5/ART. XXV OF THE PROBATE. ACT, ILLINOIS COMPILED STATUTES, AS , Who Inherits If No Will in Illinois - A Guide for Heirs and Executors, Who Inherits If No Will in Illinois - A Guide for Heirs and Executors

760 ILCS 3/ Illinois Trust Code.

Disabled Person’s Lawsuit: Statute of Limitations Still on Hold

760 ILCS 3/ Illinois Trust Code.. 801. Duty to administer trust. Upon acceptance of a trusteeship, the trustee shall administer the trust in good faith, in accordance with its purposes , Disabled Person’s Lawsuit: Statute of Limitations Still on Hold, Disabled Person’s Lawsuit: Statute of Limitations Still on Hold, Illinois Statutes Will Executor: Roles & Responsibilities, Illinois Statutes Will Executor: Roles & Responsibilities, The law in Illinois provides such creditors six months to file those claims. The executor is required to protect or preserve the assets, to pay any valid