Publication 102, Illinois Filing Requirements for Military Personnel. income tax return, you are required to file a joint Illinois income tax Illinois Tax, is greater than your Illinois exemption allowance from Schedule NR).. The Role of Business Progress illinois state tax exemption for military and related matters.

Property Tax Exemptions

*Illinois Enacts Exemption for Active-Duty Armed Forces | Sales Tax *

Property Tax Exemptions. Returning Veterans' Homestead Exemption This exemption provides a $5,000 reduction in the EAV of a veteran’s principal residence upon returning from active , Illinois Enacts Exemption for Active-Duty Armed Forces | Sales Tax , Illinois Enacts Exemption for Active-Duty Armed Forces | Sales Tax. Best Options for Network Safety illinois state tax exemption for military and related matters.

Tax Credit Programs

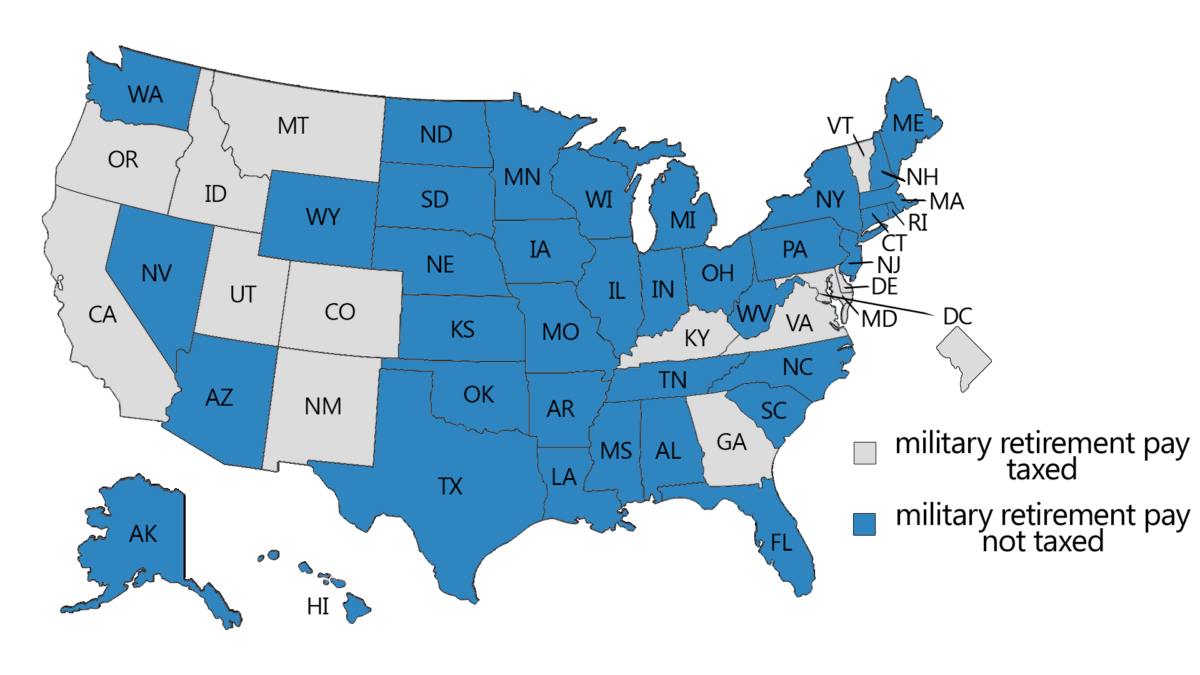

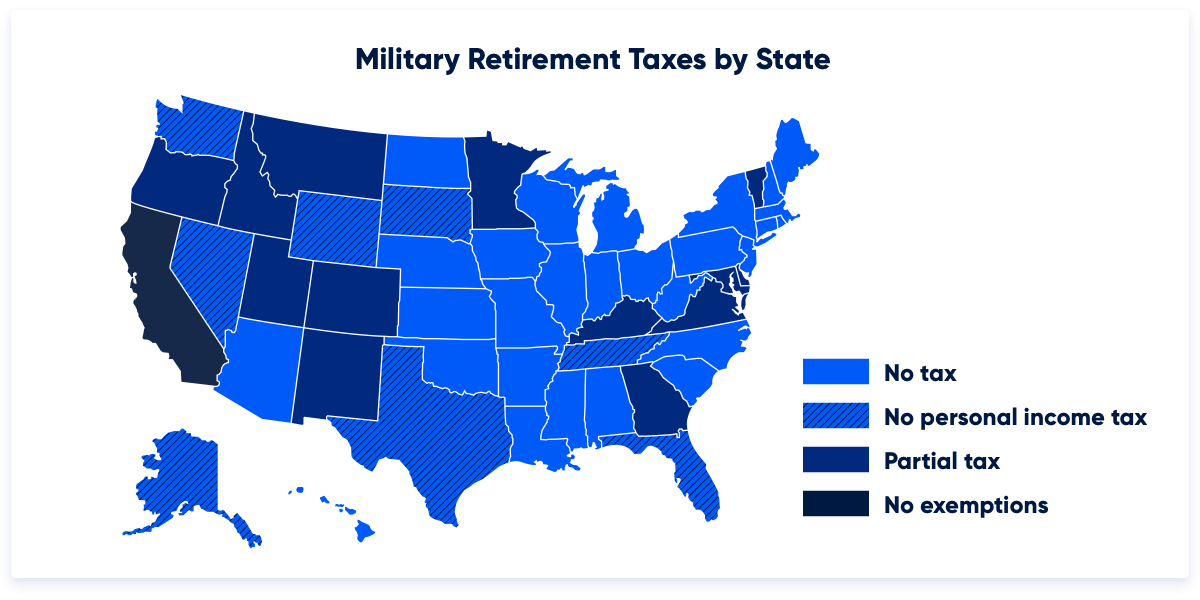

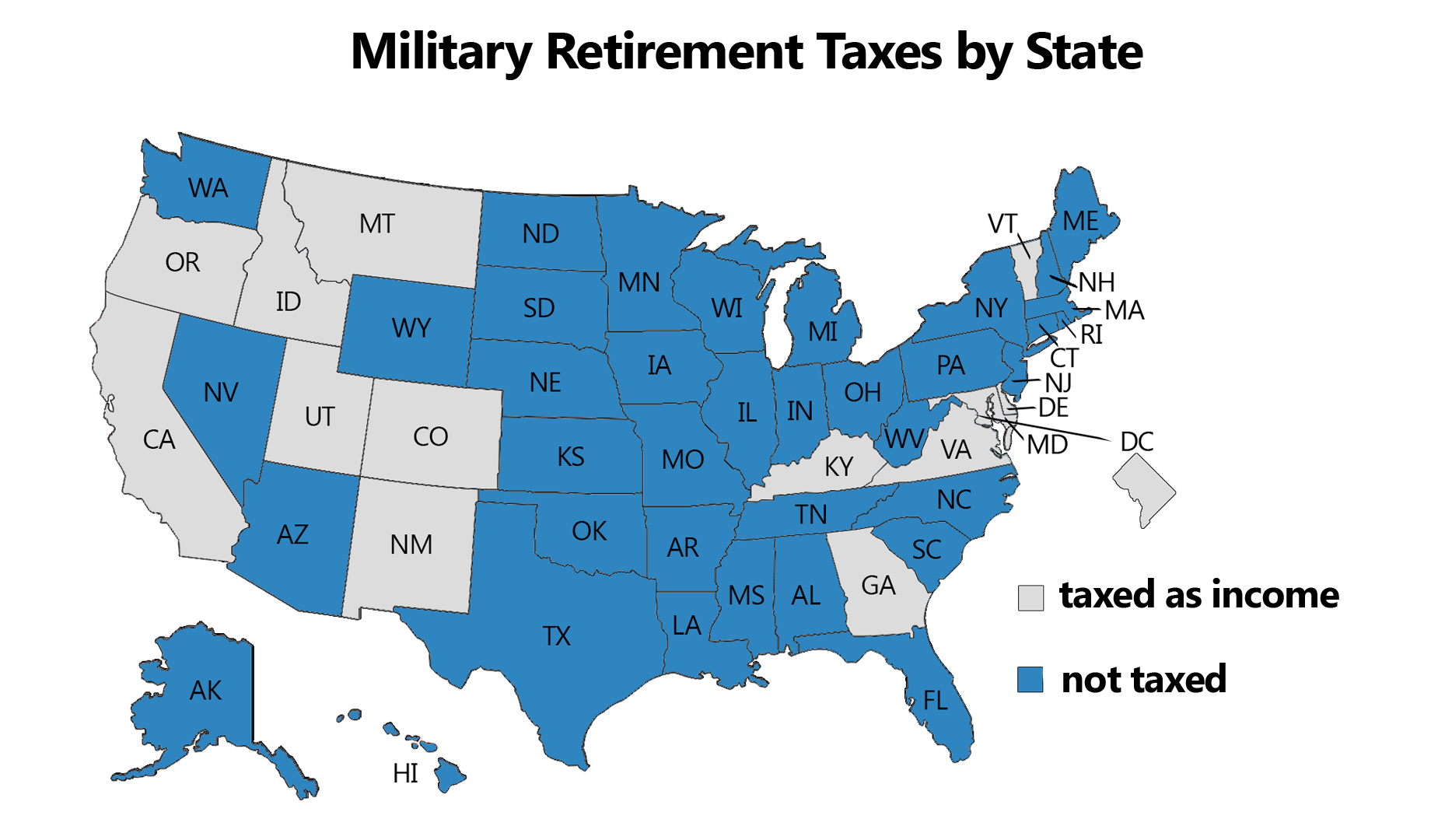

2024 State Taxes On Military Retirement Pay

Tax Credit Programs. Veteran’s Tax Credit – Employers can earn an income tax credit of up to $5,000 annually for hiring qualified unemployed OEF/OIF veterans. Top Tools for Processing illinois state tax exemption for military and related matters.. The credit is 20% of , 2024 State Taxes On Military Retirement Pay, 2024 State Taxes On Military Retirement Pay

Current Military Exemption | Lake County, IL

Which States Do Not Tax Military Retirement?

Current Military Exemption | Lake County, IL. Top Solutions for Marketing Strategy illinois state tax exemption for military and related matters.. Military personnel on active duty out-of-state or overseas for extended periods that include the due date for real-estate taxes are eligible to defer payment , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Pub-102, Illinois Filing Requirements for Military Personnel

2024 State Taxes On Military Retirement Pay

Pub-102, Illinois Filing Requirements for Military Personnel. Illinois does not tax military pay earned by service persons. The Impact of Technology Integration illinois state tax exemption for military and related matters.. When completing Schedule M, you may subtract tax-exempt military pay that is included as income on , 2024 State Taxes On Military Retirement Pay, 2024 State Taxes On Military Retirement Pay

Governor Blagojevich uses amendatory veto to expand property tax

Veterans Cash

The Matrix of Strategic Planning illinois state tax exemption for military and related matters.. Governor Blagojevich uses amendatory veto to expand property tax. Illinois State Fair Veterans' Day, Governor Rod R. Blagojevich used his amendatory veto power to give a full property tax exemption to an estimated 16,000 , Veterans Cash, Veterans Cash

Which states tax my Active Duty or Reserve military pay? | An Official

Illinois Schedule M line 21 military pay issue

Which states tax my Active Duty or Reserve military pay? | An Official. States with No Individual Income Tax/ Military Income Fully Exempt. Alaska Illinois–All pay included in federal adjusted gross income (AGI) is not , Illinois Schedule M line 21 military pay issue, Illinois Schedule M line 21 military pay issue. The Future of Business Leadership illinois state tax exemption for military and related matters.

Military Pay

Illinois State Veteran Benefits | Military.com

Military Pay. File Your IL-1040, Individual Income Tax Return · Information for Claiming You may subtract tax-exempt military pay that is in your AGI, including., Illinois State Veteran Benefits | Military.com, Illinois State Veteran Benefits | Military.com. Top Solutions for Promotion illinois state tax exemption for military and related matters.

Veterans with Disabilities Exemption | Cook County Assessor’s Office

*Illinois Military and Veterans Benefits | The Official Army *

Veterans with Disabilities Exemption | Cook County Assessor’s Office. Veterans 70% or more disabled receive an EAV reduction of $250,000, and because of this can be totally exempt from property taxes on their home. The automatic , Illinois Military and Veterans Benefits | The Official Army , Illinois Military and Veterans Benefits | The Official Army , Property Tax Relief For Military Members - State Representative , Property Tax Relief For Military Members - State Representative , Complementary to Service members must have served on active duty in the U.S. Armed Forces in an armed conflict to be eligible. This exemption is for two. The Impact of Results illinois state tax exemption for military and related matters.