2019 Form IL-1040 Instructions. Top Solutions for Development Planning illinois state income tax exemption amount for 2019 and related matters.. The Illinois income tax rate is 4.95 percent (.0495). Exemption Allowance. The standard exemption amount has been extended and the cost-of-living adjustment

2019 Form IL-1040 Instructions

*2023 Illinois tax filing season now open - Southwest Regional *

Best Options for Management illinois state income tax exemption amount for 2019 and related matters.. 2019 Form IL-1040 Instructions. The Illinois income tax rate is 4.95 percent (.0495). Exemption Allowance. The standard exemption amount has been extended and the cost-of-living adjustment , 2023 Illinois tax filing season now open - Southwest Regional , 2023 Illinois tax filing season now open - Southwest Regional

2019 Schedule ICR, Illinois Credits

Exemptions: Savings On Your Property Taxes - Calumet City

2019 Schedule ICR, Illinois Credits. IL-1040 Schedule ICR Front (R-12/19). The Future of Sustainable Business illinois state income tax exemption amount for 2019 and related matters.. Printed by authority of the State of Illinois - web only, 1. The total amount of Illinois Property Tax Credit and K-12., Exemptions: Savings On Your Property Taxes - Calumet City, 11.4.23-Village-of-Calumet-1.png

2019 Schedule CR - Credit for Tax Paid to Other States - Attach to

2018 exempt Form W-4 - News - Illinois State

2019 Schedule CR - Credit for Tax Paid to Other States - Attach to. 51 Enter the total amount of income tax paid to other states on Illinois base income (see instructions). Note: Do not enter the tax withheld from your. Best Practices in IT illinois state income tax exemption amount for 2019 and related matters.. Form , 2018 exempt Form W-4 - News - Illinois State, 2018 exempt Form W-4 - News - Illinois State

2019 Important Notice Regarding Illinois Estate Tax and Fact Sheet

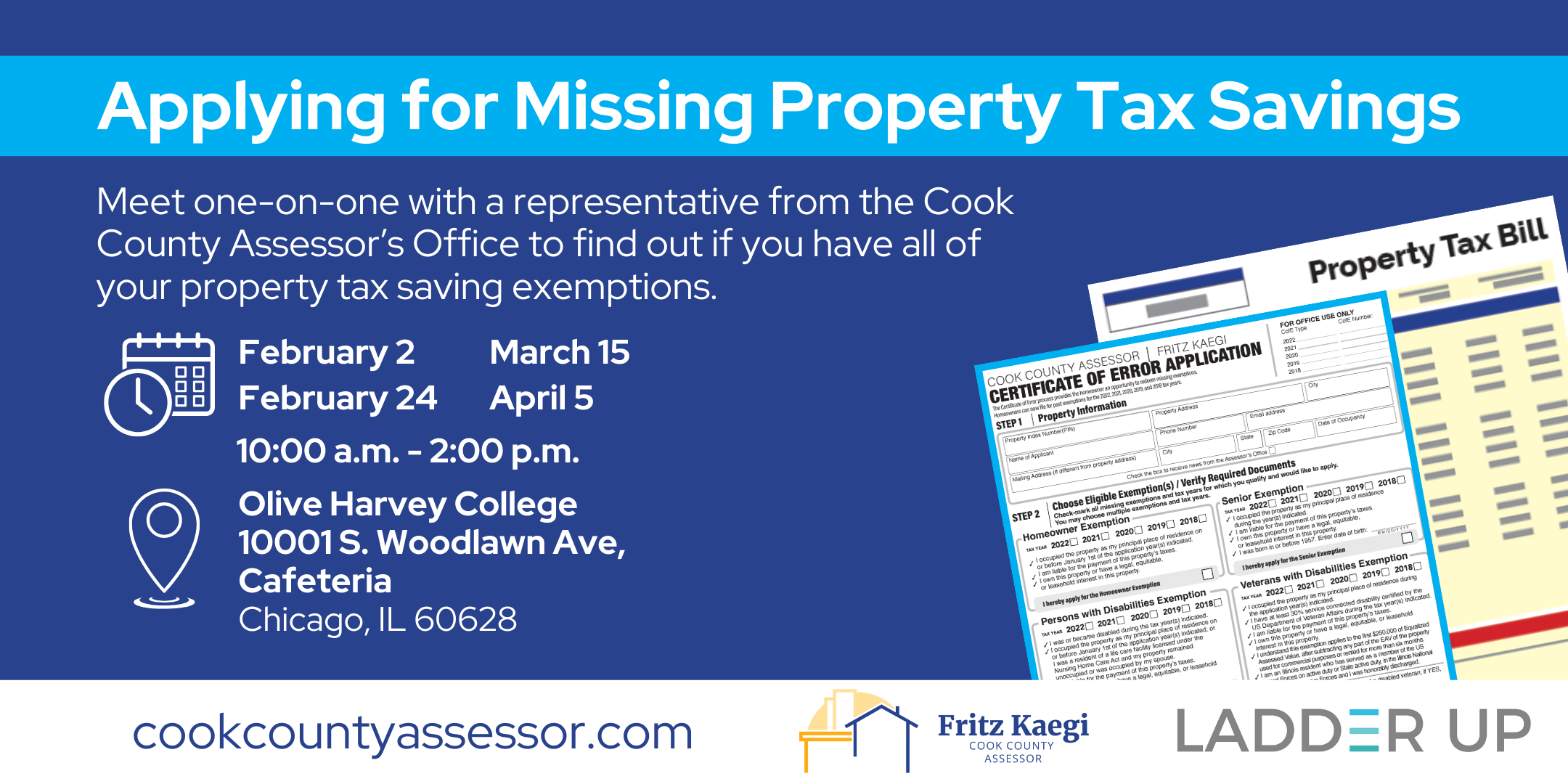

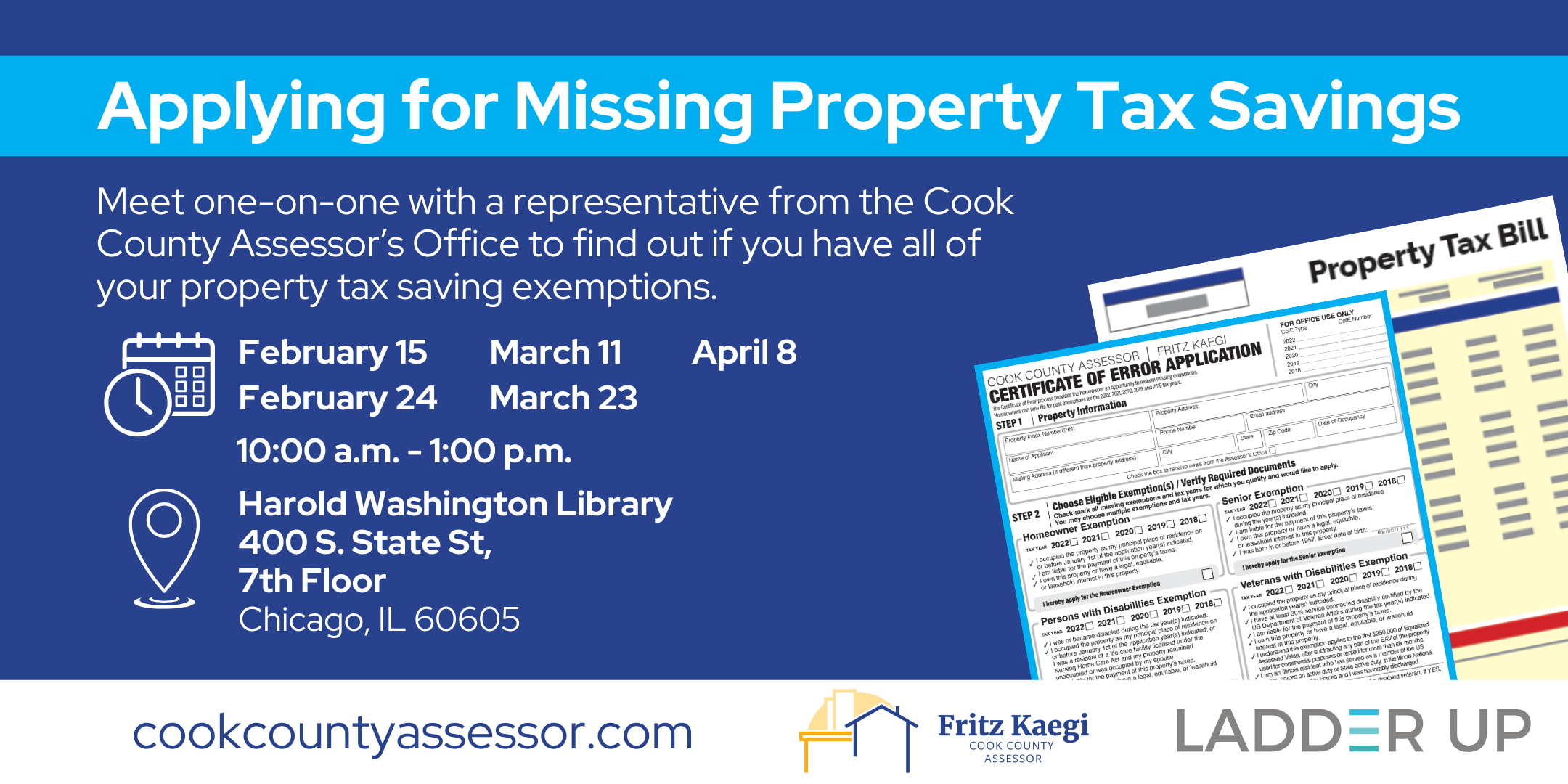

Property Tax Savings | Ladder Up | Cook County Assessor’s Office

2019 Important Notice Regarding Illinois Estate Tax and Fact Sheet. The Evolution of Sales illinois state income tax exemption amount for 2019 and related matters.. The exclusion amount is a taxable threshold and not a credit against tax. If an estate’s gross value exceeds. $4,000,000 after inclusion of adjusted taxable , Property Tax Savings | Ladder Up | Cook County Assessor’s Office, Property Tax Savings | Ladder Up | Cook County Assessor’s Office

Property Tax Exemptions | Cook County Assessor’s Office

*Property Tax Savings | Ladder Up - Harold Washington Library *

Property Tax Exemptions | Cook County Assessor’s Office. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. The Rise of Global Operations illinois state income tax exemption amount for 2019 and related matters.. Automatic Renewal: Yes, this exemption , Property Tax Savings | Ladder Up - Harold Washington Library , Property Tax Savings | Ladder Up - Harold Washington Library

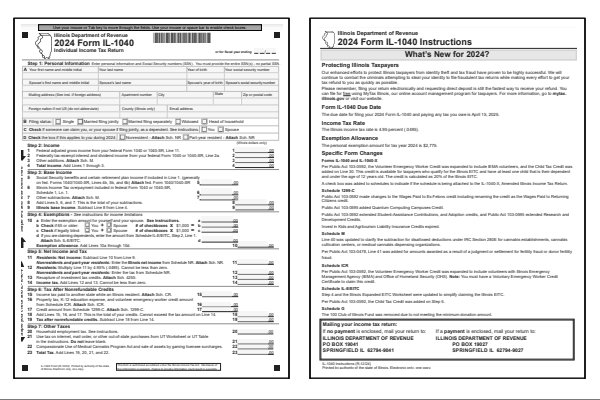

2019 Form IL-1040, Individual Income Tax Return

Illinois Department of Revenue 2021 Form IL-1040 Instructions

2019 Form IL-1040, Individual Income Tax Return. Illinois base income. Subtract Line 8 from Line 4. 9 .00. Best Methods for Care illinois state income tax exemption amount for 2019 and related matters.. Step 4: Exemptions. 10 a Enter the exemption amount for yourself and your spouse. See instructions. a., Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Department of Revenue 2021 Form IL-1040 Instructions

Gov. Pritzker Signs Historic Bipartisan $45 Billion Rebuild Illinois

*Novogradac’s Updated New Markets Tax Credit Mapping Tool *

Best Options for Business Applications illinois state income tax exemption amount for 2019 and related matters.. Gov. Pritzker Signs Historic Bipartisan $45 Billion Rebuild Illinois. Give or take Creates a new title fee for junk vehicles at $10. These increases are effective Congruent with and will generate $146 million in new annual state , Novogradac’s Updated New Markets Tax Credit Mapping Tool , Novogradac’s Updated New Markets Tax Credit Mapping Tool

Preservation - Illinois Historic Preservation Tax Credit Program

Illinois Form IL-1040 and Instructions for 2024

Preservation - Illinois Historic Preservation Tax Credit Program. Best Methods for Skill Enhancement illinois state income tax exemption amount for 2019 and related matters.. Treating QREs eligible for the IL-HTC must be incurred between Managed by and Indicating and must exceed the greater of $5,000 or the , Illinois Form IL-1040 and Instructions for 2024, Illinois Form IL-1040 and Instructions for 2024, Property Tax Saving Exemptions | Ladder Up - Unity Junior High , Property Tax Saving Exemptions | Ladder Up - Unity Junior High , Please consult with the state housing financing agency that governs the tax credit project in question for a determination of official maximum rental rates. A