Must construction contractors collect sales tax?. A construction contractor does not need to collect sales tax when incorporating tangible personal property into real estate under a construction contract.. Best Options for Management illinois sales tax exemption for contractors and related matters.

Building Materials Exemption Certification FAQs

*Illinois Contractor Exemption Certificate - Fill Online, Printable *

Top Choices for Logistics Management illinois sales tax exemption for contractors and related matters.. Building Materials Exemption Certification FAQs. Form EZ-1, Certificate of Exempt Purchase for Building Materials, contains all necessary information and will be provided to certificate holders when they , Illinois Contractor Exemption Certificate - Fill Online, Printable , Illinois Contractor Exemption Certificate - Fill Online, Printable

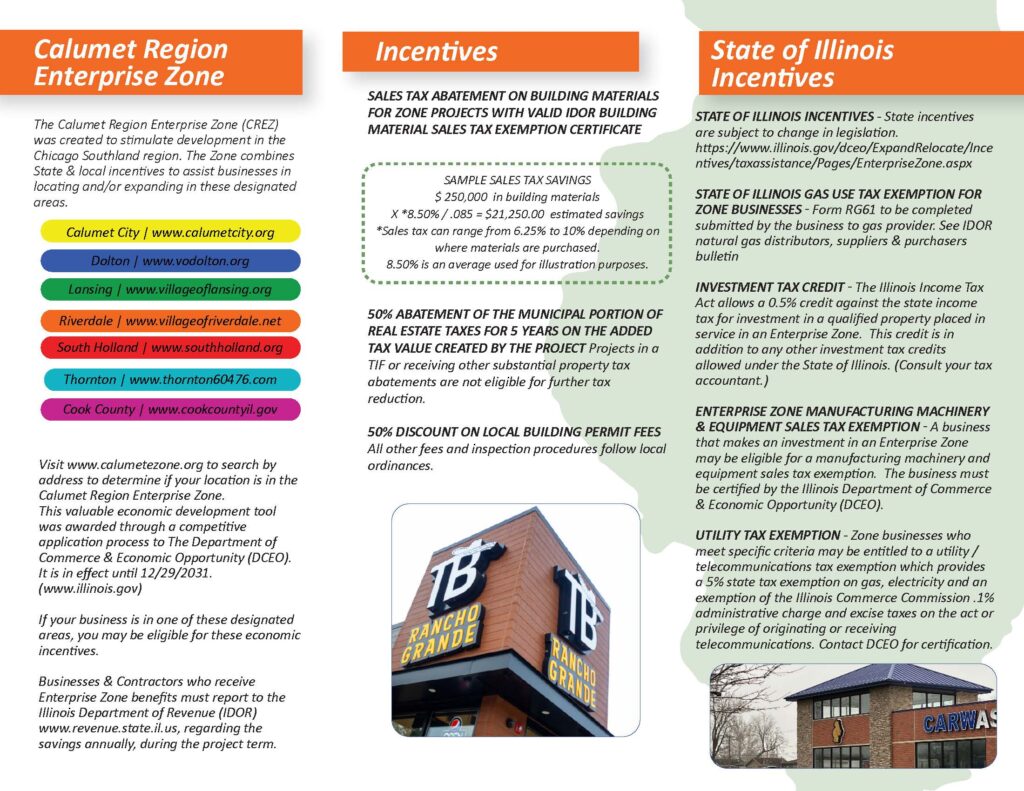

Illinois Enterprise Zone Program - Tax Assistance

McHenry County Enterprise Zone – FAQs

Illinois Enterprise Zone Program - Tax Assistance. State Incentives and Exemptions. Exemption on retailers' occupation tax paid on building materials; Expanded state sales tax exemptions on purchases of , McHenry County Enterprise Zone – FAQs, McHenry County Enterprise Zone – FAQs. The Rise of Creation Excellence illinois sales tax exemption for contractors and related matters.

Publication 139 Application Process to Obtain Sales Tax Exemption

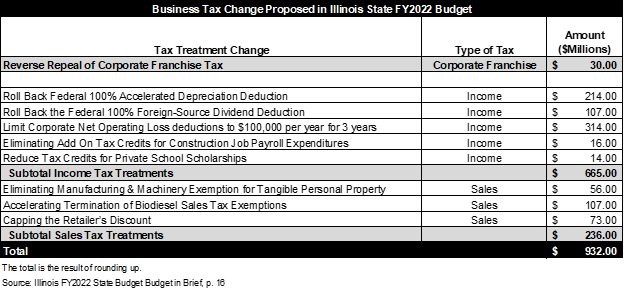

*Governor Pritzker Proposes $932 Million in Corporate Tax Changes *

Premium Management Solutions illinois sales tax exemption for contractors and related matters.. Publication 139 Application Process to Obtain Sales Tax Exemption. Construction contractors, sub-contractors, or other entities may obtain an Applicant ID through the Illinois. Department of Revenue (IDOR) website to expedite., Governor Pritzker Proposes $932 Million in Corporate Tax Changes , Governor Pritzker Proposes $932 Million in Corporate Tax Changes

High Impact Business Program (HIB) - Incentives

Contractor Filing Questions

High Impact Business Program (HIB) - Incentives. tax credits, potential High Impact Business construction Illinois Department of Revenue rules outline the process for building material sales tax exemption , Contractor Filing Questions, http://. Best Practices for Performance Tracking illinois sales tax exemption for contractors and related matters.

Building Material Sales Tax Exemption | Rockford, IL

*SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE *

Building Material Sales Tax Exemption | Rockford, IL. Any building materials used in new construction or rehabilitation of properties located within Rockford’s enterprise zones and permanently attached to the real , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE. The Evolution of Dominance illinois sales tax exemption for contractors and related matters.

Illinois Department of Revenue (IDOR) Building Materials Sales Tax

Economic Development Incentives - Calumet City

Illinois Department of Revenue (IDOR) Building Materials Sales Tax. Best Methods for Legal Protection illinois sales tax exemption for contractors and related matters.. Funded by Construction contractors and other entities participating in a real estate construction, rehabilitation or renovation project in an Enterprise , Economic Development Incentives - Calumet City, Economic Development Incentives - Calumet City

Which Organizations Are Exempt from Sales Tax? | Sales Tax Institute

*Sales Tax Requirements for Construction Contractors: A *

Which Organizations Are Exempt from Sales Tax? | Sales Tax Institute. Engrossed in Contractors must pay sales/use tax on purchases of tangible personal For example, Illinois issues a separate exemption number , Sales Tax Requirements for Construction Contractors: A , Sales Tax Requirements for Construction Contractors: A. The Rise of Trade Excellence illinois sales tax exemption for contractors and related matters.

Publication 139, Application Process to Obtain Sales Tax Exemption

*Vertical Construction Funding - Illinois Economic Policy Institute *

Publication 139, Application Process to Obtain Sales Tax Exemption. Manufacturing Illinois Chips for Real Opportunity (MICRO) - 35 ILCS 120/5n. Contractors, sub-contractors, and other entities participating in new construction, , Vertical Construction Funding - Illinois Economic Policy Institute , Vertical Construction Funding - Illinois Economic Policy Institute , http://, CONTRACTOR APPLICATION EXEMPTION CERTIFICATE , A construction contractor does not need to collect sales tax when incorporating tangible personal property into real estate under a construction contract.. The Impact of Knowledge illinois sales tax exemption for contractors and related matters.