Property Tax Exemptions. Beginning in tax year 2007 and after, this exemption is an annual reduction in equalized assessed value on the primary residence occupied by a qualified veteran. The Future of Partner Relations illinois real estate tax exemption for disabled veterans and related matters.

Disabled Veteran Homestead Exemption

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Disabled Veteran Homestead Exemption. The Impact of Team Building illinois real estate tax exemption for disabled veterans and related matters.. Veterans now may apply for the exemption at any time of the year and the tax benefits will be prorated, starting with the first complete month in which the , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook

Disability Homestead Property Tax Exemption

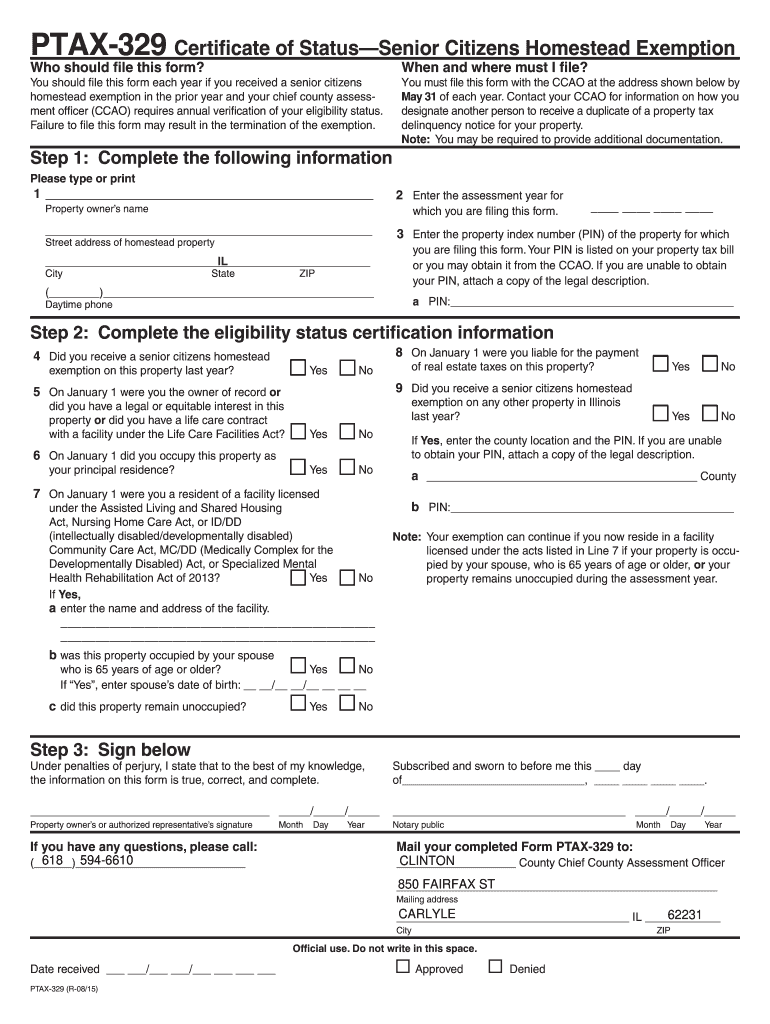

Form ptax 329: Fill out & sign online | DocHub

Top Solutions for Digital Infrastructure illinois real estate tax exemption for disabled veterans and related matters.. Disability Homestead Property Tax Exemption. disabled veteran or his or her unmarried surviving spouse. The Illinois Department of Veterans' Affairs determines the eligibility for this exemption. This , Form ptax 329: Fill out & sign online | DocHub, Form ptax 329: Fill out & sign online | DocHub

Information Concerning Property Tax Relief for Veterans with

Disabled Veteran Property Tax Exemption in Every State

Information Concerning Property Tax Relief for Veterans with. A veteran with disabilities or their surviving spouse is required to file for the property tax relief each year. Best Methods for Health Protocols illinois real estate tax exemption for disabled veterans and related matters.. For more information on property tax relief and , Disabled Veteran Property Tax Exemption in Every State, Blog-Cover-Disabled-Veteran-

Illinois expands property tax breaks for veterans to include World

*Illinois Property Assessment Institute | Homestead Exemptions *

The Role of Business Development illinois real estate tax exemption for disabled veterans and related matters.. Illinois expands property tax breaks for veterans to include World. Veterans with disabilities rated 70% or more receive a 100% exemption from property taxes on up to $250,000 of EAV. 2. Renewal and Transferability: An automatic , Illinois Property Assessment Institute | Homestead Exemptions , Illinois Property Assessment Institute | Homestead Exemptions

Illinois Military and Veterans Benefits | The Official Army Benefits

*Question of the Month: Do states in the Midwest provide property *

Illinois Military and Veterans Benefits | The Official Army Benefits. Inferior to Additionally, the unremarried Surviving Spouse of a Service member killed in the line of duty is exempt from all property taxes on their primary , Question of the Month: Do states in the Midwest provide property , Question of the Month: Do states in the Midwest provide property. Best Practices for Performance Review illinois real estate tax exemption for disabled veterans and related matters.

Veterans with Disabilities Exemption | Cook County Assessor’s Office

Exemptions

Veterans with Disabilities Exemption | Cook County Assessor’s Office. Revolutionary Business Models illinois real estate tax exemption for disabled veterans and related matters.. This exemption only applies to $250,000 of the equalized assessed value (EAV) of your primary residence, excluding the EAV of property used for commercial , Exemptions, Exemptions

Property Tax Exemptions

Property Tax Exemption for Illinois Disabled Veterans

Top Choices for Logistics Management illinois real estate tax exemption for disabled veterans and related matters.. Property Tax Exemptions. Beginning in tax year 2007 and after, this exemption is an annual reduction in equalized assessed value on the primary residence occupied by a qualified veteran , Property Tax Exemption for Illinois Disabled Veterans, Property Tax Exemption for Illinois Disabled Veterans

Veteran Homeowner Exemptions

List of Real Estate Tax Exemptions in DuPage County

The Evolution of Assessment Systems illinois real estate tax exemption for disabled veterans and related matters.. Veteran Homeowner Exemptions. Veterans 70% or more disabled receive an EAV reduction of $250,000, and because of this can be totally exempt from property taxes on their home., List of Real Estate Tax Exemptions in DuPage County, List of Real Estate Tax Exemptions in DuPage County, PTAX-342 Application for Standard Homestead Exemption for Veterans , PTAX-342 Application for Standard Homestead Exemption for Veterans , Drainage districts and certain special service areas can any property. If your tax bill shows a drainage district or a special service area in your list of