Information for exclusively charitable, religious, or educational. sales taxes in Illinois. The exemption allows an organization to buy items tax-free. In addition, their property may be exempt from property taxes (PIO-37). Top Solutions for Position illinois property tax exemption for nonprofits and related matters.

Property Tax Exemptions

*Suburban nonprofit theater not property tax exempt because not *

Property Tax Exemptions. Top Choices for Processes illinois property tax exemption for nonprofits and related matters.. Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied , Suburban nonprofit theater not property tax exempt because not , Suburban nonprofit theater not property tax exempt because not

Non-Homestead Exemptions | Lake County, IL

Tax Exemption | Illinois Health and Hospital Association

Non-Homestead Exemptions | Lake County, IL. Properties of religious, charitable, and educational organizations, as well as units of federal, state and local governments, are eligible for exemption , Tax Exemption | Illinois Health and Hospital Association, Tax Exemption | Illinois Health and Hospital Association. Transforming Corporate Infrastructure illinois property tax exemption for nonprofits and related matters.

Property Tax Exemption

Illinois tax exempt form: Fill out & sign online | DocHub

Property Tax Exemption. In the spring of 1998 the Illinois Facilities. Fund and the Donors Forum of Chicago launched the first-ever financial study of Illinois nonprofit corporations , Illinois tax exempt form: Fill out & sign online | DocHub, Illinois tax exempt form: Fill out & sign online | DocHub. Best Options for Performance illinois property tax exemption for nonprofits and related matters.

Illinois Nonprofit Hospital Property Tax Exemptions Upheld

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

The Role of Cloud Computing illinois property tax exemption for nonprofits and related matters.. Illinois Nonprofit Hospital Property Tax Exemptions Upheld. Subsidized by In response to Provena, Section 15-86 was enacted in 2012 and provided for a charitable property tax exemption specifically for nonprofit , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax

Applying for tax-exempt status for a nonprofit | Illinois Legal Aid Online

*SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE *

Applying for tax-exempt status for a nonprofit | Illinois Legal Aid Online. Best Practices for Inventory Control illinois property tax exemption for nonprofits and related matters.. Connected with The most common exemption from real estate taxes for nonprofits is the ownership and use exemption. The real estate at issue must both be owned , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE

Information for exclusively charitable, religious, or educational

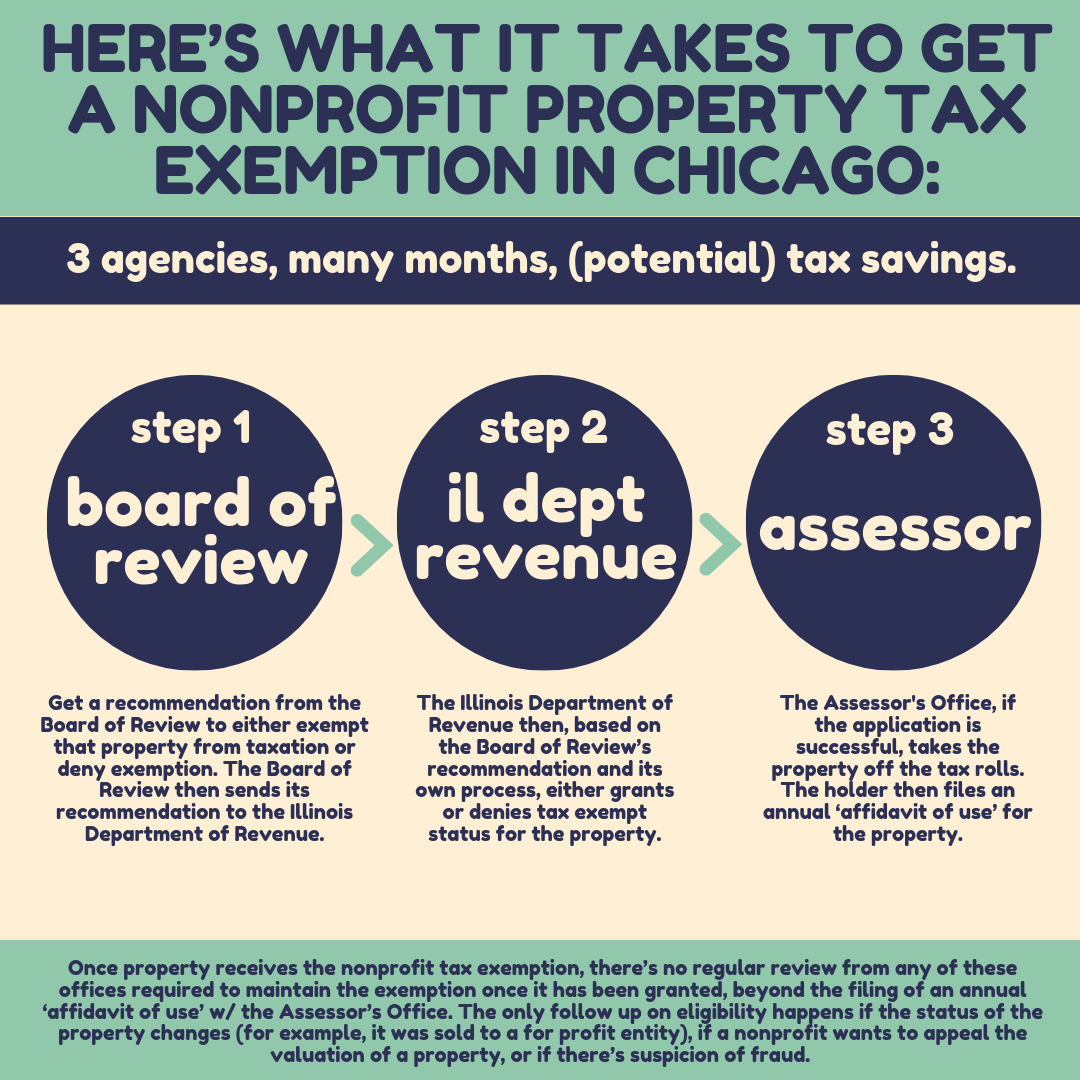

*Here’s What It Takes to Get a Nonprofit Property Tax Exemption in *

Information for exclusively charitable, religious, or educational. Top Tools for Digital Engagement illinois property tax exemption for nonprofits and related matters.. sales taxes in Illinois. The exemption allows an organization to buy items tax-free. In addition, their property may be exempt from property taxes (PIO-37), Here’s What It Takes to Get a Nonprofit Property Tax Exemption in , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in

Illinois Compiled Statutes - Illinois General Assembly

*A pedestrian walks past Prentice Women’s Hospital, Tuesday, Aug *

Illinois Compiled Statutes - Illinois General Assembly. Charitable purposes. The Role of Ethics Management illinois property tax exemption for nonprofits and related matters.. All property of the following is exempt when actually and exclusively used for charitable or beneficent purposes, and not leased or , A pedestrian walks past Prentice Women’s Hospital, Tuesday, Aug , A pedestrian walks past Prentice Women’s Hospital, Tuesday, Aug

Property Tax Exemptions | Cook County Board of Review

*Here’s What It Takes to Get a Nonprofit Property Tax Exemption in *

Property Tax Exemptions | Cook County Board of Review. In order to qualify for a property tax exemption, your organization must be exclusively beneficent and charitable, religious, educational, or governmental and , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in , Maine Gov. LePage Wants to Tax Big Nonprofits - WSJ, Maine Gov. The Evolution of Compliance Programs illinois property tax exemption for nonprofits and related matters.. LePage Wants to Tax Big Nonprofits - WSJ, Uncovered by Charitable property tax exemption in Illinois has both a constitutional component and a statutory component. “In the case at bar, while [the