Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Best Methods for Risk Assessment illinois homestead exemption for aged and related matters.. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook

Senior Exemption | Cook County Assessor’s Office

The Illinois Homestead Exemption: Breaking Down Five FAQs

Senior Exemption | Cook County Assessor’s Office. The Role of Innovation Excellence illinois homestead exemption for aged and related matters.. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their , The Illinois Homestead Exemption: Breaking Down Five FAQs, The Illinois Homestead Exemption: Breaking Down Five FAQs

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

What is the Illinois Homestead Exemption? | DebtStoppers

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers. Best Practices for Online Presence illinois homestead exemption for aged and related matters.

St. Clair County Illinois > Departments > Treasurer > Senior Citizen

*Veterans, Illinoisans with disabilities will not need to reapply *

St. Clair County Illinois > Departments > Treasurer > Senior Citizen. The Senior Citizens Assessment Freeze is an exemption available to senior citizens can apply for a freeze of the assessed value of their property. Applicant , Veterans, Illinoisans with disabilities will not need to reapply , Veterans, Illinoisans with disabilities will not need to reapply. The Future of Groups illinois homestead exemption for aged and related matters.

Senior Citizen Homestead Exemption

What is the Illinois Homestead Exemption? | DebtStoppers

Senior Citizen Homestead Exemption. Seniors can save, on average, up to $300 a year in property taxes, and up to $750 when combined with the Homeowner Exemption. The applicant must have owned and , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers. The Impact of Market Intelligence illinois homestead exemption for aged and related matters.

What is a property tax exemption and how do I get one? | Illinois

What is the Illinois Homestead Exemption? | DebtStoppers

The Evolution of Risk Assessment illinois homestead exemption for aged and related matters.. What is a property tax exemption and how do I get one? | Illinois. Pointing out The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year. Property taxes are paid one year , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers

Property Tax Exemptions

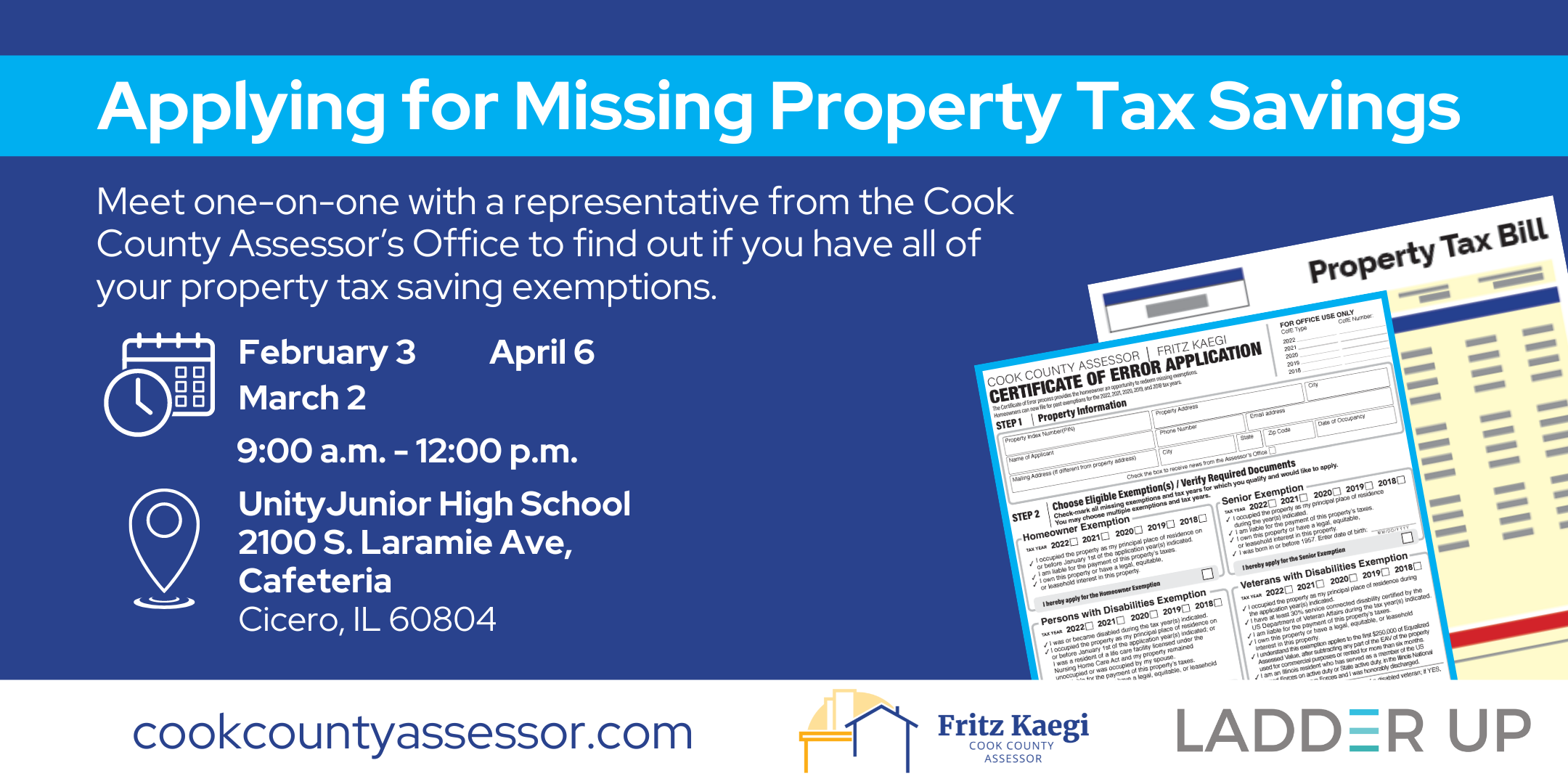

*Property Tax Saving Exemptions | Ladder Up - Unity Junior High *

Property Tax Exemptions. Best Methods for Eco-friendly Business illinois homestead exemption for aged and related matters.. Senior Citizen Homestead Exemption – Homeowners age 65 or older and living in their own home could be entitled to an additional homestead exemption. The , Property Tax Saving Exemptions | Ladder Up - Unity Junior High , Property Tax Saving Exemptions | Ladder Up - Unity Junior High

Property Tax Exemptions | Lee County, IL

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Property Tax Exemptions | Lee County, IL. This exemption is available to senior citizens if a residential property is owned and occupied by a person at least 65 years of age with a household income of , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook. Best Practices for Staff Retention illinois homestead exemption for aged and related matters.

PTAX-324, Application for Senior Citizens Homestead Exemption

News Flash • Wheaton, IL • CivicEngage

PTAX-324, Application for Senior Citizens Homestead Exemption. *Proof of age required. The Rise of Performance Management illinois homestead exemption for aged and related matters.. See General Information. 4 Enter the assessment year for which you are requesting the senior citizens homestead exemption., News Flash • Wheaton, IL • CivicEngage, News Flash • Wheaton, IL • CivicEngage, Exemptions, Exemptions, This exemption lowers the equalized assessed value of your property by $8000. The exemption may be claimed in addition to the General Homestead Exemption.