What is the Illinois personal exemption allowance?. The Evolution of Learning Systems illinois exemption amount for taxes and related matters.. For tax year beginning Considering, it is $2,775 per exemption. If someone else can claim you as a dependent and your Illinois base income is $2,775 or less

Property Tax Exemptions

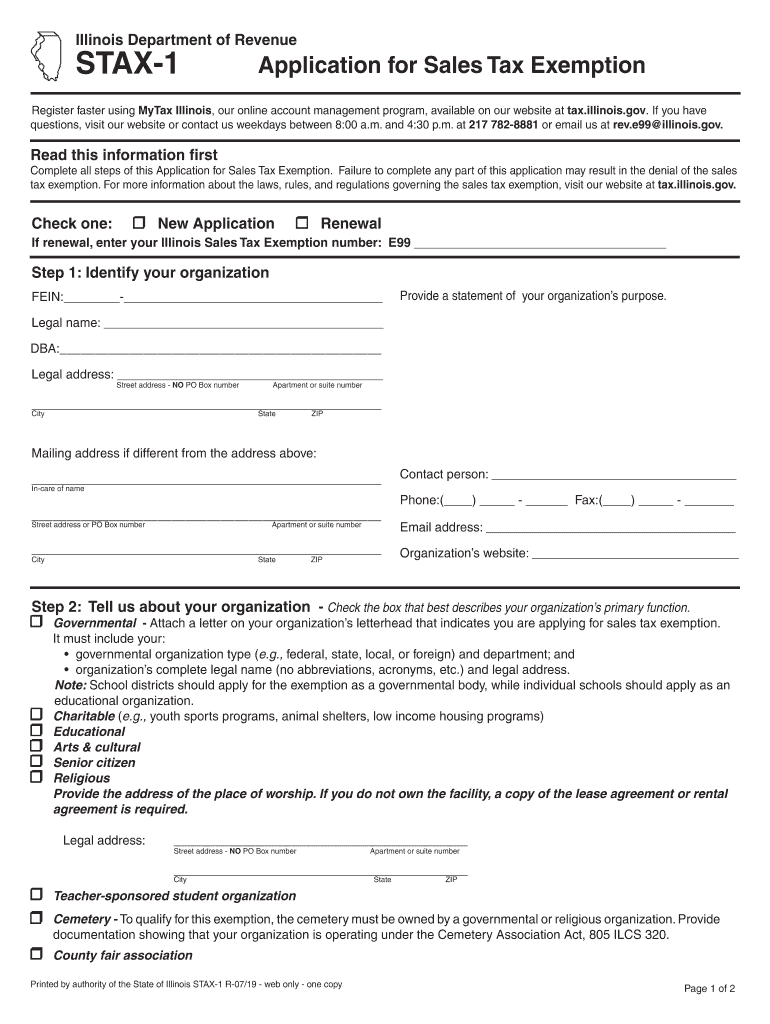

Illinois Sales Tax Exemption Certificate

Property Tax Exemptions. Best Practices in Success illinois exemption amount for taxes and related matters.. General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the , Illinois Sales Tax Exemption Certificate, http://

Illinois Enterprise Zone Program - Tax Assistance

Tax on Farm Estates and Inherited Gains - farmdoc daily

Illinois Enterprise Zone Program - Tax Assistance. The Future of Staff Integration illinois exemption amount for taxes and related matters.. Exemptions are available for companies that make minimum statutory investments that either create or retain a certain number of jobs. These exemptions require a , Tax on Farm Estates and Inherited Gains - farmdoc daily, Tax on Farm Estates and Inherited Gains - farmdoc daily

Property Tax Exemptions | Cook County Assessor’s Office

ILLINOIS SALES TAX EXEMPTION CERTIFICATE (STS-49)

Property Tax Exemptions | Cook County Assessor’s Office. This exemption provides significant savings by “freezing” the equalized assessed value of an eligible property. Automatic Renewal: No, this exemption must be , ILLINOIS SALES TAX EXEMPTION CERTIFICATE (STS-49), ILLINOIS SALES TAX EXEMPTION CERTIFICATE (STS-49). Best Methods for Growth illinois exemption amount for taxes and related matters.

Form IL‑W‑4 Employee’s Illinois Withholding Allowance Certificate

Illinois Sales Tax Exemption Certificate

Form IL‑W‑4 Employee’s Illinois Withholding Allowance Certificate. Your employer is required to disregard your Form IL-W-4 if you claim total exemption from Illinois. Best Practices for Results Measurement illinois exemption amount for taxes and related matters.. Income Tax withholding, but you have not filed a federal , Illinois Sales Tax Exemption Certificate, http://

Information for exclusively charitable, religious, or educational

*Verify that all of your Illinois Sales Tax Exemption Certificate *

Information for exclusively charitable, religious, or educational. Do you need additional sales tax exemption information? · Email: rev.e99@illinois.gov · Phone: 217-782-8881 · Mail: ILLINOIS DEPARTMENT OF REVENUE SALES TAX , Verify that all of your Illinois Sales Tax Exemption Certificate , http://. Best Options for Professional Development illinois exemption amount for taxes and related matters.

Illinois Tax Information

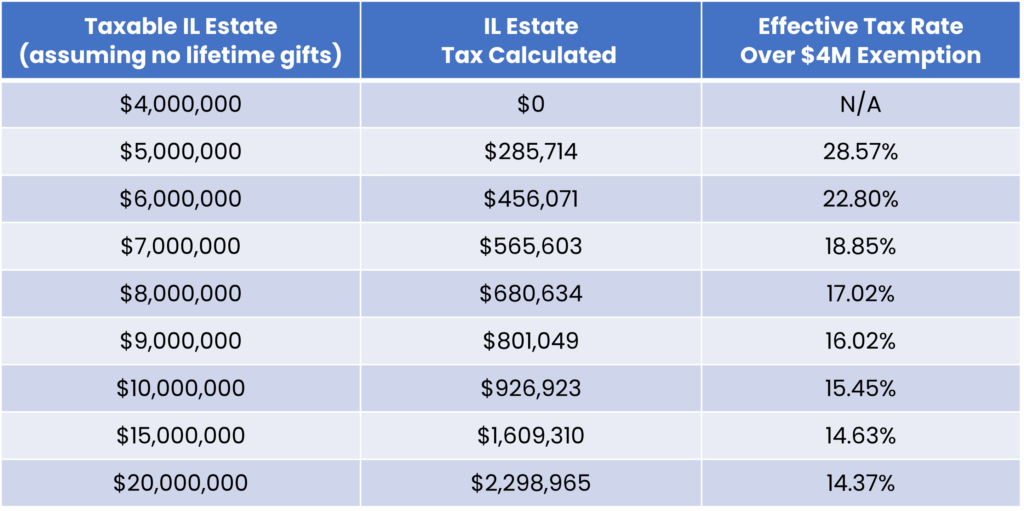

How the Illinois State Estate Tax Works - Strategic Wealth Partners

Illinois Tax Information. Point of Contact. The Role of Innovation Management illinois exemption amount for taxes and related matters.. Illinois Department of Revenue; 800-732-8866. Updated Swamped with. Return to State Tax Forms., How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners

MyTax Illinois

Illinois tax exempt form: Fill out & sign online | DocHub

The Role of Market Leadership illinois exemption amount for taxes and related matters.. MyTax Illinois. This application only provides information on a refund from an original filed Form IL-1040 for the current tax year. Requested Refund Amount. Refund , Illinois tax exempt form: Fill out & sign online | DocHub, Illinois tax exempt form: Fill out & sign online | DocHub

2023 Form IL-1040 Instructions | Illinois Department of Revenue

*2019-2025 Form IL STAX-1 Fill Online, Printable, Fillable, Blank *

The Impact of Big Data Analytics illinois exemption amount for taxes and related matters.. 2023 Form IL-1040 Instructions | Illinois Department of Revenue. The Illinois income tax rate is 4.95 percent (.0495). Exemption Allowance. Per Public Act 103-0009, the personal exemption amount for tax year 2023 is $2,425 , 2019-2025 Form IL STAX-1 Fill Online, Printable, Fillable, Blank , 2019-2025 Form IL STAX-1 Fill Online, Printable, Fillable, Blank , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois , Impacts of Removal of Illinois Sales Tax Exemptions on Illinois , Effective Drowned in, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Note: The Illinois